Energy Storage Stocks: Investment Opportunities in

Mar 28, 2025 · As the world increasingly transitions towards renewable energy, the importance of energy storage has never been more pronounced. This article explores various energy storage

Top Energy Storage Batteries ETFs | Best Lithium Fund Investing

Find the list of the top-ranking exchange traded funds tracking the performance of companies engaged in battery and energy storage solutions, ranging from mining and refining of metals

Corporate America vastly increases investment

Nov 20, 2024 · Technology firms are the dominant industry investing in solar as electricity demand soars to keep pace with data center growth. With the rise in

What companies are investing in shared energy

Jul 10, 2024 · The essence of shared energy storage lies in its ability to balance supply and demand efficiently. For instance, during sunny days, solar panels

Top 10 Energy Storage Investors in North America | PF Nexus

Aug 6, 2025 · Discover the current state of energy storage investors in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Which companies are investing in energy storage? | NenPower

Apr 5, 2024 · 1. A diverse array of companies are allocating significant resources into energy storage technology, with notable investments by global energy giants, tech firms, and

Which companies are investing in energy storage projects?

Oct 6, 2024 · Investment in energy storage technologies has led to significant advancements, including improvements in battery technology, systems integration, and deployment strategies.

Best Solar Energy Stocks to Invest In 2025 | The

May 5, 2025 · Learn to make money while investing in green energy companies like these solar stock industry leaders. Profit while investing for the world you

7 Top-Performing Clean Energy ETFs

Aug 18, 2025 · Clean energy exchange-traded funds (ETFs) are investment funds focused on holding the shares of companies investing in cleaner and alternative energy sources, like wind,

Top 5 Solar Energy Storage Companies To Consider [2025]

Jul 14, 2023 · Join us as we delve into the world of energy storage companies—unraveling breakthrough technologies and visionaries that are reshaping our energy future with

Top 10 Energy Storage Companies in North America | PF Nexus

Jul 14, 2025 · Discover the current state of energy storage companies in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Which companies are investing in energy storage? | NenPower

Apr 5, 2024 · 1. OVERVIEW OF ENERGY STORAGE INVESTMENTS The realm of energy storage has become a focal point for numerous industries, demonstrating an evident shift as

7 Energy Storage Stocks to Invest In | Investing

Jul 9, 2025 · Energy storage systems are increasingly in demand to increase the effectiveness of solar power arrays, with the Energy Information Administration

Top Energy Storage Stocks 2025: Pure-Play Watchlist

Jun 27, 2025 · In this report, we highlight the top energy storage stocks to watch, curated for exposure to breakthroughs in advanced li-ion, flow & zinc, solid-state, and green hydrogen

Top 10 Energy Storage Companies Powering Renewables

Jun 3, 2025 · NextEra Energy is one of the largest renewable energy companies in the United States, with significant investments in wind, solar, and energy storage projects. The company

Top Renewable Energy & Battery Storage Stocks Worth Investing

Mar 17, 2025 · The growth prospects for renewable energy and battery storage stocks like AEE, CMS, BE and STEM remain promising, backed by growing global electricity demand.

Top Renewable Energy & Battery Storage Stocks Worth Investing

Mar 17, 2025 · Ameren, which generates and distributes electricity, has been steadily investing in offering electricity through cleaner sources of energy generation, such as solar, wind, natural

6 FAQs about [Solar companies invest in energy storage]

What are energy storage stocks?

Energy storage stocks are companies that produce or develop energy storage technologies, such as batteries, capacitors, and flywheels. These technologies can store energy from renewable sources like solar and wind power, or from traditional sources like coal and natural gas.

Which energy storage companies are leading the charge in 2025?

That’s exactly where utility-scale energy storage companies come into play. These innovators are building large-scale battery systems and storage infrastructures that enable grid flexibility, stabilize supply, and support decarbonization efforts. Here are ten leading companies leading the charge in energy storage in 2025. 1. Avaada

Are energy storage stocks a good investment?

Currently, energy storage stocks are a relatively safe investment to make for the future, and if trends hold, they have solid potential for growth. However, if this doesn’t appear to be a good fit for your investment portfolio, then it’s best to look at other options.

Who owns Vivint Solar?

Acquired by Sunrun in 2020 for US$3.2bn, Vivint Solar entered the home energy storage market in 2017 with a partnership with Mercedes-Benz Energy followed by another partnership with LG Chem. Known for its residential solar installations, Vivint has emerged as a notable player in the energy storage sector as it has expanded its offerings.

Are energy storage systems in demand?

Energy storage systems are increasingly in demand to increase the effectiveness of solar power arrays, with the Energy Information Administration estimating in February that new utility-scale electric-generating capacity on the U.S. power grid will hit a record in 2025 after a 30% increase over the prior year.

Does Tesla have a battery storage business?

Tesla has been growing its energy storage business in recent years. Established as a key player in the electric automotive industry, it has diversified its offerings to include battery storage — now one of its strongest offerings. Tesla Energy’s energy storage business has never been better.

Learn More

- Ranking of companies supplying solar energy storage cabinets

- Upstream companies of wind power solar power and energy storage

- Irish solar photovoltaic energy storage companies

- Photovoltaic energy storage cabinet solar float price

- Monrovia Solar Energy Storage Project

- Energy storage methods for solar thermal power plants

- Sophia Solar Energy Storage

- Solar Energy Storage Power Station

- Wind solar and energy storage subsidies

Industrial & Commercial Energy Storage Market Growth

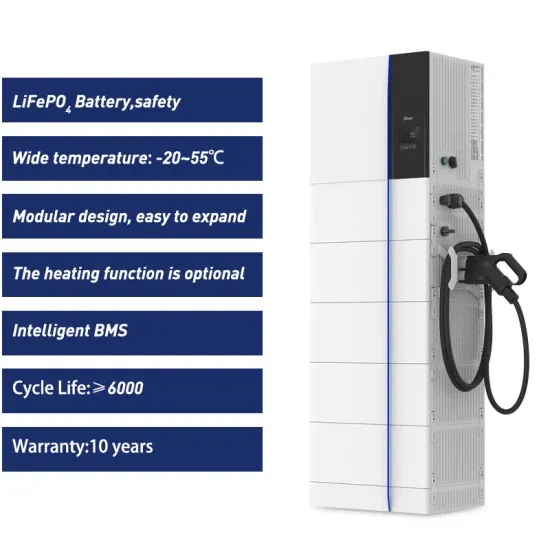

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.