5 Projects Powering Libya''s Natural Gas Sector

Jul 4, 2025 · Libya is advancing a series of strategic gas infrastructure projects aimed at boosting domestic supply, curbing emissions and increasing exports to Europe. These developments

Libya s policies on power plant energy storage

Advancing Libya''''s Energy Transition and Climate Resilience Tripoli, 07/March/2024 – Today marks a significant step forward in Libya''''s journey towards sustainable development as the

Prospects of renewable energy as a non-rivalry energy alternative in Libya

Mar 5, 2021 · The country has a significant potential of diverse renewable energy (RE) resources that can have a pivotal role in the national energy mix as a NREA. This paper does not only

Libya energy storage new materials expansion

Table 1. Listed the development of Libyan energy demand (Schäfer,2016). Over the years,Libya''s electricity consumption is projected to increase dramatically. This will contribute

LEES 2025 Day One: Industry Leaders Discuss Libya''s Energy

Jan 18, 2025 · The first day of the Libya Energy & Economic Summit (LEES) 2025 featured a dynamic technical program, hosted by the Society of Petroleum Engineers (SPE) of Libya,

Libya''s NOC Signs Strategic Cooperation Agreement with Hill

Jul 25, 2025 · Libya''s National Oil Corporation (NOC) signed a key cooperation agreement between Mellitah Oil and Gas Company and U.S.-based consultancy Hill International to

Libya''s Photovoltaic Energy Storage Policy: Powering the

Apr 29, 2025 · That''s Libya today – a solar goldmine stuck in fossil fuel limbo. But change is brewing. With global oil prices doing the cha-cha slide and climate targets knocking louder

Libya Energy Storage Materials Industrial Park: A Strategic

That''s where the Libya Energy Storage Materials Industrial Park comes in. Officially launched in Q1 2025, this $2.7 billion megaproject aims to position Libya as a regional leader in battery

What are the new energy storage industries in Libya

Recapping Libya''''s Upstream Revival in 2023 Libya''''s oil and gas industry has seen several milestones in 2023, advancing the country''''s pursuit to stabilize and expand its energy sector.

Libya Eyes Energy Revival With $8 Billion Gas Projects

4 days ago · The "A" and "E" field development includes two new platforms tied to the Mellitah complex. The project integrates carbon capture and storage (CCS) technology to cut

How Eni''s €8B Libya Investment is Reshaping Energy Security

Jun 11, 2025 · The plan includes large-scale infrastructure upgrades, particularly in energy transport and production, helping Libya modernize its sector and increase exports while

Libya Launches 20 Strategic Power Projects to Bolster Energy

Dec 10, 2024 · This initiative aligns with the government''s strategy to enhance Libya''s generation capacity through gas-to-power projects, renewable energy and regional grid interconnections.

Exploring Optimum Sites for Exploitation Hydropower Energy Storage

May 16, 2025 · The study identified several promising locations in Libya for establishing PHES stations, which could reduce the electricity deficit by storing surplus energy for retrieval on

Advancing Libya''s Energy Transition and Climate

Mar 7, 2024 · With a firm commitment to supporting Libya''s energy transition and climate resilience efforts, the European Union has allocated funding to GIZ

Libya''s New Energy Storage Materials: The Hidden Gem in

a country with enough lithium and manganese reserves to power millions of electric vehicles, yet stuck in political limbo. That''s Libya today—a land of untapped potential in new energy storage

METLEN''s Strategic Expansion and Role in Libya''s Energy

Jul 28, 2024 · This interview covers METLEN''s expansion plans in the MENA region, particularly in Libya, their contributions to Libya''s energy transition through green metallurgy projects,

Libya Oil, Gas And Energy News

Jul 30, 2025 · The Ministry of Oil and Gas of Libya officially endorses LEES 2026, underscoring the summit''s role as a premier platform to showcase investment opportunities and drive

5 Ways Libya is Reclaiming its Spot in the Global Energy

Jul 16, 2025 · Libya is making a strategic return to the global energy arena through targeted reforms, upstream expansion and infrastructure investment. As such, the country is offering

Libya Looks to Diversify Its Energy Mix – Libya Tribune

Oct 6, 2024 · Libya''s desert terrain offers significant opportunities for the development of solar and wind energy projects, and its experience in the international energy market will help it to

5 Ways Libya is Reclaiming its Spot in the Global Energy

Jul 16, 2025 · Libya is revitalizing its energy sector through licensing, production growth, infrastructure upgrades and strategic partnerships to attract global investment.

IMPROVING LIBYA''S CAPACITIES

Aug 4, 2025 · Harnessing this potential can facilitate Libya''s transition from a fossil fuel-based economy to a key player in renewable energy usage and exportation. The primary beneficiary

Libya''s New Energy Storage Materials: The Hidden Gem in

Why Libya''s Energy Storage Materials Could Be a Game-Changer a country with enough lithium and manganese reserves to power millions of electric vehicles, yet stuck in political limbo.

Libya''s Infrastructure Rebuild: Italian Expertise,

Sep 18, 2024 · The Libya-Italy Roundtable and VIP Networking Evening – taking place in Rome on September 23 – will showcase Libya''s current infrastructure

Libya''s Power Storage: Lighting the Path Through Crisis and

Why Libya''s Energy Future Hinges on Power Storage Solutions It''s a sweltering summer night in Tripoli, and Fatima''s ice cream shop is packed. Just as the line peaks, the lights flicker. Her

Libya Looks to Diversify Its Energy Mix – Libya Tribune

Oct 6, 2024 · Libya is focusing on developing its renewable energy potential, particularly solar and wind power, to reduce its dependence on oil and enhance energy security. The country''s

6 FAQs about [Libya s new energy development and energy storage]

Can Libya develop a green energy sector?

Libya’s desert terrain offers significant opportunities for the development of solar and wind energy projects, and its experience in the international energy market will help it to develop its new green energy sector.

Why does Libya need alternative energy sources?

Libya regularly faces power shortages in the face of rising energy demand due to its heavy reliance on oil and gas and years of underinvestment in the country’s infrastructure. This has left the country with poor energy security, encouraging the leadership to develop alternative energy sources to solidify its energy independence in the future.

What re technologies are available in Libya?

Existing utilization state and predicted development potential of various RE technologies in Libya, including solar energy, wind (onshore & offshore), biomass, wave and geothermal energy, are thoroughly investigated.

Can a rational use of energy save energy in Libya?

It has been estimated that the rational use of energy in Libya through utilizing more efficient appliances and lighting combined with improved behavior and energy management initiatives can save up to 2000 MW of installed capacity equivalent to burning 50 M barrels of oil [ 161 ].

How much energy does Libya use?

Electricity and gasoline represent the bulk of energy consumption in Libya [ ]. According to the International Energy Agency (IEA), electricity consumption in Libya was equivalent to 2580 kilo tonne of oil equivalent (ktoe) i.e., 2580 × 10 kg in 2017− a figure that is greater than its counterpart of the year 2000 by a factor of 2.5 (1032 ktoe) [ ].

How efficient is power generation in Libya?

On the other hand, power generation efficiency in Libya is at the average of 28%, while losses in power transmission and distribution systems are at the level of 14% [ 168 ]. Therefore, efficiency of existing power generation and transmission infrastructure systems should be improved urgently.

Learn More

- New Energy Storage System Research and Development

- Sunshine New Energy Industrial and Commercial Energy Storage Project Development

- Papua New Guinea energy storage module equipment sales

- Santo Domingo Energy Storage New Energy Technology Company

- Nepal s new energy storage appliances

- Moroni s new photovoltaic energy storage system

- New battery for energy storage

- New Energy Storage Cabinet Site

- New York High-Performance Energy Storage Battery Company

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

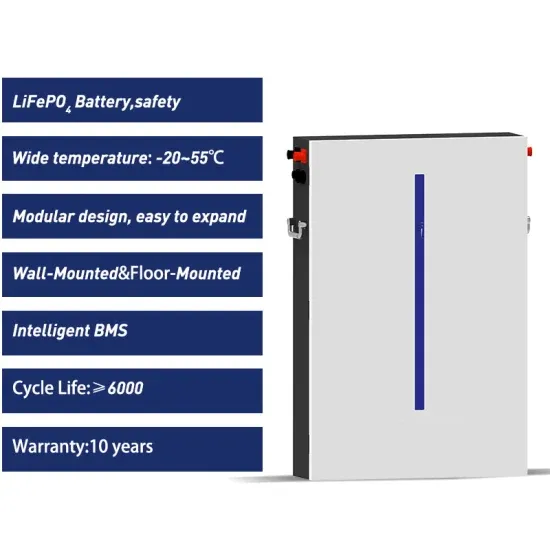

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.