CRRC Energy Storage: The Game-Changing New Energy Cell

Ever wondered how a train manufacturing giant became a top-tier new energy cell supplier? Let''s talk about CRRC Energy Storage – the quiet powerhouse revolutionizing renewable energy

CRRC Canada Energy Storage System: Powering the Future

Ever wondered how Canada could keep the lights on during a polar vortex? Enter the CRRC Canada Energy Storage System – a game-changer in how we store and manage energy. As

InfoLink Releases Q1 2025 Global Energy Storage System

The top five global energy storage system integrators (AC side) in Q1 2025 were: Sungrow, Tesla, BYD Energy Storage, HyperStrong, and CRRC Zhuzhou Institute. The shipment performance

Canada''s Largest Battery Project Powers Clean Future

Nov 15, 2024 · Canada is charging forward with energy storage innovations, positioning battery technology as a critical asset in its shift to a low-carbon economy. Ontario''s latest move saw

CRRC Shines at SNEC 2025: Powering a Zero-Carbon Future

Jun 13, 2025 · Zero-Carbon Park Solution From DC1000V/1500V energy storage cabinets to liquid-cooled supercharging piles, we deliver end-to-end "Equipment+Platform+Service" for

First Authoritative Carbon Footprint Certification! This New Energy

Jul 24, 2024 · Recently, CRRC Ziyang obtained the carbon footprint certificate of new energy locomotives (engine + power battery) issued by an international authoritative certification body,

Crrc canada energy storage institute

By interacting with our online customer service, you''ll gain a deep understanding of the various Crrc canada energy storage institute featured in our extensive catalog, such as high-efficiency

Market Snapshot: Energy storage in Canada may multiply by

Jul 23, 2025 · BESS is the fastest growing energy storage technology in Canada and is also the dominant storage technology in terms of capacity and number of sites. All but four projects

CRRC Canada Steps Into the Energy Storage Arena: What

Mar 27, 2021 · How CRRC''s Playbook Differs From Traditional Energy Giants While competitors focus on megaprojects, CRRC''s going modular—like Lego for the energy sector. Their

crrc canada launches energy storage products

A snapshot of Canada''''s energy storage market in 2023 By Justin Rangooni May 30, 2023 ( view the original article in Energy Storage News) The last 12 months have seen considerable

688Ah Energy Storage Cells Officially Rolled Off the

Jan 23, 2025 · As a world-leading energy storage system integrator, CRRC, with a keen sense of the terminal market, accurately judged the next-generation large battery cell for energy storage

New Era in Energy Storage:CRRC Zhuzhou and Great Power

Feb 10, 2025 · On January 21, CRRC Zhuzhou Electric Locomotive Institute Co., Ltd. and Great Power officially launched the 688Ah WindPeng battery cell, signaling the entry of the energy

CATL, Sungrow and CRRC Zhuzhou lead Chinese energy storage

Jul 11, 2025 · The China Energy Storage Alliance (CNESA) has released its 2024 rankings of Chinese energy storage companies, with CATL, Sungrow, and CRRC Zhuzhou Institute

6 FAQs about [Canadian CRRC Energy Storage Battery]

What is the largest battery storage project in Canada?

OHSWEKEN – The governments of Canada and Ontario are working together to build the largest battery storage project in the country. The 250-megawatt (MW) Oneida Energy storage project is being developed in partnership with the Six Nations of the Grand River Development Corporation, Northland Power, NRStor and Aecon Group.

Are battery storage projects gaining traction in Canada?

Battery storage projects are gaining traction across Canada, driven by federal incentives and increasing provincial investments. For instance, Alberta’s recent 60 MW battery facility and Saskatchewan’s utility-scale battery storage installation signal a strong nationwide commitment to supporting renewable energy sources like wind and solar.

How can Canada get more battery storage projects off the ground?

Global market forces are moving battery storage from margin to mainstream, and federal and provincial governments in Canada are making moves to get more battery storage projects off the ground here at home. To date, the main source of federal support has come through the Canada Infrastructure Bank (CIB).

What types of energy storage are available in Canada?

There are three main types of energy storage currently commercially available in Canada: Storage is playing an increasingly important role in the electricity system by improving grid reliability and power quality, and by complementing variable renewable energy sources (VRES) like wind and solar.

Are pumped hydro and battery energy storage a new technology in Canada?

Some technologies, like pumped hydro, have a long history in Canada. Others, like battery energy storage systems (BESS) are new technologies to many and raise questions, especially as project approvals anticipate the integration of these assets into peoples’ communities.

Can Ontario increase its battery storage capacity?

At the provincial level, Crown corporations and system operators are taking action. Ontario is making big strides to increase its battery storage capacity. The largest project under construction in the province is currently the Oneida Energy Storage project, which is expected to have an installed storage capacity of 250 megawatts by 2025.

Learn More

- Bangji CRRC Energy Storage Battery

- Canadian Energy Storage Battery Wholesale

- Canadian Photovoltaic Energy Storage Contracting Company

- Dakka Smart Energy Storage Lithium Battery

- Tunisia battery energy storage system

- Energy storage battery box model

- Somalia communication base station energy storage battery factory is in operation

- German energy storage battery wholesaler

- Large battery with high energy storage

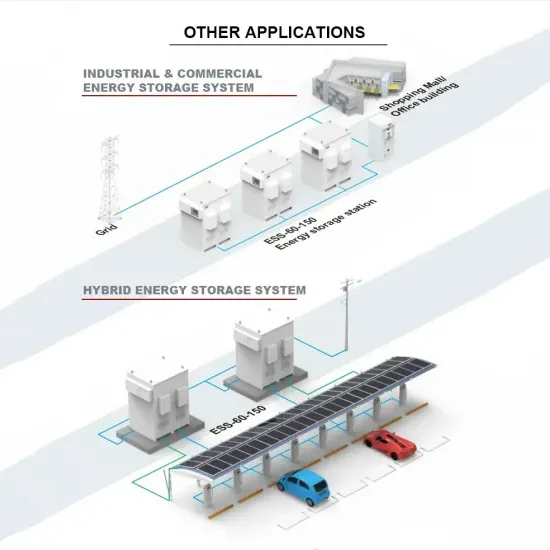

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.