Large scale energy storage system Namibia

First utility-scale battery energy storage system to be developed in Namibia- said the company is committed to building a world-class facility and making it a landmark in the new energy fields

Power grid battery Namibia

Namibia signs for its first grid-scale battery storage project – EQ This move reflects Namibia''''s commitment to modernizing its grid and integrating energy storage solutions, contributing to a

BESS Projects Fact Sheet 12 July 2021

Jul 12, 2021 · Introduction and Background By 2030 the Namibian government plans to increase the share of renewable energies (RE) in its electricity generation from around 30% to 70%.

World s largest battery storage Namibia

The Erongo Battery Energy Storage System, also Erongo BESS, is a planned 58 MW (78,000 hp) battery energy storage system installation in Namibia. The BESS, the first of its kind in the

Mega battery to facilitate breakthrough for renewables in Namibia

Aug 17, 2025 · In Namibia, one of the largest electricity storage systems in southern Africa is currently being built – financed with a grant from KfW. Namibia has great potential for solar

Namibia power grid battery storage

The Erongo Battery Energy Storage System, also Erongo BESS, is a planned 58 MW (78,000 hp) battery energy storage system installation in . The BESS, the first of its kind in the country and

Namibia energy storage for grid stability

Namibia energy storage for grid stability Namibia energy storage for grid stability NamPower''''s Senior Manager of Generation Projects, Ben Mingeli, emphasised the importance of Battery

Namibia grid-side energy storage project | Solar Power

In Short : Namibia has signed for its inaugural grid-scale battery storage project, marking a significant advancement in the country''''s energy infrastructure. said the company is committed

Namibia energy storage for grid stability

"To mitigate intermittency and maintain grid stability, NamPower is developing and constructing Battery Energy Storage System (BESS) projects such as the Omburu BESS with a capacity of

Utility scale battery energy storage Namibia

A grant of 20 million (US$22.66 million) has been made to Namibias government-owned electric utility company for the development of the African countrys first grid-scale battery storage

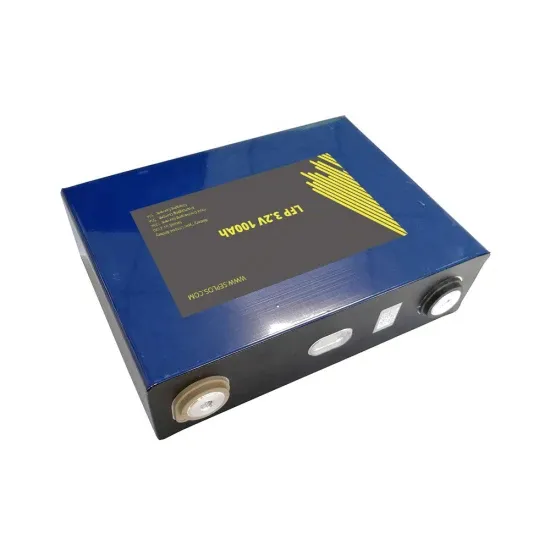

Namibia lithium ion battery energy storage

As the first utility-scale storage projects in Namibia, the Omburu BESS will provide the following benefits: o Surplus electricity from RE generation as well as cheaper electricity imports from

Learn More

- Sana a Grid Energy Storage Company

- A company in Turkmenistan that makes energy storage base stations

- Energy Storage Lithium Battery Company

- Which photovoltaic energy storage company is suitable in Skopje

- Is there any company producing energy storage mobile power supply in Almaty Kazakhstan

- Santo Domingo Energy Storage New Energy Technology Company

- Nassau smart energy storage battery customization company

- Kenya Energy Storage Charging Pile Equipment Company

- Yemen lithium battery energy storage cabinet design company

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.