Where to Buy Outdoor Power Supply in Aarhus Denmark A

Aarhus, Denmark''s second-largest city, offers multiple options for purchasing outdoor power solutions. Here''s a breakdown of the most trusted sources: 1. Local Retailers Specializing in

Denmark Outdoor PV Power Supply Market: Trends, Key

Jul 11, 2025 · Denmark Outdoor PV Power Supply Market was valued at USD 0.9 Billion in 2022 and is projected to reach USD 2.2 Billion by 2030, growing at a CAGR of 13.1% from 2024 to

PowerCon to Deliver Transformer Station to Port of Aarhus

Jan 27, 2025 · The Port of Aarhus, Denmark''s largest commercial port, is set to establish the country''s first shore power facility for container ships. The new agreement, finalized with

Friluftsland | Tættere på naturen | Besøg os

Find det bedste udstyr til aktivt friluftsliv ️ Kæmpe udvalg af outdoortøj, vandrestøvler- og sko. Køb telte, sovegrej, klatreudstyr og rygsække her.

On Shore Power Supply in the Nordic Region project report

Jun 27, 2025 · Aarhus – Odden: The Port of Aarhus supply shore power in agreement with Molslinien for the ferries sailing between Aarhus – Odden. It has delivered shore power from

Who supplies power supplies in Denmark? Manufacturers and suppliers

Searching for power supplies? In the business search engine SJN you find products and services from manufacturers, suppliers, importers, exporters and distributors.

Find Electrical Equipment, Appliance, and Component

Find info on Electrical Equipment, Appliance, and Component Manufacturing companies in Aarhus C, including financial statements, sales and marketing contacts, top competitors, and

Vestas Wind Systems: Denmark''s renewable energy pioneer

Jan 20, 2025 · Vestas Wind Systems, headquartered in Aarhus, Denmark, is a global leader in wind energy solutions. Established in 1945, the company has played a pivotal role in

Shanghai Electric Wind Power Group European Innovation

Aug 12, 2025 · Shanghai Electric Wind Power Group European Innovation Center | 415 followers on LinkedIn. The SEWPG European Innovation Center in Aarhus, Denmark (part of Shanghai

Port of Aarhus plans shore power project

Aarhus, Denmark (Ports Europe) January 29, 2025 – The Port of Aarhus has an onshore power (cold ironing) plant to supply dockside energy to container ships. The port has signed a

Electricity Prices in Denmark: Everything You

Feb 13, 2025 · According to the Danish power supply authority, compared to the third quarter of 2021, the increase in electricity has been nearly 83%. So, that

Shore power for containerships at Port of Aarhus soon reality

Jan 24, 2025 · Containerships calling at the container terminal at the Port of Aarhus will soon be able to turn off their diesel generators and receive shore power. Courtesy of the Port of Aarhus

Learn More

- Selling outdoor power supplies in Latvia

- Can you save money by selling outdoor power supplies

- Manufacture and sell outdoor energy storage mobile power supplies

- 12 Is there any difference between the three 12V outdoor power supplies

- What are the small energy storage outdoor power supplies

- Aarhus High Power Uninterruptible Power Supply Denmark

- What are the flameproof outdoor power supplies

- What are the types of low-quality outdoor power supplies

- Denmark Aarhus Energy Storage Power Overseas Warehouse

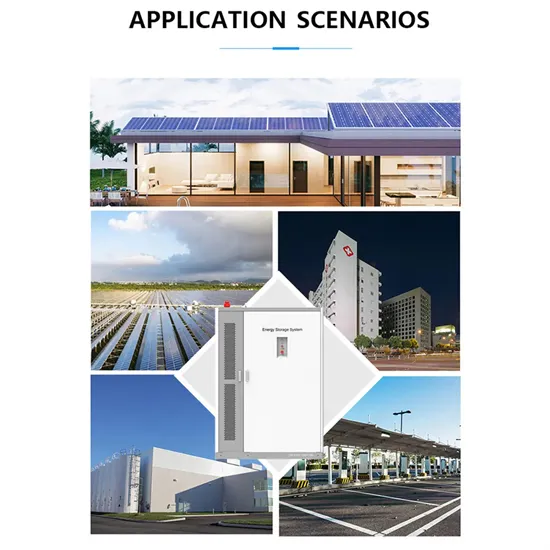

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.