Power Supply for 5G Infrastructure | Renesas

Aug 19, 2025 · Renesas'' 5G power supply system addresses these needs and is compatible with the -48V Telecom standard, providing optimal performance, reduced energy consumption, and

Optimal configuration for photovoltaic storage system capacity in 5G

Feb 14, 2025 · Base station operators deploy a large number of distributed photovoltaics to solve the problems of high energy consumption and high electricity costs of 5G base stations this

pimrc2010_final.dvi

Apr 8, 2022 · Concerning energy efficiency, utilizing micro base stations with their smaller power consumption capabilities appear promising. In this paper we study various homogeneous and

Selecting the Right Supplies for Powering 5G Base

Jul 2, 2022 · As a result, a variety of state-of-the-art power supplies are required to power 5G base station components. Modern FPGAs and processors are built using advanced nanometer

Integrated Micro Base Station Power Supply Market Growth

The rapid global rollout of 5G networks is significantly boosting demand for integrated micro base station power supplies, as telecom operators require compact, high-efficiency solutions for

Energy-efficiency schemes for base stations in 5G

In today''s 5G era, the energy efficiency (EE) of cellular base stations is crucial for sustainable communication. Recognizing this, Mobile Network Operators are actively prioritizing EE for

5G Micro Base Station Power Supply 42-59V 56A 3000W

The 5G micro base station power supply is capable of converting, regulating, and managing the input power (such as AC or DC) to meet the strict requirements of voltage, current, and power

Strategy of 5G Base Station Energy Storage Participating

Oct 3, 2023 · The energy storage of base station has the potential to promote frequency stability as the construction of the 5G base station accelerates. This paper proposes a control strategy

5G Base Station Power Supply Growth Opportunities and

Jan 8, 2025 · The global 5G base station power supply market is estimated to be worth USD 7203 million in 2025 and is projected to grow at a CAGR of 7.3% from 2025 to 2033. The market

5G Base Station Power Supply System: NextG Power''s

May 21, 2025 · Discover NextG Power''s 5G micro base station power solutions! Our IP65-rated 2000W/3000W modules and 48V 20Ah/50Ah LFP batteries ensure reliable connectivity.

Power consumption based on 5G communication

Oct 17, 2021 · This paper proposes a power control algorithm based on energy efficiency, which combines cell breathing technology and base station sleep technology to reduce base station

5G Micro Base Station Power Supply Solution | Reliable

Sunergy Technology''s 5G Micro Base Station Power Supply Solution ensures reliable backup power, rugged durability, and fast deployment for 5G networks. With expandable battery

Low-Carbon Sustainable Development of 5G Base Stations in

May 4, 2024 · 5G base stations are categorized into micro base stations, macro base stations, and indoor sub-systems based on their transmit power and coverage. As 5G operates at a

Building better power supplies for 5G base stations

May 25, 2025 · Building better power supplies for 5G base stations Authored by: Alessandro Pevere, and Francesco Di Domenico, both at Infineon Technologies Infineon Technologies -

Integrated Micro Base Station Power Supply Market

May 4, 2025 · Key players in the integrated micro base station power supply ecosystem are aggressively pursuing cross-industry collaborations to address critical challenges like energy

Selecting the Right Supplies for Powering 5G Base Stations

As a result, a variety of state-of-the-art power supplies are required to power 5G base station components. Modern FPGAs and processors are built using advanced nanometer processes

Cellular Micro Base Stations Enhanced Coverage;

Mar 3, 2025 · The Micro Base Station market is experiencing significant growth, driven by the increasing demand for enhanced cellular coverage, especially in

5G macro base station power supply design strategy and

Oct 24, 2024 · For macro base stations, Cheng Wentao of Infineon gave some suggestions on the optimization of primary and secondary power supplies. "In terms of primary power supply, we

Base station power supply_5G_广东凌讯微电子有限公司

The market demand for base station power supply is also gradually increasing, among which, the performance improvement of the communication power conversion system comes from the

Carbon emissions and mitigation potentials of 5G base station

Jul 1, 2022 · However, a significant reduction of ca. 42.8% can be achieved by optimizing the power structure and base station layout strategy and reducing equipment power consumption.

Small Cells, Big Impact: Designing Power Soutions for 5G

Apr 1, 2023 · Small cells are smaller and cheaper than a cell tower and can be installed in a variety of areas, bringing more base stations closer to users. A large number of base stations

Power Consumption Modeling of 5G Multi-Carrier Base

Jan 23, 2023 · However, there is still a need to understand the power consumption behavior of state-of-the-art base station architectures, such as multi-carrier active antenna units (AAUs),

Resilient and sustainable microgeneration power supply for 5G

Jan 1, 2021 · A mechanism is proposed to exploit microgeneration and mobile networks to improve the resilience by managing the renewable energy supplies, energy storage systems,

5G Micro Base Station Power Supply Lithium battery | B2USA

The EnerSmart 5G Micro Base Station Power Supply is developed for the 5G telecom market. It consists of the power supply module (rectifier, monitoring unit, communication unit, and power

6 FAQs about [5g communication micro base station power supply]

What is a 5G base station?

A 5G network base-station connects other wireless devices to a central hub. A look at 5G base-station architecture includes various equipment, such as a 5G base station power amplifier, which converts signals from RF antennas to BUU cabinets (baseband unit in wireless stations).

How much power does a 5G base station use?

Each nation has a different 5G strategy. For 5G, China uses 3.5GHz as the frequency. Then, a 5G base station resembles a 4G system, but it’s on a much larger scale. For sub-6GHz in 5G, let’s say you have a macro base station. The power levels at the antenna range from 40 watts, 80 watts or 100 watts.

How does a 5G base station reduce OPEX?

This technique reduces opex by putting a base station into a “sleep mode,” with only the essentials remaining powered on. Pulse power leverages 5G base stations’ ability to analyze traffic loads. In 4G, radios are always on, even when traffic levels don’t warrant it, such as transmitting reference signals to detect users in the middle of the night.

How will mmWave based 5G affect PA & PSU designs?

Site-selection considerations also are driving changes to the PA and PSU designs. The higher the frequency, the shorter the signals travel, which means mmWave-based 5G will require a much higher density of small cells compared to 4G. Many 5G sites will also need to be close to street level, where people are.

Should a 5G power amplifier be combined with a power amplifier?

For 5G, infrastructure OEMs are considering combining the radio, power amplifier and associated signal processing circuits with the passive antenna array in active antenna units (AAU). While AAUs improve performance and simplify installation, they also require the power supply to share a heatsink with the power amplifier for cooling.

Why does 5G cost more than 4G?

This percentage will increase significantly with 5G because a gNodeB uses at least twice as much electricity as a 4G base station. The more operators spend on electricity, the more difficult it is to price their 5G services competitively and profitably.

Learn More

- Marseille 5g communication base station power supply

- 5g micro base station supporting power supply

- 5g communication base station super capacitor construction hybrid power supply

- Thailand communication base station inverter hybrid power supply

- Is the uninterrupted power supply of the communication base station a data link layer

- Tender for uninterrupted power supply maintenance of Ngerulmud communication base station

- Regeneration of backup power supply for communication base station

- Optical storage 5G base station power supply

- How to use the 5g base station power supply to receive correctly

Industrial & Commercial Energy Storage Market Growth

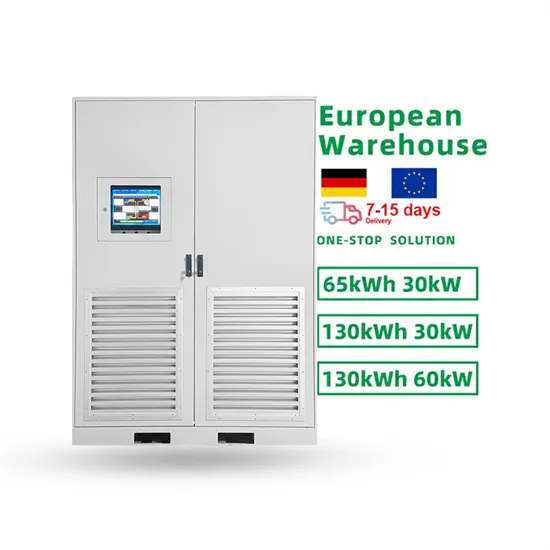

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

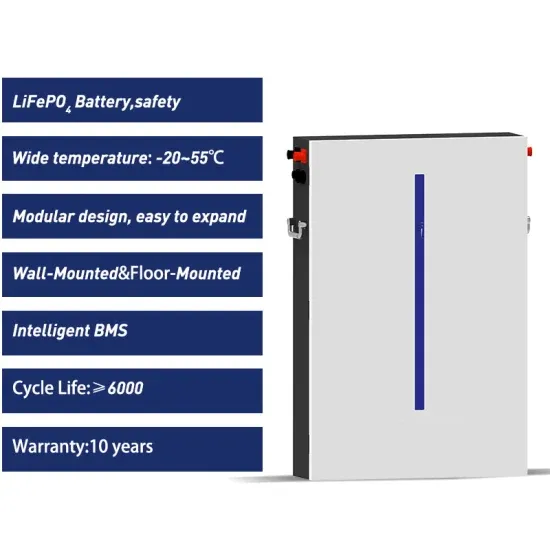

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.