The Rise of Vanadium Redox Flow Batteries

May 29, 2024 · In recent years, vanadium redox flow batteries (VRFBs) have emerged as a promising solution for large-scale energy storage, particularly in the renewable energy sector.

Flow Battery Sector Responds: We Can Meet Specs For

Apr 7, 2023 · "CellCube, a (vanadium refox flow battery company or VFRB) company in which we are a shareholder would be able to deliver flow batteries with an RTE over 70% for this tender.

Here''s the Top 10 List of Flow Battery Companies

Sep 12, 2024 · South Africa is also the third vanadium producer, behind Russia and China. The mineral is used in vanadium redox flow batteries (VRFBs), which are known for their efficiency

Vanadium Redox Flow Battery (VRFB) Companies

This report lists the top Vanadium Redox Flow Battery (VRFB) companies based on the 2023 & 2024 market share reports. Mordor Intelligence expert advisors conducted extensive research

Vanadium Flow Batteries Powering Renewable Futures

Enter vanadium flow batteries (VFBs), the dark horse of energy storage. VFBs store energy in liquid electrolytes - think industrial-scale "refillable" batteries. Cellcube''s latest ESO 260 model

cape town vanadium liquid flow energy storage project

Now, MIT researchers have demonstrated a modeling framework that can help. Their work focuses on the flow battery, an electrochemical cell that looks promising for the job—except for

About Invinity / Utility-Grade Energy Storage

Our vanadium flow batteries unlock low-cost, low-carbon renewable energy on demand, delivering clean energy for generations to come. Invinity was created to address the large and rapidly

Top 10 Companies in the All-Vanadium Redox Flow Batteries

Jun 9, 2025 · In this analysis, we profile the Top 10 Companies in the All-Vanadium Redox Flow Batteries Industry —technology innovators and project developers who are commercializing

6 FAQs about [Cape Town Vanadium Flow Battery Company]

What are vanadium redox flow batteries?

The mineral is used in vanadium redox flow batteries (VRFBs), which are known for their efficiency in storing large amounts of energy, says Mikhail Nikomarov, the CEO of Bushveld Energy, a company that produces these batteries. China dominates the battery storage sector, producing nearly 85% of the world’s cells and storage.

What are the current commercial flow battery chemistries?

Current commercial flow batteries are based on vanadium- and zinc-based flow battery chemistries. Typical flow battery chemistries include all vanadium, iron-chromium, zinc-bromine, zinc-cerium, and zinc-ion.

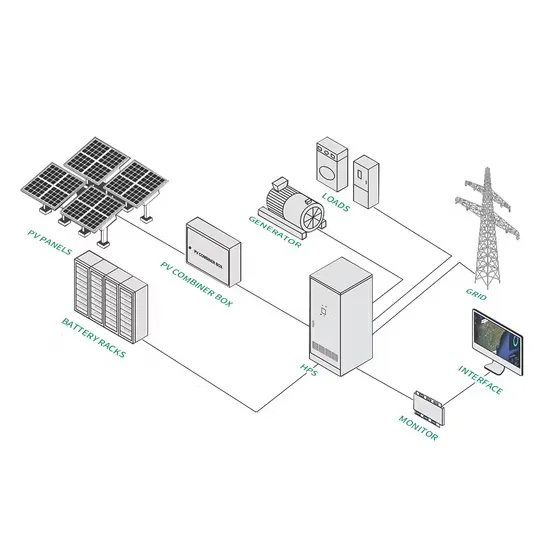

What are flow batteries used for?

Flow batteries help create a more stable grid and reduce grid congestion and fill renewable energy production shortfalls for asset owners. Global R&D is fueling the development of flow battery chemistry by significantly enabling higher energy density electrodes and also extending flow battery applications.

Are flow batteries the future of energy storage?

Flow batteries, with their ability to create a more stable grid and reduce grid congestion, are considered a promising technology for energy storage. Their adoption is closely linked with the surging energy storage market and can help fill renewable energy production shortfalls.

What makes VRB energy different from other flow batteries?

VRB Energy's long-lasting vanadium flow batteries are reliable, recyclable, safe, and scalable. What sets them apart from other battery systems is their ability to last longer than other flow batteries. Other prominent flow battery companies include Rongke Power, Redflow Ltd., and KORID ENERGY (KE).

Are iron flow batteries better than Li-ion batteries?

Iron flow batteries have a longer asset life than Li-ion batteries. Battery manufacturers are collaborating with utility companies to implement iron flow battery projects, aiming to replace diesel-fueled power generation with the more environmentally friendly flow battery system.

Learn More

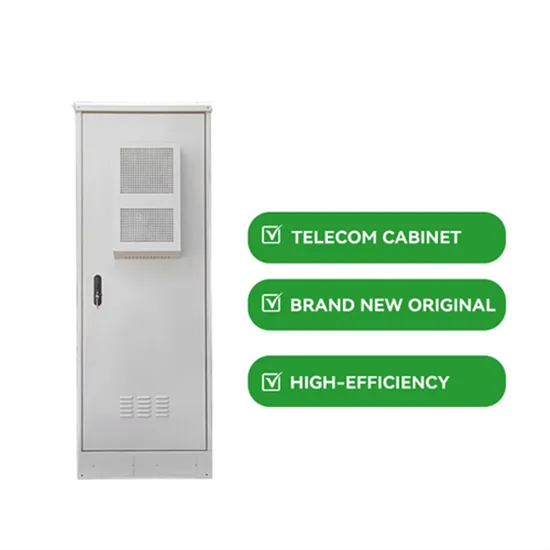

- Cape Town Smart Battery Cabinet Manufacturer

- Communication base station flow battery equipment manufacturing company

- Battery costs for Cape Town communication base stations

- Vanadium Redox Flow Battery Configuration

- Cape Town Energy Storage Battery Manufacturer

- Djibouti Flow Battery Technology Company

- Vanadium Redox Flow Battery in Hamburg Germany

- Nigerian Vanadium Flow Battery

- Cape Town solid state energy storage battery manufacturer

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.