Top Ten Photovoltaic Glass Brands in China for 2024

Sep 16, 2024 · Top Ten Photovoltaic Glass Brands in China for 2024 As of August 19, 2024, the list of the top ten photovoltaic (PV) glass brands in China has been officially released. This

Huge PV Glass Project Goes Live in China, Paving the Way

May 13, 2025 · It features 20 base plate production lines and 16 solar panel and backsheet production lines, utilising world-leading ultra-thin photovoltaic calendering technology and

Global and China Photovoltaic Glass

May 21, 2019 · PV glass price began to pick up after September 2018 as a result of the fact that production cuts and cold repair of companies eased some oversupply pressures and that

Corporate Profile_About Flat_Flat Glass Group Co., Ltd

Flat Glass Group Co., Ltd, located at Xiuzhou National High-tech Zone, Jiaxing City, Zhejiang Province, occupies an area of more than 370,000m2 with a covered area of more than

Top 10 Leading Solar Glass Manufacturers in India

Jan 28, 2025 · 1. Borosil Renewables Top of the list is Borosil Renewables, the first solar glass manufacturer in India. Established in 2015, this company is

Top 10 Photovoltaic Glass (PV Glass) Supplier in

Apr 8, 2025 · The company operates several photovoltaic glass production lines and continues to expand its production capacity to meet the growing demand.

Top 10 Photovoltaic Glass Brand & Manufacturers

Jul 22, 2025 · This section provides a list of the top 10 Photovoltaic Glass manufacturers, Website links, company profile, locations is provided for each company. Also provides a detailed

Top Ten Photovoltaic Glass Brands in China for 2024

As of August 19, 2024, the list of the top ten photovoltaic (PV) glass brands in China has been officially released. This ranking is based on professional evaluations that consider market

Top 10 Photovoltaic Glass (PV Glass) Supplier in

Apr 8, 2025 · Here is an overview of the top 10 photovoltaic glass suppliers in China for 2024. 1. XINYI SOLAR. Established: 2009. Location: Wuxi, China.

China Glass Manufacturers, OEM/ODM Glass Deep

Jiangsu Chunge Glass Co., Ltd is a professional OEM/ODM glass manufacturers and glass deep processing factory, We specialize in custom glass, involving photovoltaic solar cell glass, new

500,000 Tons, Total Investment of 2 Billion Yuan: Another Photovoltaic

Apr 28, 2025 · Project name: Annual output of 500,000 tons of photovoltaic glass production line project. Project construction location: in Khalifa Industrial Park Free Trade Zone (KIZAD), Abu

福莱特玻璃集团股份有限公司|太阳能光伏玻璃|浮法玻璃|工程

PV Glass Float Glass Architectural Glass Household Glass Solar Power Station VIEW MORE 1 专业的玻璃解决方案 Professional Glass Solution Available

6 FAQs about [Berne photovoltaic glass production company]

Who makes solar Photovoltaic Glass?

As a leading solar photovoltaic glass manufacturer, it is a holding business for investments that produces and sells photovoltaic glass goods. IRICO Group is widely recognized as one of the world's top solar photovoltaic glass manufacturers. It was founded in 1984 and is currently headquartered in Beijing, China.

What makes Acht a top Photovoltaic Glass manufacturer?

The company is a prominent player in the photovoltaic glass market, offering ultra-clear rolled glass and TCO glass essential for solar energy applications. ACHT’s advanced technology, R&D system, and extensive corporate culture have solidified its position as a top photovoltaic glass manufacturer.

Who is the best solar photovoltaic glass manufacturer?

IRICO Group is widely recognized as one of the world's top solar photovoltaic glass manufacturers. It was founded in 1984 and is currently headquartered in Beijing, China. They offer innovative photovoltaic solar modules that can be used to manufacture solar cell panels. Flat Glass Group was set up in 1971.

What is solar glass?

Mainly engaged in high-quality, high-tech glass deep processing, the products include photoelectric touch glass (monitor front and rear panels and touch screen glass), home appliance glass, photovoltaic glass, and high-end home decoration glass. Solar glass is a glass material that integrates the function of solar power generation.

Why is China a leader in Photovoltaic Glass Manufacturing?

As the global demand for clean energy continues to rise, China has solidified its position as a leader in photovoltaic (PV) glass manufacturing. The country's manufacturers are renowned for their innovation, advanced production techniques, and ability to meet the growing needs of the solar industry. What Is Photovoltaic Smart Glass?

Why is the Solar Photovoltaic Glass market expanding?

Due to the rising demand for ecological construction practices and green energy sources, the market for solar photovoltaic glass has been expanding quickly. Globally, governments are encouraging the use of solar PV glass through various regulations and rewards, fueling market expansion.

Learn More

- Is there any production control for photovoltaic glass

- Photovoltaic glass production in India

- Is there photovoltaic glass production in Nigeria

- Which glass photovoltaic power generation company is the best in Sao Tome and Principe

- Photovoltaic glass production in Nepal

- Photovoltaic tempered glass company

- Main production areas of photovoltaic glass

- Mali double-glass photovoltaic module production company

- The impact of Bhutan s photovoltaic glass production reduction on

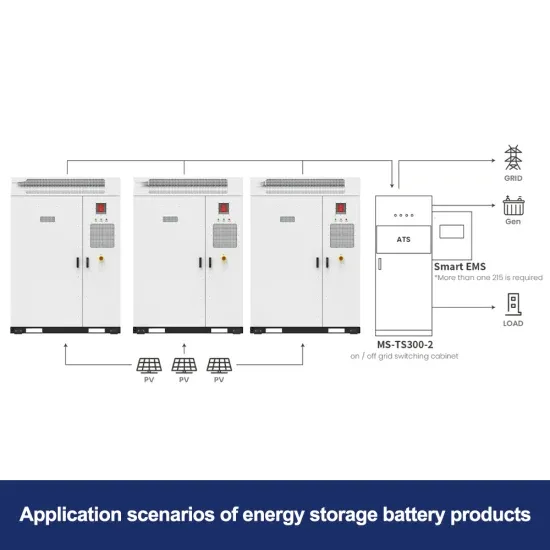

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.