China Wholesale Solar Inverter Suppliers, Manufacturers

Scroll down to check an exclusive list of top China wholesale solar inverter suppliers, manufacturers (OEM, ODM & OBM), wholesalers, factory lists, distributors, exporters,

Top Chinese On-Grid Inverter Manufacturers for Global

Top Chinese Manufacturers of On-Grid Inverters for Global Suppliers As the world shifts towards renewable energy, the demand for on-grid inverters has skyrocketed. China, being a global

Top 10 Hybrid inverter manufacturer Companies and

Are you considering a hybrid inverter for your energy needs? Understanding the top manufacturers can make all the difference. By comparing leading factories, you''ll discover

Solar Inverters_Energy Storage Inverters

Solis is one of the world''s largest and most experienced manufacturers of solar inverters supplying products globally for multinational utility companies, commercial & industrial rooftop

Top 10 hybrid inverters Manufacturers in China

Nov 21, 2024 · Customers can select the components that best fit their home or business to build out (specify) the ideal hybrid inverter setup. Goodwe is a furniture store that has both efficient

Top Chinese On-Grid Inverter Manufacturers for Global Buyers

Jul 30, 2025 · Discover the top Chinese manufacturers of on-grid inverters for global buyers. Learn about the benefits of sourcing on-grid inverters from China and find the right

Off Grid Solar Inverter Manufacturers in China

Jul 31, 2025 · Looking for reliable off grid solar inverter manufacturer? Our China-based solar power inverter factory offers top-quality OEM inverters. Partner

China China Hybrid Inverter On Grid Companies Company

Jun 26, 2024 · Looking for a reliable China hybrid inverter on grid supplier? Find top-quality products directly from the factory at Company Name. We are a leading company in the

Best Inverter Buying Guide for 2025

Looking for the best inverter for your solar system in 2025? Avoid common pitfalls and make an informed decision with this comprehensive guide. Choosing the right inverter for your solar

Buyer''s Guide to Off-Grid Solar Inverter Manufacturers in China

Mar 24, 2025 · Buyer''s Guide to Off-Grid Solar Inverter Manufacturers in China: Your Path to Energy Independence Imagine powering your home, RV, or remote cabin with clean,

Unmatched Quality from China The Best Hybrid Inverter On Grid

Jun 23, 2025 · Hybrid inverters are super important when it comes to boosting the efficiency and reliability of sustainable energy systems. They''re pretty neat because they combine Solar

Top 10 Hybrid inverter supplier China Products Compare 2025

By comparing the top hybrid inverter factories, you can ensure you''re making an informed choice that meets your energy demands and budget. Understanding the strengths of these suppliers

China Hybrid Grid Inverter, Hybrid Grid Inverter Wholesale

The Hybrid Grid Inverter is a standout piece in our Solar Inverter collection.Identifying a reliable manufacturer for solar inverters involves reviewing product range, manufacturing processes,

China''s Top Solar Power Inverter Manufacturers: 2025

Jul 1, 2025 · Searching for reliable solar power inverter manufacturers in China? Discover the 2025 ranking of top Chinese brands and their innovative industrial inverter solutions.

6 FAQs about [Best China hybrid inverter on grid Buyer]

Who is the best inverter manufacturer in China?

1. Huawei - Top Hybrid Inverter Manufacturer in China Huawei is a global technology leader founded in 1987 by Ren Zhengfei. It has made significant inroads into the photovoltaic industry with its advanced inverter technology. In the solar energy sector, Huawei has been the world's top inverter supplier for 5 consecutive years until 2019.

What are the best hybrid inverters?

Another major manufacturer is Goodwe. These are some of the best hybrid inverters, known in particular for their common efficiency with most businesses being that it has to be reliable energy.

Who is the world's top solar inverter supplier?

In the solar energy sector, Huawei has been the world's top inverter supplier for 5 consecutive years until 2019. Its inverters are designed to provide smart, stable, and efficient PV systems, offering customers high return on investment.

What is a hybrid inverter?

CKMINE Hybrid inverter has come up with some special features which makes solar to produce the highest power. This implies that the photovoltaic panels are capable of creating even more electrical energy causing cost savings on power bills. Hybrid inverters by Goodwe are built-in with maximum power point tracking system, MPPT.

What is a hybrid inverter by goodwe?

Hybrid inverters by Goodwe are built-in with maximum power point tracking system, MPPT. By doing so, it actually rocks ETQ’s Microgrid platform baseline ADMS architecture by continuously monitoring the output of solar panels and optimizing voltage on-the-fly to provide maximum energy output.

Who makes the best solar inverter?

A well-known brand in the solar industry, SMA produces high-quality string and central inverters for both residential and commercial solar systems. 4. Ginlong Technologies Co. Ltd.

Learn More

- Best China on grid hybrid inverter company

- Hot sale 15kw hybrid inverter in China Buyer

- Cheap on grid hybrid solar inverter Buyer

- China hybrid inverter on grid in Panama

- China on grid hybrid inverter in Belarus

- Best hybrid inverter mppt for sale Buyer

- China on grid hybrid inverter in Botswana

- China on grid hybrid solar inverter for sale

- Best China 3 5 kva hybrid inverter exporter

Industrial & Commercial Energy Storage Market Growth

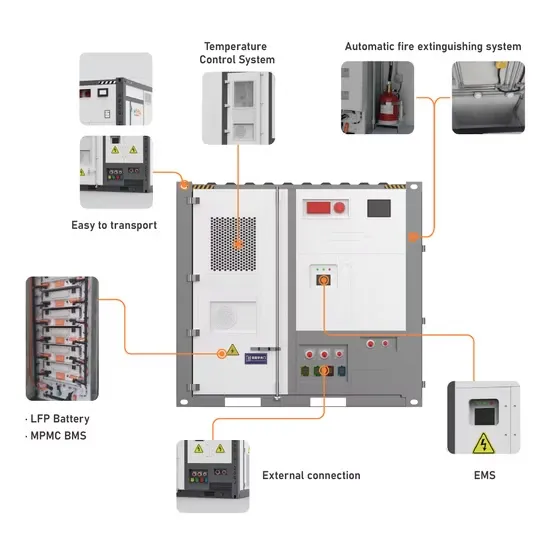

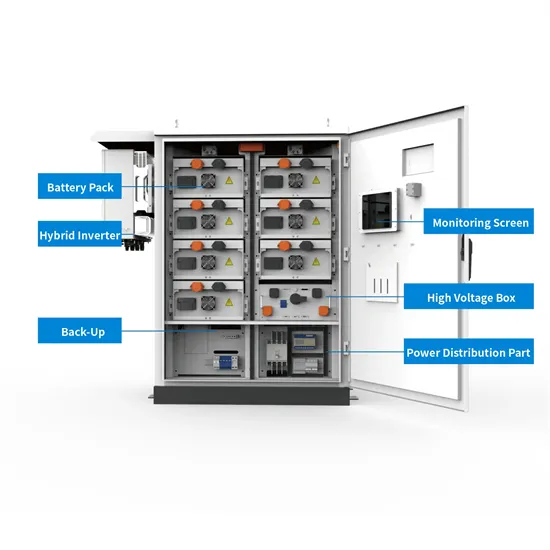

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

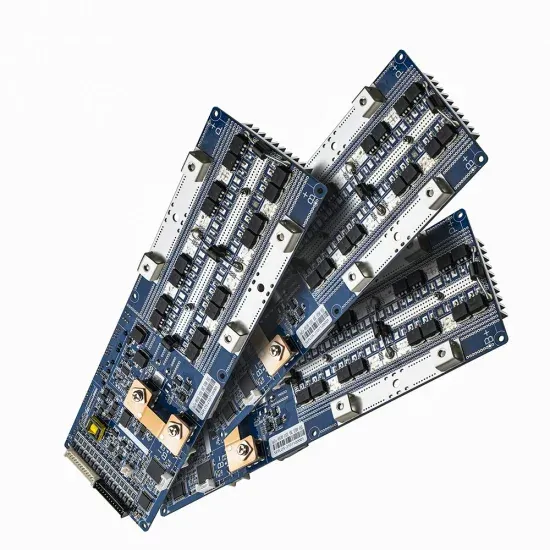

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.