Top 10 Energy Storage Companies in North America | PF Nexus

Jul 14, 2025 · Discover the current state of energy storage companies in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Top 30 Energy Storage Solutions Companies — A

6 days ago · Explore the top 30 energy storage solutions companies in the USA that are driving the transition towards a sustainable and renewable energy future.

North America Energy Storage Companies

Mordor Intelligence expert advisors conducted extensive research and identified these brands to be the leaders in the North America Energy Storage industry. Need More Details on Market

BESS in North America_Whitepaper_Final Draft

Apr 23, 2021 · This whitepaper reflects on available opportunities across the battery energy storage industry focusing on the market development in the United States and Canada.

Top 50 Energy Storage Companies in 2021 | YSG Solar

Jan 12, 2021 · With energy storage becoming more prevalent throughout the energy sector, more and more companies are offering energy storage solutions to consumers. Below, you''ll find a

Energy Storage Expertise and Solutions

Aug 19, 2025 · Today, ENGIE has 25 grid-scale energy storage projects in North America with the capacity to deliver ~2 GW of power to the grid and another ~2 GW under construction. These

Battery Energy Storage Systems Report

Jan 18, 2025 · This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their

North American Power | Electricity and Natural

4 days ago · Find a low, fixed-rate energy plan with North American Power. Enjoy low, fixed energy rates, award winning customer service, and a personalized

Top US Energy Storage Suppliers: A 2023 Industry Deep Dive

Dec 14, 2019 · Looking for a list of US energy storage suppliers that actually power our clean energy future? You''re not alone. The US energy storage market grew a whopping 80% year

What You Need to Know about North American BESS Supply Chains | EVLO Energy

Apr 10, 2024 · EVLO places considerable emphasis on sourcing components within North America whenever possible, particularly for parts that affect cybersecurity. 100% of EVLO''s

6 FAQs about [North American home energy storage power supplier]

What are the top 10 energy storage manufacturers in USA?

The article will mainly explore the top 10 energy storage manufacturers in USA including Tesla, Enphase Energy, Fluence Energy, GE Vernova, Powin Energy, NextEra Energy, Wärtsilä, Primus Power, ESS INC., Form Energy.

How many energy storage projects does Engie have in North America?

Today, ENGIE has 3 grid-scale energy storage projects in North America with the capacity to deliver 520 MW of power to the grid and another 2 GW under construction. These projects support the growing demand for renewable energy and enable greater reliability and resilience on power grids, while enabling the net zero energy transition.

Which companies provide energy storage systems?

Tesla Energy also provides the Powerpack, a large-scale system designed for utility customers to manage and store energy efficiently. Enphase Energy, Inc., based in Fremont, California, specializes in solar microinverters, battery energy storage system design, and EV charging for homes.

How many MWh of energy storage systems does powin have?

As a leader in the energy storage industry, Powin has deployed or is building over 17,000 MWh of energy storage systems worldwide. Powin is dedicated to being the top provider of safe, scalable, and integrated battery storage and software solutions, driving the transition to a cleaner energy landscape.

What is Engie energy storage?

ENGIE designs, deploys, operates and aggregates grid scale and onsite energy storage systems, which can dispatch electricity when needed, even during peak hours, with 24/7 reliability. Grid-scale storage offers reliability and ancillary services to meet the growing demand for electricity needs.

Who is NextEra Energy?

NextEra Energy, Inc., headquartered in Juno Beach, Florida, is a leading clean energy company that stands at the forefront of innovation in energy solutions. The company employs around 14,900 people across the US and Canada and is renowned for its significant role in the renewable energy sector.

Learn More

- Can North American energy storage power be used for shipping

- Home energy storage mobile power supplier foreign trade

- Beirut home energy storage power supply manufacturer

- Home energy storage power supply for camping

- North Macedonia Mobile Energy Storage Power Supply

- Damascus lithium energy storage power supplier

- Chad lithium energy storage power supplier

- North American Energy Storage Product Manufacturers

- North Asia Outdoor Energy Storage Power Supply

Industrial & Commercial Energy Storage Market Growth

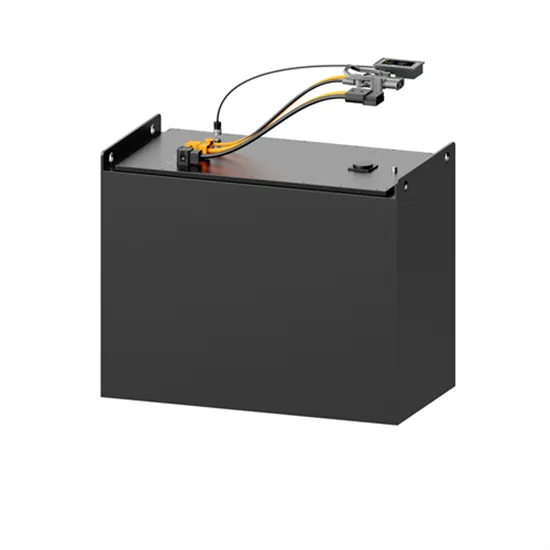

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.