Market Opportunities for Battery Energy Storage Systems (BESS)

Jul 8, 2025 · Voltage and Reactive Power: PV plants with grid-forming inverters and batteries can both provide reactive power compensation, voltage support, and other dynamic support

Expert analysis: How to approach battery energy

Jan 16, 2025 · What are the opportunities and challenges for business cases for stand-alone battery energy storage systems (BESS) in European markets like

BESS eskom brochure RGB 8 Nov

Nov 9, 2023 · BESS offers rapid power output adjustments critical for grid stability, responding to supply and demand fluctuations, minimising outages, and ensuring reliable power delivery.

Leveraging Battery Energy Storage for Enhanced

Mar 1, 2024 · BESS can act as a reliable backup power source during grid outages. The stored energy in the batteries is readily available to power critical telecom equipment, ensuring

Growth Opportunities for the Grid-scale Battery Energy

Oct 18, 2024 · "Growth Opportunities for the Grid-scale Battery Energy Storage Systems (BESS) Industry" This study provides a regional-level forecast and analysis of how grid-scale BESS

Enabling renewable energy with battery energy storage

Feb 10, 2025 · ortunities associated with BESS is to segment the market by the applications and sizes of users. There are three segments in BESS: front-of-the-meter (FTM) utility-scale

Utility-scale battery energy storage system (BESS)

Mar 21, 2024 · Introduction Reference Architecture for utility-scale battery energy storage system (BESS) This documentation provides a Reference Architecture for power distribution and

Battery Energy Storage Systems Report

Jan 18, 2025 · This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their

BESS (Battery Energy Storage Systems)

Boost energy storage with Industrial/Commercial & Home BESS, powered by lithium batteries. Ensure grid stability, savings, & backups. Plus, power base stations with Huijue Energy

Backup power for Europe

Jan 9, 2025 · In this report, we review the key factors shaping the business models of BESS-related investments in Germany, the UK, France, Spain, Italy, and the Netherlands. We cover

Unlocking the potential of Battery Energy Storage Systems (BESS

1 day ago · As Southeast Asia continues to experience rapid economic growth and urbanization, the demand for reliable and sustainable energy solutions is higher than ever. With many

6 FAQs about [What are the business opportunities for outdoor communication power supply BESS]

What is a Bess energy storage system?

BESS are innovative technologies that are crucial when it comes to demand response programs and flexibility, as they can improve system utilization and drive economic growth. In addition, hybrid energy storage systems can be used to optimize performance, efficiency and increase cost-effectiveness.

How can a virtual power plant benefit from Bess?

Energy management systems and software solutions can optimize the operation and performance of BESS, facilitating grid integration and saving costs. Virtual Power Plants can aggregate distributed energy resources and optimize their capabilities.

What services can Bess provide?

A few out of multiple grid services that BESS can provide are short-term balancing, operating reserves, ancillary services for grid stability, long-term energy storage, and restoration of grid operations after a blackout.

What is Bess & why is it important?

BESS has rapidly become the fastest-growing clean energy technology, driven by the growth of wind and solar and the need for grid flexibility. Governments, system operators, and regulators recognize the diverse benefits of energy storage and are advancing regulations and incentives to support the technology's deployment, albeit at varying rates.

How will a low-price scenario impact the Bess industry?

The low-price scenario and the push for domestic content and higher ESG transparency are injecting additional dynamism into the industry. The publisher forecasts cumulative grid-scale BESS capacity to grow nearly eight-fold, reaching 549.93 GW/1,549.02 GWh by 2030.

Who is a Bess provider?

ive utility-scale BESS a share of up to 90 percent of the total market in that year (Exhibit 2).Customers of FTM installations are primarily utilities, grid operators, and renewable developers looking to balance the intermi tency of renewables, provide grid stability services, or defer costly investments to their grid. The BESS providers i

Learn More

- How is the outdoor communication power supply BESS business doing

- Accra BESS Power Outdoor Communication Power Supply

- Barbados Outdoor Communication Power Supply BESS Manufacturer

- Malaysia has outdoor communication power supply BESS

- Maldives Outdoor Communication Power Supply BESS Network

- Outdoor Communication Power Supply BESS City

- Outdoor communication power supply BESS platform recommendation

- How much does a large outdoor communication power supply BESS cost

- Does the outdoor communication power supply BESS have a good prospect

Industrial & Commercial Energy Storage Market Growth

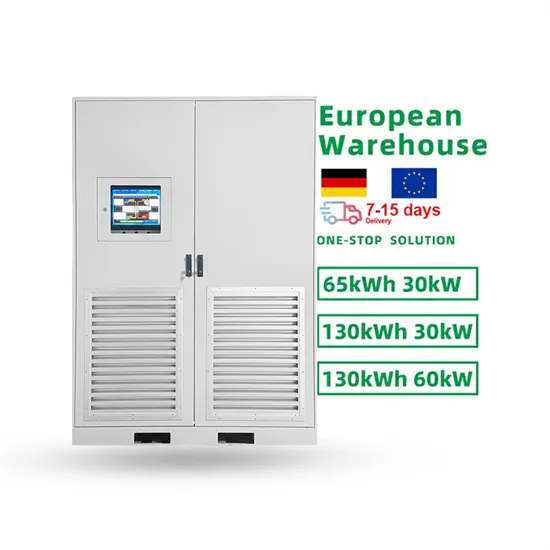

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.