HT SWITCHGEAR – Regency Power Limited

Regency Power Limited manufactures high voltage switchgear (hereafter called HT Panel) which is applied for power control and distribution systems of AC 50Hz, rated working voltage up to

Low voltage switchgear supplier in Bangladesh

This LV switchgear is equipped with robust protection features designed to prevent short circuits, overloads, and any potential damage to your equipment. Give us a call at +8801672073817 or

China Main Lv Switchgear Panel, Main Lv Switchgear Panel Wholesale

China Main Lv Switchgear Panel wholesale - Select 2025 high quality Main Lv Switchgear Panel products in best price from certified Chinese manufacturers, suppliers, wholesalers and factory

LV SWITCHGEAR Panels suppliers Bangladesh by Brilltech

LV SWITCHGEAR Panels suppliers, Dealers, Suppliers, Manufactures, Exporters and Contractors in Dhaka, Khulna, Rajshahi, Chittagong, Sylhet, Barisal Bangladesh.Reviews For

List of Panel companies in Bangladesh

Oil Type Transformer.04. Cast Resign Dry Transformer.05. LV, MV HV Switchgear Panel06. LV Circuit Breaker.07. Panel SA EPS Insulation & Packaging. "We are manufacturer EPS

Wholesale lv switchgear panel For Pro Power Distribution

Buy a wholesale lv switchgear panel and experience smooth management and distribution of electricity. Visit Alibaba and order power distribution equipment that you like.

Switchgear – Siemex Power Generation Ltd.

LV Switchgear Enclosures for side-by-side and stand-alone cabinets Degree of protection IP31 or IP55 Main busbars up to 6000A 2 Main busbar systems are possible in each section Clear

Industrial Electrical Panels & Switchgear | IESL Bangladesh

IESL Bangladesh supplies high-voltage switchgear, LV distribution boards, motor control centers (MCC), and automated power solutions for industries, plants, and commercial complexes

Electrical Distribution Panel – Fire Protection System Bangladesh

An electrical distribution panel is for distributes the electrical load at various portion of the electrical system. Innovern engineering is the designer, manufacturer, supplier as well as

Top LV Switchgear Products 2025 – Best Power Solutions

The top LV switchgear products in 2025 include Siemens SIVACON S8, Siemens SIEPAN, JRC Panels, and Schrack LV Components. These solutions provide advanced protection, modular

Electrical Substation Supplier Company List in Bangladesh 2025

We manufacture and supply electrical items like Transformer, Substation, PFI panel, HT LT panel with 100% original components. We ensure 24 hours service to solve any issues.

Learn More

- High quality wholesale lv switchgear panel manufacturer

- Wholesale lv switchgear panel in Guatemala

- Philippines Cebu photovoltaic panel wholesale factory direct sales

- Saint Lucia Photovoltaic Panel Wholesale Manufacturer

- European battery photovoltaic panel wholesale factory direct sales

- China wholesale 2 breaker sub panel Factory

- Wholesale 4000 amp switchgear in Mombasa

- Wholesale switchgear and control

- Wholesale switchgear breaker in Cape-Town

Industrial & Commercial Energy Storage Market Growth

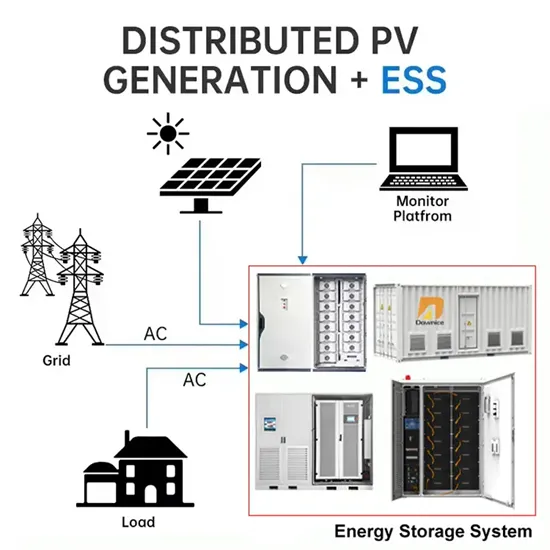

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

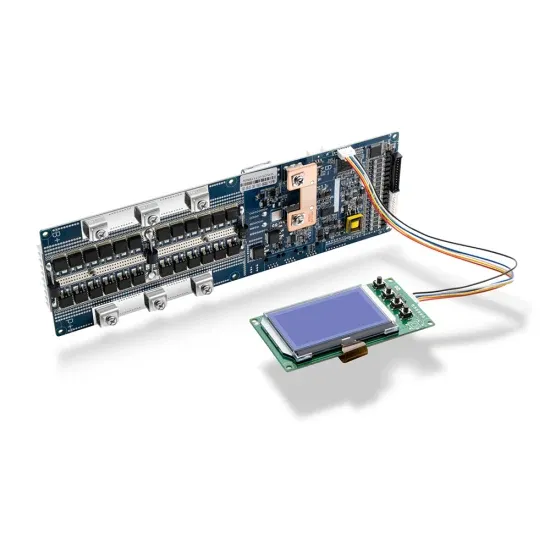

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.