UPS selection, installation and maintenance

May 9, 2018 · Purpose of uninterruptible power supply (UPS) The purpose of this publication is to provide guidance for facilities engineers in selecting, installing,

Analysis of uninterruptable power supply critical-to-quality

Jun 27, 2023 · To eliminate these problems, it is important to accurately evaluate the performance of electrical appliances. With this in mind, this paper investigates the power, runtime, and

Uninterruptible Power Supply (UPS) – Definition, Block

Dec 16, 2022 · Learn about Uninterruptible Power Supply (UPS), its definition, block diagram, types, and various applications in this comprehensive guide.

Denmark Uninterruptible Power System (UPS) Market:

Jul 11, 2025 · Denmark Uninterruptible Power System (UPS) Market was valued at USD 4.00 Billion in 2022 and is projected to reach USD 6.57 Billion by 2030, growing at a CAGR of 6.3%

Price of backup UPS uninterruptible power supply in Aarhus Denmark

Uninterruptible Power Supply (UPS) – Best Prices from top UPS Brands. We proudly feature top brands like APC UPS, DIGITEK, and MERCER UPS, which are known for their reliability and

What Is an Uninterruptible Power Supply (UPS) System?

Feb 25, 2025 · An uninterruptible power supply (UPS) system provides backup power during electrical outages using a battery, inverter, and rectifier. When grid power fails, the UPS

Port of Aarhus to implement onshore power supply by 2026

Jan 28, 2025 · Ports in Aarhus, Gothenburg, Bremerhaven, and Stockholm will all offer shore power for containerships by 2030 as part of the "OPS Network" project. The project is

Uninterruptible power: Adoption trends to 2025

Sep 12, 2023 · Data center uninterruptible power supply (UPS) systems are evolving. New technologies are enabling various electrical approaches. But will UPS systems of the future

HPE Uninterruptible Power System (UPS)

The HPE Line Interactive Rackmount Uninterruptible Power Systems safeguards the steady flow of clean and protected power within your computing environment that has the optional capacity

6 FAQs about [Aarhus substation in Denmark UPS uninterruptible power supply]

What is an uninterruptible power supply (UPS)?

In order to eliminate or reduce the loss of important data or control, it may be necessary to provide a level of power protection for your particular needs. An Uninterruptible Power Supply (UPS) can be that answer. These devices are designed to provide continuous power to a load, even with an interruption or loss of utility supply power.

Will MV ups be used in 2025?

Our study suggests that for the foreseeable future — by 2025 — MV UPS systems are unlikely to be used by significantly more operators than today. Distributed uninterruptible power systems with batteries will also continue to be favored by only a relative few (mostly cloud operators).

Will a 3-phase UPS system continue to dominate in the future?

Centralized, 3-phase UPS systems will continue to dominate for the next few years, at least, even though problems with batteries, product reliability and safety, in addition to other factors, are likely to persist.

Are MV UPS systems too new?

But, as our study shows, sometimes it is simply that an approach is too new, and therefore considered unproven, especially for enterprises and the colocation providers that serve them. Our study suggests that for the foreseeable future — by 2025 — MV UPS systems are unlikely to be used by significantly more operators than today.

Will a data-driven ups remote monitoring service stymie data center adoption?

There is an appetite for data-driven UPS remote monitoring services, including condition-based maintenance, but IT security requirements threaten to slow — or stymie — broad adoption. Power infrastructure requirements in data centers will be shaped by several factors in the coming years.

Will centralized UPS systems continue to dominate data centers?

Some clear trends emerge, notably that centralized UPS systems will likely continue to dominate in data centers with at least 1 megawatt of IT capacity, especially in those owned by enterprises and colocation providers.

Learn More

- Aarhus Denmark UPS uninterruptible power supply

- Vanuatu substation ups uninterruptible power supply

- Aarhus High Power Uninterruptible Power Supply Denmark

- Sucre substation UPS uninterruptible power supply

- Yemen mining UPS uninterruptible power supply quotation

- Direct sales of UPS uninterruptible power supply

- Integrated UPS uninterruptible power supply

- What types of batteries can be used in UPS uninterruptible power supply

- Portable UPS Uninterruptible Power Supply in China and Africa

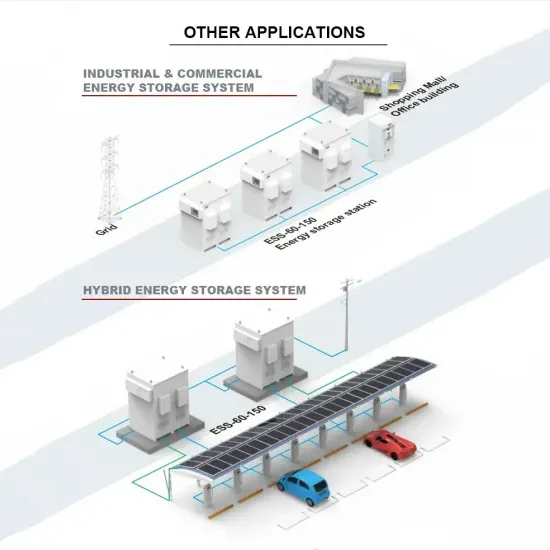

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.