best lead acid energy storage battery brands

Jul 29, 2025 · Lead acid energy storage batteries are rechargeable batteries that use lead dioxide and sponge lead as electrodes and sulfuric acid as the electrolyte. They store electrical energy

Common lead-acid battery brands for liquid-cooled energy storage

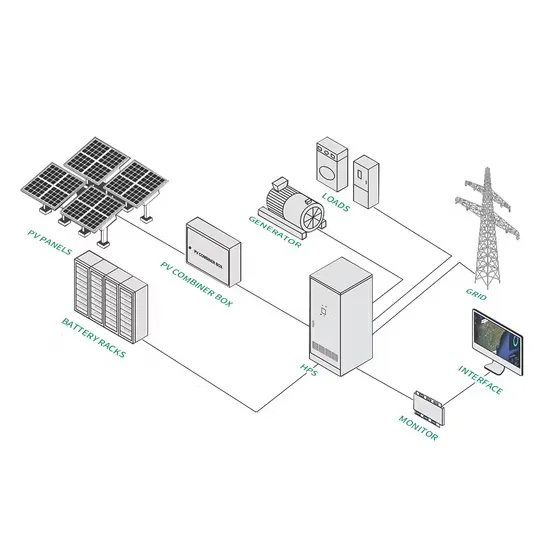

Explore cutting-edge energy storage solutions in grid-connected systems. Learn how advanced battery technologies and energy management systems are transforming renewable energy

Top 10 Lead-Acid Battery Manufacturers – Don''t

Mar 23, 2025 · Smaller brands like Powsea offer excellent value for specific applications. Lead-acid batteries are outdated. → They are still widely used in

Vietnam Battery Manufacturers Ranking-Ritar International

Feb 11, 2025 · CSB Battery Vietnam, a subsidiary of CSB Energy Technology Co., Ltd., is a significant player in the manufacturing of valve-regulated lead-acid (VRLA) batteries.

Battery Energy Density Chart: Power Storage Comparison

Dec 1, 2024 · Lead-acid batteries rely on heavier materials like lead, resulting in lower energy density. Emerging technologies like solid-state batteries use advanced electrolytes that

Lead–acid battery energy-storage systems for electricity

Nov 30, 2001 · This paper examines the development of lead–acid battery energy-storage systems (BESSs) for utility applications in terms of their design, purpose, benefits and

(PDF) Lead batteries for utility energy storage: A

Feb 1, 2018 · Lead batteries are very well established both for automotive and industrial applications and have been successfully applied for utility energy

Lead batteries for utility energy storage: A review

Feb 1, 2018 · Lead–acid batteries have been used for energy storage in utility applications for many years but it has only been in recent years that the demand for battery energy storage

Top 10 Car Battery Brands in the World | Global Sources

Apr 22, 2025 · For conventional lead-acid batteries, brands like Optima, Bosch, and VARTA consistently receive high ratings for reliability and performance. For electric vehicles, battery

Top Lead-Acid Energy Storage Battery Brands in 2025:

Think lead-acid batteries are yesterday''s news? Think again! These workhorses still power 60% of global energy storage systems, from solar farms to telecom towers. The secret sauce?

Energy Storage Lead-Acid Battery Manufacturers: The Power

Feb 9, 2025 · Why Lead-Acid Still Rules the Energy Storage Arena Think lead-acid batteries are yesterday''s news? Think again! These workhorses still power 60% of global energy storage

Compare the Best 10 Solar Batteries in Nigeria in

Jul 20, 2025 · Inverter batteries are used to store extra energy produced by solar panels during the day or PHCN power for usage at night or on cloudy days. In

Do You Know the Top 5 Lead-Acid Battery Manufacturers?

May 26, 2025 · Lead-acid batteries are among the world''s safest and most reliable energy storage devices. A lead-acid (Pb) [the symbol Pb from the Latin Plumbum] battery is a rechargeable

6 FAQs about [Energy storage lead-acid battery brand]

What is the global lead acid battery market company blog?

The Global Lead Acid Battery Market Company Blog continues to witness significant growth driven by its applications in automotive, industrial, and renewable energy sectors.

How do lead acid batteries work?

Lead acid batteries comprise lead and lead dioxide plates that are immersed within a sulfuric acid electrolyte solution. These plates are arranged into cells which, when connected together, produce a complete unit called a battery. This chemical reaction between the chemicals creates an electron flow which produces electrical energy.

What are the Best Lead-acid batteries?

Industries across the globe heavily rely on lead-acid batteries to power their operations and keep things running smoothly. Among these batteries’ most reputable and reliable providers are Leoch, Yuasa, Power-Sonic, Varta, JYC battery, Ritar, Exide, Long, Duracell, and Banner – the top ten brands discussed in this article.

Why are lead-acid batteries so popular?

Lead-acid batteries have longevity and efficiency for powering various devices like automobiles or backup systems, so it’s no wonder why these batteries have been common across industries. With this in mind, let’s find out which brands rank amongst our Top 10 may be interesting!

Who makes lead-acid batteries?

The field of lead-acid batteries features some significant players, such as Yuasa – reputed for its storied legacy and stronghold presence within the industry. From 1965 onwards until today, Yuasa continues to furnish high-end products engineered for various requirements.

What is the future of the lead-acid battery market?

Latin America & Africa: Emerging markets driven by infrastructure development and power backup needs. These companies play a crucial role in shaping the future of the lead-acid battery market, which is expected to remain a key component of global energy solutions due to its reliability and cost-effectiveness.

Learn More

- Brussels special energy storage battery brand

- Lead-acid battery energy storage solution

- What is the ampere of the largest lead-acid energy storage battery

- Ljubljana imported energy storage battery brand

- Photovoltaic power station energy storage battery brand

- Ladder lead-acid battery energy storage

- Energy storage lead-acid maintenance-free battery

- North American energy storage lithium battery brand

- Nairobi large energy storage battery brand

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.