10kwh Dyness Powerbox PRO Solar Energy Battery

Dec 17, 2023 · 10kwh Dyness Powerbox PRO Solar Energy Battery, Find Details and Price about Lithium Battery Pack Powerbox PRO from 10kwh Dyness Powerbox PRO Solar Energy

Sellers in Italy | PV Companies List | ENF Company Directory

Italian wholesalers and distributors of solar panels, components and complete PV kits. 117 sellers based in Italy are listed below. Renergy Di Reale Ing. Flavio. List of Italian solar sellers.

Italy: statistical data and forecasts for the PV and

Jun 21, 2022 · Below is a summary of the reports prepared by Italia Solare regarding the first quarter of 2022 extracted from Gaudì data (Gestione

China Powerbox, Powerbox Wholesale, Manufacturers, Price

China Powerbox wholesale - Select 2025 high quality Powerbox products in best price from certified Chinese manufacturers, suppliers, wholesalers and factory on Made-in-China

China''s Huasun, Italy''s New Time Partner For 1 GW BIPV Factory

Aug 18, 2025 · This collaboration with New Time follows Huasun''s 2024 partnership with Bee Solar to establish vertically integrated factory for wafers, cells and PV modules in Italy (see

Reliable Solutions for Efficient solar panel powerbox in

Discover the benefits of reliable solar panel powerbox with high-capacity power and compact design. Perfect for outdoor adventures or emergency backup, ensuring energy independence

Top Solar Panel Manufacturers Suppliers in Italy

3 days ago · FuturaSun is an Italian company that thanks to a steady growth year on year has become an international group including R&D subsidiaries, offices in Europe and China, and

Factory Price in Stock 10kwh Dyness Lifepo4 Lithium Battery

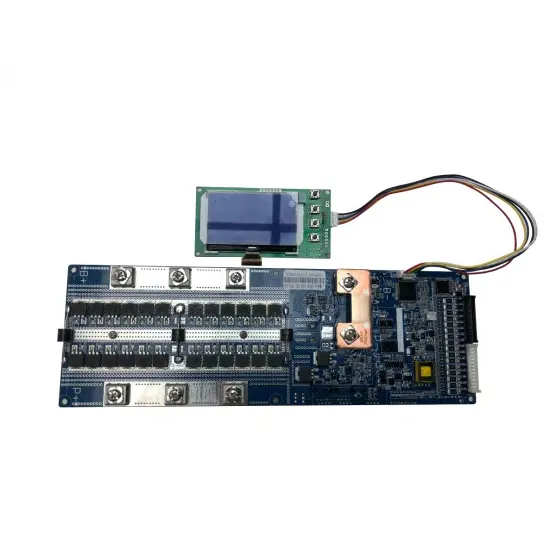

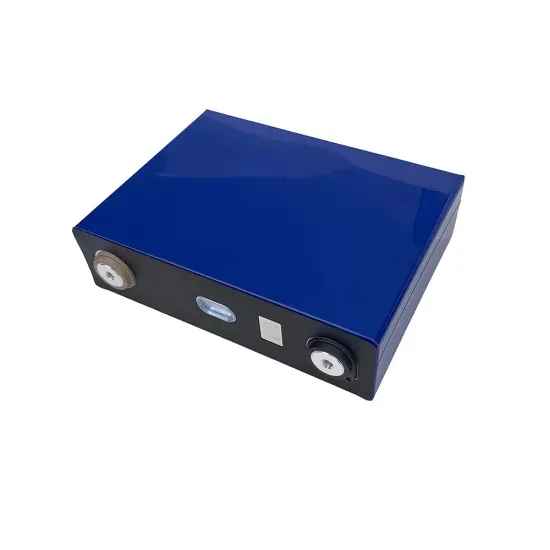

Dyness Powerbox Pro The Powerbox Pro is a type of deep cycle and high capacity LFP battery with improved safety, long lifespan, and optimizeduser experience. lt is especially designed

Top 100 Solar Panel Companies in Italy (2025) | ensun

Find the right companies for free by entering your custom query! Peimar is an Italian manufacturer that specializes in high-efficiency photovoltaic modules, offering top-performing solar panels

Solarbox

Jul 7, 2025 · SolarBox s.r.l. is a leading Italian company in the photovoltaic market for the design and production of string combiner boxes for both new build and retrofit utility-scale solar power

Ready To Ship Dyness Powerbox Pro Smart Lifepo4 200ah 51.2v PowerBox

Ready To Ship Dyness Powerbox Pro Smart Lifepo4 200ah 51.2v Powerbox Pro 10kwh Energy Storage Lithium Battery With Factory Price - Buy Dyness Lithium Battery dyness dyness

Top 5 Solar Energy System Supplier In Italy

Dec 11, 2024 · Check out the 9 top solar energy providers in Italy and find what they can do for you. As part of this, it has developed First Supplier - one of Italy''s statement renewable energy

Largest solar power stations in Italy

Here is a list of the largest Italy PV stations and solar farms. Get to know the projects'' power generation capacities in MWp or MWAC, annual power output in GWh, state of location and

6 FAQs about [Factory price solar powerbox in Italy]

How much does solar power cost in Italy?

The average yield for solar photovoltaic (PV) installations in Italy is approximately 1200 kWh per kWp per year. 2 The average cost of electricity for households in Italy is approximately USD $0.12-0.13 per kWh. Applies for both residential and commercial. 3

How much does a crystalline silicon photovoltaic module cost in Italy?

The average price of crystalline silicon photovoltaic (PV) modules in Italy decreased steadily from over two euros per watt before 2010 to a minimum of 0.29 euros per watt in 2019. Prices have been increasing since that year and amounted to 0.45 euros per watt in 2022. Get notified via email when this statistic is updated.

Who is solarbox?

SolarBox s.r.l. is a leading Italian company in the photovoltaic market for the design and production of string combiner boxes for both new build and retrofit utility-scale solar power plants, as well as for residential and commercial installations. All products are supervised by qualified personnel, from design to marketing and technical support.

What is the market share of solar energy in Italy?

The solar rooftop segment continues to dominate the Italian solar energy market, holding approximately 63% market share in 2024. This significant market position is driven by several factors, including the country's robust residential and commercial adoption of solar PV systems.

Will SoliTek build a solar PV module factory in Italy?

March 2023: Solitek announced the construction of a solar PV module manufacturing factory in Italy with a 600 MW annual capacity. The company is expected to build its facility in the Benevento region with a EUR 50 million (USD 53.5 million) investment and come online in quarter two of 2024.

How can I get involved in the Italian solar market?

Get involved in the Italian solar market by attending the debut edition of Solar & Storage Italia – taking place 8-9 October. Italy’s solar market has grown from 4,000 MW in 2005 to over 26 GW in 2023, driven by strong policies and cutting-edge technologies.

Learn More

- Hot sale factory price solar powerbox Seller

- Factory price solar powerbox in Iraq

- China 4 2 kw solar inverter factory Price

- Cheap 7 5 kw solar inverter factory Price

- Factory price safety breaker in Pretoria

- Factory price 3 phase breaker in Mumbai

- 7 5 kw solar inverter factory in Azerbaijan

- 7 5 kw solar inverter factory in Guyana

- Factory price serket breaker in Mozambique

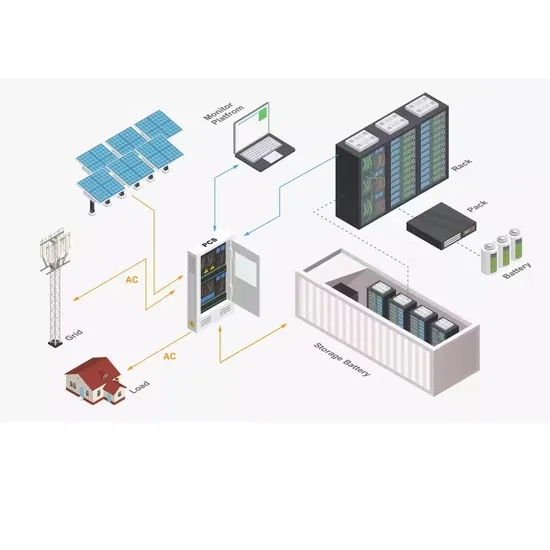

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.