Global energy storage cell shipment ranking 1Q-3Q24

Nov 15, 2024 · According to InfoLink''s global lithium-ion battery supply chain database, energy storage cell shipments reached 202.3 GWh in the first three quarters of 2024, up 42.8% YoY.

CATL Reinforces Dominance in Energy Storage and Power Battery

Feb 24, 2025 · Compared to 2023, CATL''s market share has increased by 2%, marking a significant milestone in its continued global dominance. According to SNE Research, the

LISHEN | LISEHN Battery | Lithium Battery | Li-ion Battery

Mar 3, 2023 · According to preliminary research from Gaogong Industry Research Institute (GGII), China''s lithium battery shipments reached 786 GWh in Q1-Q3 2024, marking a 30% year-on

Global Li-ion battery shipments rise in 2024: EV Tank

Global shipments of electric vehicle (EV) power batteries and energy storage batteries surged in 2024, and could continue growing until 2030, according to Chinese research institution EV

EVE ''s energy storage battery shipments doubled in the first

Aug 26, 2024 · Among them, power battery shipments were 13.54GWh, a year-on-year increase of 7.03% while energy storage battery shipments were 20.95GWh, a year-on-year increase of

How much is the growth rate of energy storage battery shipments

Jan 1, 2024 · The growth rate of energy storage battery shipments has witnessed exponential increases in recent years due to several driving factors. 1. The demand for renewable energy

Energy storage battery exports in the first five months of

Jul 19, 2024 · In May alone, the domestic export volume of energy storage batteries was as high as 4 GWh, marking a year-on-year growth of 664%. According to data from the China

GGII: The shipment volume of China''s energy storage lithium batteries

Jul 15, 2024 · GGII predicts that the total shipment volume of lithium batteries for energy storage in 2024 will exceed 240GWh, with power energy storage becoming the main driver of growth

Energy storage battery shipments in 2025

The lithium batteries is the most commercialized new energy storage route. It is predicted that the shipment of energy storage lithium batteries will exceed 300gwh in 2025. However, due to the

Home Energy Storage Industry Analysis Report | Keheng

Dec 12, 2024 · Preface What is the development trend of home energy storage systems? Home energy storage systems can usually be combined with distributed photovoltaic power

Rising Demand for Energy Storage Batteries Sparks

Apr 20, 2025 · Energy Storage Battery Demand Forecast is looking promising, prompting major companies to ramp up production. According to Zhitong Finance, on December 12, during the

Chinese lithium battery shipments up 32.6% in 2024

Jan 20, 2025 · Shipments of Chinese lithium batteries increased 32.6% to 1,175 gigawatt-hours in 2024, Kallanish learns from the Gaogong Industrial Institute (GGII). The volume breaks down

VIVNE Leaf battery replacement and upgrade

Aug 24, 2024 · VIVNE Leaf battery replacement and upgradeHome > Blog > 9 Chinese companies including EVE Energy, Ruipu Lanjun, and Envision Power ranked among the top

In 2022, global lithium-ion battery shipments

Jun 30, 2025 · Abstract: The "White Paper on the Development of China''s Lithium-ion Battery Industry (2023)" shows that in 2022, the overall global

China''s Lithium Battery Sector Shifts Focus to

Nov 4, 2024 · In the first three quarters of 2024, China''s lithium battery shipments soared to 786 gigawatt-hours (GWh), a significant increase from 605 GWh in

Future of China''s New Energy Storage in 2024: Institutions

Jan 9, 2024 · The latest data released by the China Power Battery Application Branch shows that the global energy storage battery shipments reached 173 GWh (calculated at the terminal), a

Top Lithium Battery Exporters in 2025: Which Country Leads

Feb 21, 2025 · The research institutions EVTank and Ive Economic Research Institute, together with the China Battery Industry Research Institute, have jointly released the "White Paper on

China energy storage lithium battery shipments

Jan 15, 2023 · In 2022, shipments of lithium batteries for energy storage will rise. GGII research data shows that in 2022, the shipment of energy storage lithium

The Latest Top 10 Global Battery Shipments in 2024

The Latest Top 10 Global Battery Shipments in 2024 The Latest Top 10 Global Battery Shipments in 2024 The global power and energy storage battery market is in the midst of a fierce battle,

Chinese lithium battery shipments up 32.6% in 2024 | SEAISI

Jan 20, 2025 · Shipments of Chinese lithium batteries increased 32.6% to 1,175 gigawatt-hours in 2024, Kallanish learns from the Gaogong Industrial Institute (GGII). The volume breaks down

U.S. Tariff Hikes Expected to Boost ESS Installation Capacity

Jun 3, 2024 · Energy storage battery deployment in the power sector doubled compared to the previous year. However, to meet the global 2030 target, the battery industry must expand

GGII: 2025H1 China''s lithium battery shipments increased

Domestic energy storage lithium battery shipments have maintained a year-on-year growth rate of over 120% for two consecutive quarters. Affected by national supplements, the domestic 3C

Global Li-ion battery shipments rise in 2024: EV Tank

Global shipments of electric vehicle (EV) power batteries and energy storage batteries surged in 2024, and could continue growing until 2030, according to Chinese research institution EV Tank.

Learn More

- Does the energy storage battery in a solar power station have a big role to play

- Lithium battery energy storage for power plants

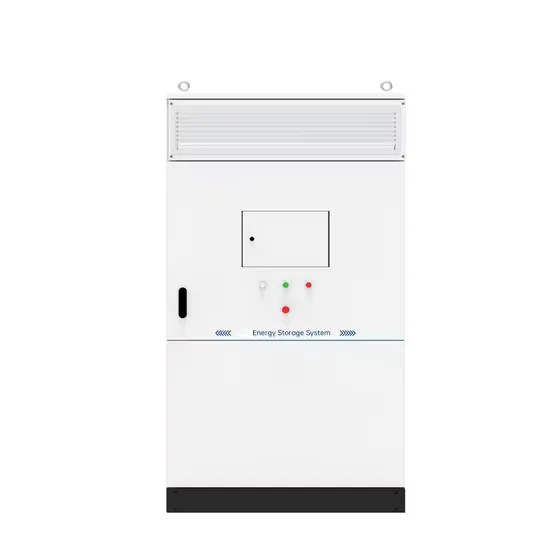

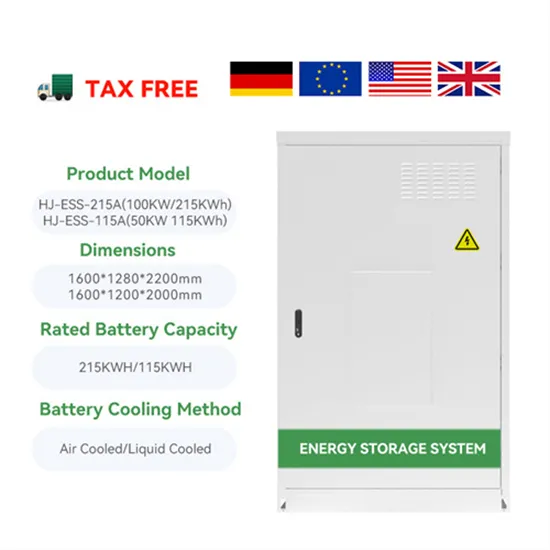

- Energy storage cabinet battery power 215KWh

- Peak regulation benefits of battery energy storage power stations

- Power of pure liquid-cooled energy storage battery cabinet

- Photovoltaic energy storage battery power

- The difference between power type and energy storage type battery

- Battery energy storage system power generation in the communication base station room

- Off-grid energy storage power station battery design

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.