Spain second country in world for stand-alone battery-based

Dec 20, 2024 · Renewable energy will cover almost half of the world''s electricity demand by 2030, according to the Renewables 2024 report by the International Energy Agency (IEA), thanks to

Total electricity generation 2021 | System reports

Apr 8, 2022 · The energy landscape in Spain in 2021 continued to make progress in its recovery after the impact of the COVID-19 pandemic. In this context, electricity generation in the

Spain sets new 2030 energy storage target of 22.5 GW

Sep 27, 2024 · By 2030, Spain expects to install 22.5 GW of energy storage projects, including included battery energy storage, pumped hydropower and solar thermal plants. The plan also

The Spanish Electricity System 2020

Mar 21, 2023 · GWh The demand for electricity in Spain during 2020 showed a decrease of 5.5% with respect to the previous year, reaching a demand total of 249,991 GWh, this being the

Spain: Tesla Wins 400MWh Major Energy Storage Order

Aug 12, 2025 · In Madrid, Spain, independent power producer Matrix Renewables (invested by the TPG Rise Fund) has submitted environmental impact assessment and administrative

Energy storage in Spain: Forecasting electricity excess and assessment

Jan 15, 2018 · To facilitate the penetration of renewable energy sources up to significant shares, massive long-term electricity storage technologies must be considered. Among these

5 Trends Shaping M&A in Spain''s Energy Storage Market

Jun 11, 2025 · Spain is rapidly becoming a hotspot for investment in energy storage. As the country continues its transition to renewable energy sources, demand for flexible grid

Spain: battery storage capacity 2023-2027| Statista

Jul 10, 2025 · The capacity installed in grid-scale battery storage systems in Spain is forecast to increase from ** megawatt-hours in 2023 to approximately

Analysis of District Heating and Cooling systems in Spain

Dec 1, 2020 · It is evaluated the energy demand for heat and cold, respectively, of the following different energy resources available in Spain: residual heat, thermal power stations, waste,

Strategy for energy storage in Spain for 2050

Nov 4, 2020 · To do that, it is necessary to study the different storage technologies and make a comparison between them, to analyse which storage systems are more useful for large-scale

Strategy for energy storage in Spain for 2050

Nov 4, 2020 · PHES (pumped hydro energy storage) technology is considered a large-scale energy storage system. This type of plants tends to have hight rated power and are usually

Iberia: Why are there no batteries in Spain?

Spain has only 18 MW of grid scale batteries. This research examines why Spain lags in storage deployment, what is changing now, and how developers can capitalise on the emerging

6 FAQs about [Total demand for energy storage power stations in Madrid]

What is Spain's battery storage market?

Spain’s battery storage market is dominated by customer-sited systems. Utility-scale storage remains nascent. Currently, Spain’s storage market is mainly composed of small-scale batteries co-located with solar PV. Spain’s household electricity prices now stand at over EUR 0.30/kWh on average.

How much does electricity cost in Spain?

Spain’s household electricity prices now stand at over EUR 0.30/kWh on average. In addition, Spain’s reliance on fossil gas has increased price volatility in recent years.16,17,18,19 This variability, combined with Spain’s excellent solar resources, make the economics of combining solar with storage increasingly favorable.

What will Spain's energy plan look like in 2030?

By 2030, Spain expects to install 22.5 GW of energy storage projects, including included battery energy storage, pumped hydropower and solar thermal plants. The plan also aims for 76 GW of solar power, 62 GW of wind power, which includes 3 GW of offshore wind, along with 1.4 GW of biomass projects.

How many GW of hydro capacity does Spain have?

Spain operates 17 GW of hydro capacity plus 3.3 GW of pumped storage. These assets have historically provided: Seasonal energy storage in reservoirs. Asset owners optimise based on the water value, considering power prices months into the future. Pumped Hydro responds to wholesale market price signals.

Does Spain have a storage market?

Currently, Spain’s storage market is mainly composed of small-scale batteries co-located with solar PV. Spain’s household electricity prices now stand at over EUR 0.30/kWh on average. In addition, Spain’s reliance on fossil gas has increased price volatility in recent years.16,17,18,19

Will Spain achieve 20GW of storage by 2030?

In addition, Spain has developed a national storage roadmap that includes a target to achieve 20GW of storage by 2030. However, current levels of customer-sited storage adoption already exceed its 2030 targets.37 To date, neither has been sufficiently attractive to mobilize investments at scale.

Learn More

- Energy storage power stations can reduce electricity charges when increasing demand

- Total investment in energy storage power stations

- Which companies have energy storage power stations in Greece

- What are the chemical energy storage power stations in Toronto Canada

- The application of batteries in energy storage power stations

- Channel cooperation for energy storage power stations

- What are the energy storage photovoltaic power stations

- Energy storage power stations emphasize safety

- Energy storage power stations under construction and in operation

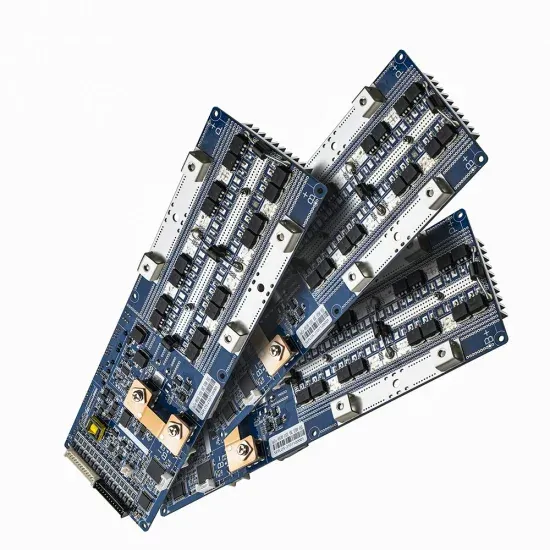

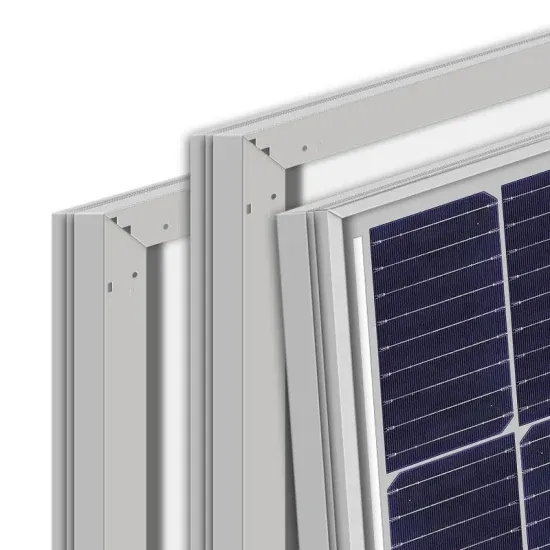

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.