5g base station architecture

Dec 13, 2023 · 5G (fifth generation) base station architecture is designed to provide high-speed, low-latency, and massive connectivity to a wide range of devices. The architecture is more

China has more than 3.8 million 5G base stations

Jun 28, 2024 · China''s 5G base stations account for 60 percent of the global total, Zhao added. In China, more than half of all mobile phone users are 5G users, Zhao told MWC Shanghai.

Global 5G Progress-Europe, USA, China, Japan, South Korea

More than 1.02 million 5G base stations have been deployed globally, and China has more than 718,000 5G base stations. All cities at and above the prefectural level have full coverage of 5G

China reaches over 4 million 5G base stations

Sep 30, 2024 · 5G mobile subscribers in China reached 966 million China had surpassed 4.04 million 5G base stations as of the end of August, according to data released by the country''s

China has more than 3.8 mln 5G base stations-Xinhua

Jun 26, 2024 · China''s 5G base stations account for 60 percent of the global total, Zhao added. In China, more than half of all mobile phone users are 5G users, Zhao told MWC Shanghai.

Ambitious 5G base station plan for 2025

Dec 28, 2024 · China aims to build over 4.5 million 5G base stations next year and give more policy as well as financial support to foster industries that can define the next decade, the

China has more than 3.8M 5G base stations

Jun 27, 2024 · China''s 5G base stations account for 60 percent of the global total, Zhao added. In China, more than half of all mobile phone users are 5G users, Zhao told MWC Shanghai.

China home to 4.25 million 5G base stations

Jan 22, 2025 · The number of 5G base stations in China has hit 4.25 million, with the number of gigabit broadband users surpassing 200 million, official data showed Tuesday. More than

China 5G rush – 4.5m 5G base stations, 300 5G-A

Jun 27, 2025 · Chinese operators have rolled out 5G-Advanced (5G-A) networks in more than 300 cities, local press reported, citing data from the MIIT. 5G-A

China now has 5G base stations in "all" cities and urban areas

Jan 14, 2022 · In terms of infrastructure construction, as of the end of November 2021, China has built a total of 1.396 million 5G base stations. The 5G base stations cover all cities and urban

China has more than 3.8 million 5G base stations

Jun 28, 2024 · There were more than 3.8 million 5G base stations in China by the end of May 2024, the latest data from the Ministry of Industry and Information Technology (MIIT) has

China has more than 3.8 mln 5G base stations

Jun 26, 2024 · China''s 5G base stations account for 60 percent of the global total, Zhao added. In China, more than half of all mobile phone users are 5G users, Zhao told MWC Shanghai.

Nuku''alofa, Tonga | EBSCO Research Starters

6 days ago · Nuku''alofa is the capital of Tonga, an island nation in the South Pacific Ocean. Tonga is also a royal seat and the only remaining constitutional monarchy in the region.

China 5G rush – 4.5m 5G base stations, 300 5G-A

Jun 27, 2025 · 5G on 5M sites – China has over 4.486 million 5G sites; 5G now comprises more than 35% of total mobile base stations. 5G-A in 300 cities –

5 FAQs about [Which Nuku alofa has more 5G base stations ]

How many 5G base stations are there in China?

In data collected between July 2022 and June 2024, China was reported to have had around 3.5 million 5G base stations installed across the country, with Chinese mobile operators investing heavily in 5G infrastructure. By comparison, the European Union had around 460,000 thousand base stations, while the United States had approximately 175,000.

Who makes 5G in China?

While 92 percent of 5G base stations in China had been manufactured by Chinese companies, Ericson and Nokia were the only overseas players accounting for six and two percent of base stations respectively. All companies have generated significant profits from their 5G business in China. Get notified via email when this statistic is updated.

How many DoCoMo base stations are there in 2021?

In an earlier post on NTT Docomo, we pointed out that Docomo coverage is forecast to increase from 500 base stations in 150 locations to 10,000 sites (in about 500 cities) by June 2021 and 20,000 by March 2022. According to Tefficient, Rakuten had 5739 LTE base stations on air at the end of June.

How many LTE base stations does Rakuten have?

The three incumbent operators have roughly 200000 LTE base stations each. @Rakuten_Mobile had 5739 LTE base stations on air at the end of June. Within that coverage area, Rakuten's UN-LIMIT customers have unlimited mobile data, outside of it limited data over au's network.

What is a baseband unit (BBU)?

For example on a tower hosting multiple operators, each of them will have their own Baseband Unit (BBU), so this is multiple base stations. If for an operator, there are multiple generations of technologies and within each of these generation, multiple frequencies, sectors, etc.

Learn More

- Which appliance is used in 5G base stations

- What are the uninterrupted power supplies for 5G communication base stations in Mozambique

- China Communications accelerates 5g base stations

- How many 5G outdoor base stations are there

- How many capacitors are generally used in 5g base stations

- How many 5G base stations are there in North Macedonia

- How to power 5g small base stations

- How to view nearby 5G base stations

- Battery specifications for 5G base stations

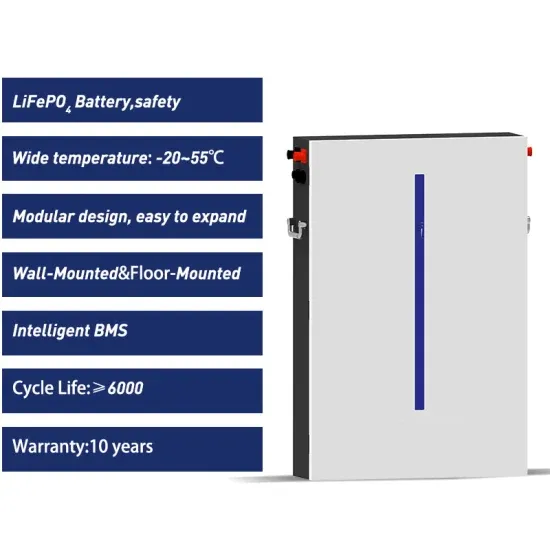

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.