Communication Base Station Smart Control | HuiJue Group E

As global mobile data traffic surges 35% annually, legacy communication base station management struggles to balance energy efficiency with service quality. Did you know a single

Base Station Energy Storage Improvement | HuiJue Group E

Why Energy Storage Is the Silent Crisis in Telecom Infrastructure? Did you know base stations consume 60-80% of a mobile network''s total energy? As 5G deployment accelerates globally,

Top 5 energy storage battery BMS manufacturers in China

Data shows that a total of 1.559 million 5G base stations have been built and opened in China, and the 5G network has covered all prefecture-level cities and counties across the country. It

Energy Storage in Telecom Base Stations: Innovations

With the relentless global expansion of 5G networks and the increasing demand for data, communication base stations face unprecedented challenges in ensuring uninterrupted power

Communication Base Station Energy Efficiency | HuiJue

The Silent Crisis in 5G Expansion As global 5G deployments accelerate, communication base station energy consumption has surged by 300% compared to 4G infrastructure. Did you know

China mobile energy storage base station

The new Togdjog Shared Energy Storage Station will add to Huadian''''s 1 GW solar-storage project base and 3 MW hydrogen production project in Delingha, making it not only the largest

China s communication base station solar energy

The widespread installation of 5G base stations has caused a notable surge in energy consumption, and a situation that conflicts with the aim of attaining carbon neutrality.

Communication Base Station Energy Storage | HuiJue Group

Why Energy Storage Is the Missing Link in 5G Expansion? As global 5G deployments accelerate, operators face a paradoxical challenge: communication base station energy storage systems

Communication Base Station Battery Market Size, Share

Aug 6, 2025 · Sustainable and Green Energy Initiatives Sustainable and green energy initiatives are reshaping the communication base station battery market by prioritizing eco-friendly and

Communication Base Station Battery Disposal | HuiJue Group

The Silent Crisis in 5G Expansion As global 5G infrastructure grows by 19% annually, communication base station battery disposal emerges as a critical yet overlooked challenge.

Communication Base Station Energy Storage Battery

Apr 3, 2025 · The communication base station energy storage battery market is experiencing robust growth, driven by the increasing demand for reliable and uninterrupted power supply for

Global Communication Base Station Battery Trends: Region

Mar 31, 2025 · The Communication Base Station Battery market is experiencing robust growth, driven by the expanding deployment of 5G and 4G networks globally. The increasing demand

Communication Base Station Energy Storage Battery

May 8, 2025 · The Communication Base Station Energy Storage Battery market is experiencing robust growth, driven by the increasing demand for reliable and efficient power backup

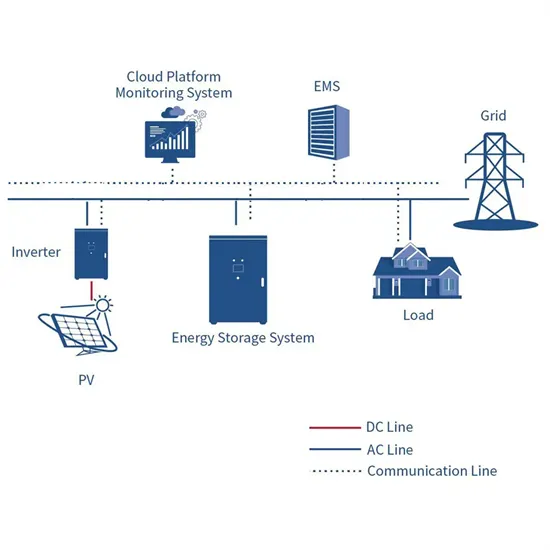

Energy consumption comprehensive management system of communication

The base station for communication, access points, and module bureaus Energy consumption (including main equipment, power system, air conditioning system, monitoring equipment,

Communication Base Station Energy Metering | HuiJue

The Silent Power Drain in 5G Era Did you know a single 5G base station consumes 3-4 times more energy than its 4G counterpart? As global mobile data traffic surges 40% annually,

Communication Base Station Industry Outlook | HuiJue

China''s Smart Grid Integration Breakthrough State Grid Corporation''s collaboration with ZTE has yielded base stations that automatically switch between grid and battery power during peak

Communication Base Station Energy Storage Systems

Powering Connectivity in the 5G Era: A Silent Energy Crisis? As global 5G deployments surge to 1.3 million sites in 2023, have we underestimated the energy storage demands of modern

Communication Base Station Market Analysis | HuiJue Group

China''s Millimeter Wave Breakthrough Deploying 210,000 5G base stations in Q3 2023 alone, China Mobile achieved 2.6 Gbps peak speeds using 26 GHz bands. Their 3D coverage

cairo communication base station energy storage battery

Lithium battery is the magic weapon for communication base station energy storage system and power container energy storage China''''s communication energy storage market has begun to

Communication Base Station Energy Storage Lithium Battery

Apr 22, 2025 · The Communication Base Station Energy Storage Lithium Battery market is experiencing robust growth, driven by the increasing deployment of 5G and other advanced

Communication Base Station Consumption Tracking

China''s new energy mandate (effective June 2024) requires all communication infrastructure to implement ISO 50001-certified tracking systems. This could create a $7.8 billion market for

Exploring Communication Base Station Energy Storage

Apr 6, 2025 · The global market for communication base station energy storage lithium batteries is experiencing robust growth, driven by the increasing demand for reliable and efficient power

6 FAQs about [China s communication base station energy management system brand share]

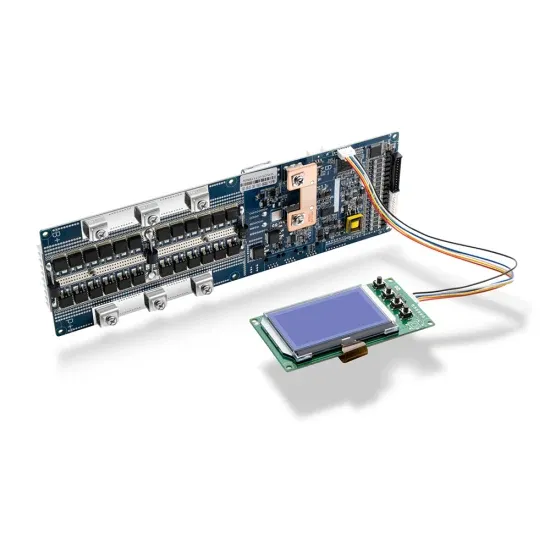

What is the market value of energy storage BMS in China?

GGII predicts that by 2025, the market value of China’s energy storage BMS will reach 17.8 billion RMB, with a compound annual growth rate of 47%. Here are the top 10 energy storage BMS companies in China. 1. Gold Electronics

Who are the top 5 energy storage battery BMS manufacturers in China?

Third-party BMS companies are numerous. And the top 5 energy storage battery BMS manufacturers in China in 2023 are BMSER, Gold Electronic, Kgooer, Huasu and Tian Power. Company profile: BMSER is a company that focuses on the innovative development and application of high performance BMS chips and system application solutions.

Who are the top 5 Chinese companies in direct current energy storage?

Globally, the top five Chinese companies in the direct current (DC) side of energy storage are: 1. BYD – Leading the global market in DC energy storage. 2. Yuanxin Storage – Known for its expertise in DC energy solutions. 3. Jingkong Energy – Noted for its advanced DC storage systems. 4.

What is Tian power high-voltage energy storage BMS system?

Tian Power high-voltage energy storage BMS system is mainly used in power grid energy storage, industrial and commercial energy storage, high-voltage home energy storage, UPS energy storage and other application fields, and can meet the application and safety requirements of battery systems within 1500V.

What is China's energy storage lithium battery shipments in 2022?

In 2022, China’s energy storage lithium battery shipments reached 130GWh, a year-on-year growth rate of 170%. As one of the core components of the electrochemical energy storage system, under the dual support of policies and market demand, the shipments of leading companies related to energy storage BMS have increased significantly.

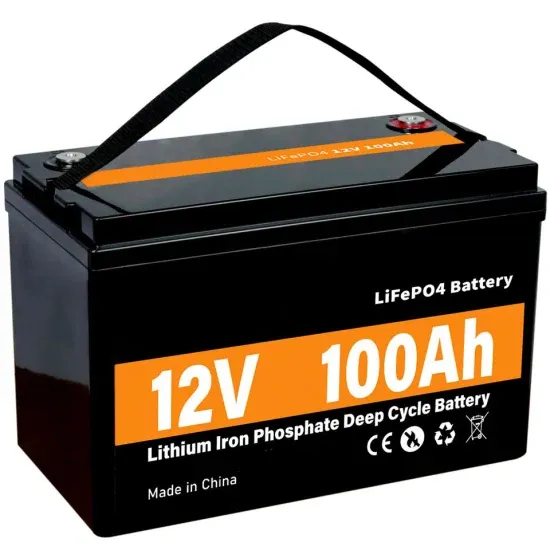

Which Chinese companies use lithium batteries in base stations & data centers?

In the global market for lithium batteries used in base stations and data centers, the top five Chinese companies are: 1. Shuangdeng – Leading the market with high-performance lithium batteries. 2. Nandu Power Supply – Known for its reliable lithium battery solutions.

Learn More

- Barbados Wireless Communication Base Station Energy Management System

- Energy storage cabinet for energy management system of Polish communication base station

- St John s 5G communication base station energy management construction project

- Bogota Communication Base Station Energy Management System

- Can Huawei use the 5G communication base station energy management system

- China s most remote communication base station battery energy storage system 100KWh

- Communication base station energy management system and communication relay

- Feasibility study on the construction of communication base station energy management system project

- Guinea communication base station energy management system 6 9MWh

Industrial & Commercial Energy Storage Market Growth

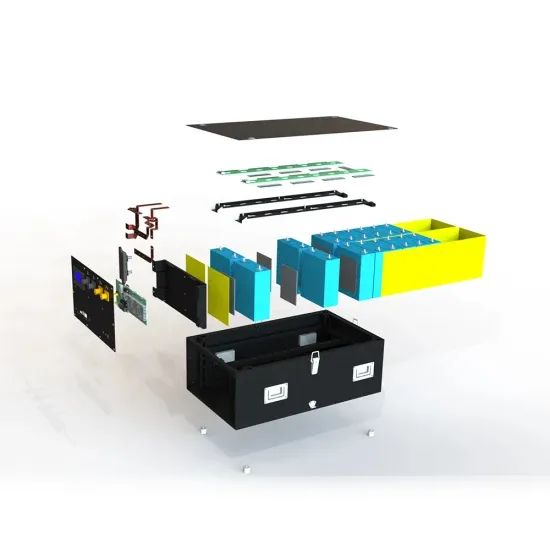

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.