Overview and State of Play on Energy Storage in Asia

Jun 15, 2023 · Asia Pacific (APAC) maintains its lead in building on a power capacity (gigawatt) basis, representing 44% of global additions in 2030. China leads in deployments in the region,

Utility-scale PV cheapest power source in Asia Pacific, says

Mar 1, 2024 · Wood Mackenzie says the levelized cost of electricity (LCOE) in the Asia-Pacific region hit an all-time low in 2023, as utility-scale PV beat coal to become the cheapest power

Asia Pacific Solar Power Market to Hit Strong Growth 25.31%

Feb 24, 2025 · The Asia-Pacific solar power market size is expected to reach around USD 1,084.32 billion by 2034 and is growing at a CAGR of 25.31% from 2025 to 2034. The global

energy storage prices – pv magazine Australia

Jan 20, 2021 · Photovoltaic Markets and TechnologyWoodMac predicts 30% drop in Asia Pacific front-of-the-meter battery costs by 2025 A new report from Wood Mackenzie suggests costs of

Asia Pacific Photovoltaic Energy Storage

Asia Pacific Solar Energy Storage Battery Market Size and Growth 2024 to 2034. The Asia Pacific solar energy storage battery market size was exhibited at USD 2.39 billion in 2023 and is

Asia Pacific Photovoltaic Energy Storage Prices: 23% Cost

Let''s cut to the chase: utility-scale photovoltaic energy storage systems in the Asia Pacific region are now priced at ¥0.92 per watt-hour, down 18% from 2022 levels.

Asia Pacific Photovoltaic Energy Storage Hydrogen

Jul 3, 2025 · The Asia Pacific photovoltaic (PV) system cables market is witnessing robust growth driven by the rising adoption of solar energy across residential, commercial, and industrial

Asia Pacific Solar Power Market Size, Share [2032]

Apr 18, 2024 · Asia Pacific solar power market was valued at US$ 349.6 billion in 2023 and is projected to attain a market valuation of US$ 2,738.9 billion by 2032 at a CAGR of 25.7%

Solar inflation reverses as renewable costs in

Feb 29, 2024 · The cost of electricity generated from renewable sources, known as the levelised cost of electricity (LCOE), is declining significantly in the Asia

Asia-Pacific – pv magazine International

May 28, 2019 · Renewable energy investment in the Asia-Pacific region, excluding China, will overtake spending on oil and gas exploration and production by 2020, finds Norwegian

Asia-Pacific Energy Storage System Price Trends: What You

Let''s face it – the Asia-Pacific energy storage system price trends are hotter than a lithium battery on a summer day. From solar farms in Australia to EV factories in China, everyone''s asking:

Lessons Learned From Techno-Economic Analysis of

Mar 22, 2023 · The analysis uses NREL''s REopt®2 platform, a distributed energy modeling and optimization tool, to identify the cost-optimal system sizing for BESS, in conjunction with

Utility-scale PV cheapest power source in Asia Pacific, says

Mar 1, 2024 · Wood Mackenzie says the levelized cost of electricity in the Asia-Pacific region hit an all-time low in 2023, as utility-scale PV beat coal to become the cheapest power source. It

6 FAQs about [Photovoltaic energy storage prices in Asia Pacific]

What is Asia Pacific on grid solar PV market?

Asia Pacific On Grid Solar PV Market was valued at USD 71.5 billion in 2023 and is set to grow at a CAGR of 4% from 2024 to 2032. Large scale renewable energy deployment owing to growing sustainable energy targets in line with falling prices of solar panels, inverters, and balance of system components will stimulate the product adoption.

What is the value of Asia Pacific solar power market?

Market Scenario Asia Pacific solar power market was valued at US$ 349.6 billion in 2023 and is projected to attain a market valuation of US$ 2,738.9 billion by 2032 at a CAGR of 25.7% during the forecast period 2024–2032. The Asia Pacific region has firmly staked its claim as a powerhouse in the global solar power landscape.

How big is the solar PV market in Asia?

Asia Pacific utility-scale grid solar PV market is anticipated to exceed USD 56 billion by 2032, owing to the increasing focus on large-scale solar projects to meet growing energy demands sustainably in the region. How big is the on-grid solar PV market in China?

Will Asia-Pacific solar photovoltaic (PV) market grow by 2028?

Asia-Pacific Solar Photovoltaic (PV) Market is poised to grow at a CAGR of 10.38% by 2028. Declining cost of solar PV module prices and growing distributed solar power generation drive the industry.

Is Asia Pacific a powerhouse in solar power?

The Asia Pacific region has firmly staked its claim as a powerhouse in the global solar power landscape. In 2023, the region accounted for over 65% of the global solar PV installed capacity. China, leading the charge, reached an astounding 390 GW of installed solar capacity by the end of 2022.

What is the market size of solar PV in APAC?

Asia Pacific market size for on-grid solar PV was reached USD 71.5 billion in 2023 and will exhibit a 4% CAGR from 2024 and 2032, attributed to rising energy demands, coupled with efforts to reduce carbon emissions and declining costs of solar technology. What factors are driving the demand for utility-scale grid solar PV in APAC?

Learn More

- Madagascar photovoltaic power generation and energy storage prices

- Huawei Southeast Asia Photovoltaic Power Generation and Energy Storage

- Charging and discharging prices of photovoltaic energy storage power stations

- Central Asia Photovoltaic Energy Storage Power Station

- East Asia Energy Storage Photovoltaic Project

- Canadian Energy Storage Photovoltaic Project Prices

- Small photovoltaic energy storage in Central Asia

- Solar photovoltaic panels and energy storage equipment

- Photovoltaic power generation energy storage pump in Karachi factory Pakistan

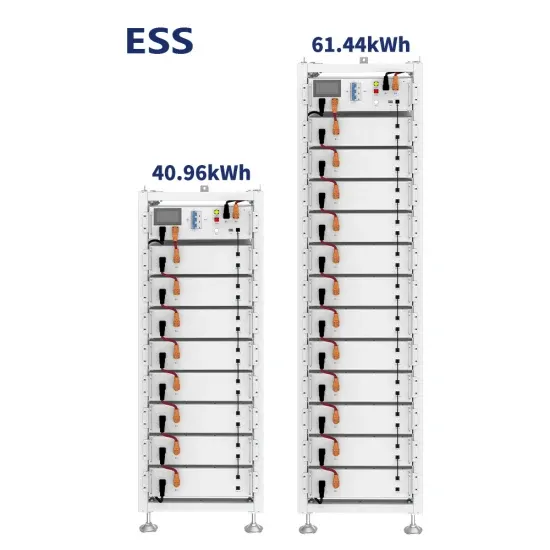

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.