Chinese, Finnish firms launch Finland''s 1st cathode active

Apr 30, 2025 · HELSINKI, April 29 (Xinhua) -- Chinese and Finnish companies broke ground Tuesday on Finland''s first lithium-ion battery cathode active material (CAM) plant, a project

Construction of the cathode active material plant

Apr 29, 2025 · The groundbreaking of Finland''s first lithium-ion battery cathode active material (CAM) plant was celebrated today in Kotka. The event was

Wholesale 24v circuit breaker in finland

Due to the fact the company established, we''ve been committed to Wholesale 24v circuit breaker in finland in China sales and service, we''ve consistently adhering for the "quality initially,

Batteries from Finland

Jun 6, 2019 · Batteries from Finland -project is enhancing the growth of knowledge basis and global competitiveness along the entire battery value chain – from raw material production to

China China Battery System Circuit Breaker Manufacturers

We are able to guarantee you products high quality and competitive value for China Battery System Circuit Breaker, 10 Amp Circuit Breaker, 32a Circuit Breaker, Mcb, 3 Phase Circuit

Top Electric Breaker Suppliers in Finland

Jan 16, 2025 · Electric Breakers When installing a solar panel system, you have to be familiar with the electric breakers and how it works with a solar PV system to avoid future electric problems.

Nader Circuit Breaker

Jun 13, 2025 · Nader is the largest circuit breaker manufacturer of china, mainly engaged in R & D, production and sales of terminal appliances, power distribution appliances, control

Dispute over Chinese workforce at Kotka battery plant

May 8, 2025 · Conflicting reports emerge over how many Chinese workers may arrive for the construction of a battery materials plant in Kotka, Finland, as authorities and contractors offer

ABB Xiamen Switchgear Co., Ltd. | Electrification

Established in 1992, we are the first ABB joint venture in China. The Company specializes in the production, sales and service of 3.6kV-40.5kV medium voltage switchgears and circuit breakers.

Circuit Breakers companies in Finland | Electrical companies

Find detailed information about circuit breakers companies Finland for your Electrical and surveillance needs from our Electrical directory. Make sales enquiries or order product and

Finnish-Chinese battery plant in Kotka moves to

Mar 22, 2025 · Finnish Minerals Group and Beijing Easpring Material Technology have announced the start of construction of a cathode active material (CAM)

Finnish-Chinese battery plant in Kotka moves to

Mar 22, 2025 · The Finnish State will also support the initiative by capitalising Finnish Minerals Group with EUR 100 million. "With the Kotka CAM plant, we

China high voltage switchgear in finland

Our company primarily engaged and export China high voltage switchgear in finland. we depend on sturdy technical force and constantly create sophisticated technology to meet the demand

6 FAQs about [China battery circuit breaker in Finland]

Where is Finland's first lithium-ion battery cathode active material plant located?

The groundbreaking of Finland’s first lithium-ion battery cathode active material (CAM) plant was celebrated today in Kotka. The event was addressed, among others, by the Finnish Minister of Economic Affairs, the Ambassador of China, and the Chairman of the City Board of Kotka.

Could Kymenlaakso become Europe's largest battery plant?

The Finnish Minerals Group, which owns 40 percent of the Hamina factory, plans another battery materials plant for nearby Kotka. That facility is to make cathode active material. According to the company, the sites could turn the Kymenlaakso region into one of Europe's largest clusters of battery material plants.

What does Finland's new lithium-ion battery plant mean for the battery industry?

The announcement was made on Wednesday 20 March 2025, marking a major step in the development of Finland’s battery value chain. The plant will produce CAM, a key component in lithium-ion batteries, with an initial capacity of 60,000 tonnes per year. Future expansion is also part of the long-term plan.

Who uses Kotka battery material?

The material produced in Kotka will be used by battery manufacturers in Europe and around the world. Dr. Chen Yanbin, Chairman of the Board of Beijing Easpring, and Matti Hietanen, CEO of Finnish Minerals Group, at the groundbreaking ceremony. Picture: City of Kotka.

What is CNGR Finland?

The permit issued to the company CNGR Finland allows annual production of 60,000 tons of battery chemicals as well as energy production for the facility’s production needs. The factory is to be located adjacent to the port of Hamina, about 150km east of Helsinki.

Does CNGR Finland have to pay a fishery fee?

The CNGR Finland bid drew hundreds of concerned responses last summer. According to the decision, the company must comply with emission restrictions and pay an annual fishery fee. A sign marking land reserved for the planned battery parts factory (file photo). Image: Antro Valo / Yle

Learn More

- China battery circuit breaker in Sao-Paulo

- China battery circuit breaker in Lithuania

- China battery circuit breaker in Thailand

- High quality old circuit breaker in China for sale

- Main circuit breaker in China in Latvia

- Main circuit breaker in China

- China single circuit breaker

- China d curve circuit breaker in Angola

- China single circuit breaker in Norway

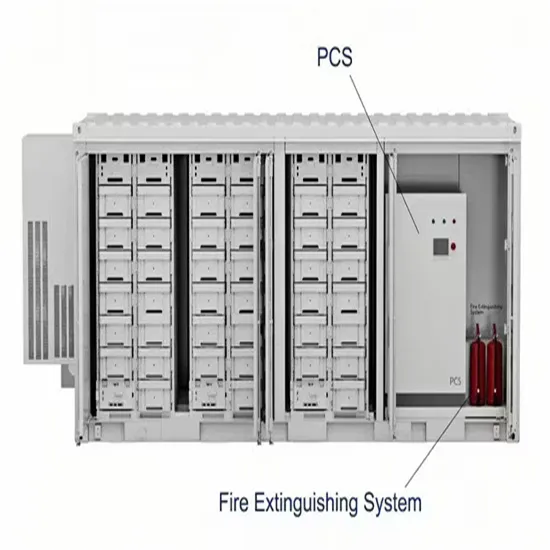

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.