Switchgear in Oman | Electrical Switchgear Suppliers in

List of 20+ electrical switchgear manufacturers & dealers in Oman. Get high, medium voltage & low voltage switchgear panel boards, circuit breakers at cheap price from top electrical

Al Hassan, Siemens extend co-operation agreement

May 2, 2011 · Al Hassan Power Industries LLC (AHPI), part of the Manufacturing SBU of Al Hassan Group, recently signed an OEM agreement with Siemens LLC Oman for manufacture

AL HASSAN SWITCHGEAR – Al Hassan LLC

Al Hassan Switchgear Manufacturing Co. LLC (AHSG) & Al Hassan Power Industries LLC (AHPI) are the largest manufacturers of Switchgear Equipment in Oman with manufacturing facilities

Akos Naar to head Al Hassan group''s manufacturing units

Aug 7, 2011 · The Al Hassan Group has appointed Akos Naar as general manager for its manufacturing Strategic Business Unit (SBU), comprising Al Hassan Switchgear

Al Hassan Switchgear Manufacturing Company Llcs

May 2, 2025 · Al Hassan Switchgear Manufacturing Company Llcs Company Profile with Product wise Import Export Shipment Data along with Company Key Decision Makers Contacts like:

Al hassan switchgear in china in slovenia

Our organization primarily engaged and export Al hassan switchgear in china in slovenia. we depend on sturdy technical force and continuously create sophisticated technology to meet the

Switchgear firm is a key player

Al Hassan, a major name in the Sultanate''s trading community, entered the manufacturing sector with its switchgear unit. Today, its manufacturing "Strategic Business Unit (SBU)" also

AL HASSAN SWITCHGEAR MANUFACTURING in Abu Dhabi

Aug 4, 2025 · In Abu Dhabi, Infobel has listed 108,747 registered companies. These companies have an estimated turnover of 11964.549 billions and employ a number of employees

Al hassan switchgear for sale in belgium

Al hassan switchgear for sale in belgium Supplier having a higher company reputation,from China.Our solutions include: Al hassan switchgear for sale in belgium Solutions are primarily

Al hassan switchgear for sale in kenya

Al hassan switchgear for sale in kenya Supplier with a high business reputation,from China.Our solutions consist of: Al hassan switchgear for sale in kenya Goods are mainly exported to

Al Hassan LLC Careers & Jobs | GulfTalent

In the year 1975 Al Hassan LLC started as a small electrical supplies shop in Old Mattrah selling fans, wires, & other electrical items. Years later Al Hassan had diversified into manufacturing &

Al Hassan Switchgear Manufacturing

Jan 3, 2024 · If you are looking to establish relationship with Al Hassan Switchgear Manufacturing you can save time by getting access to the key decision makers and get a detailed report on Al

Al Hassan''s Buraimi switchgear plant to boast cutting-edge

Sep 20, 2008 · Al Hassan Switchgear Manufacturing Company (Ghala), whose sales volume is slated to touch $35 million, has started building a new export-oriented factory in Buraimi,

Al Hassan Switchgear Manufacturing Co. LLC Al Hassan

Manufacturing Al Hassan Group through its own companies Al Hassan Switchgear Manufacturing Co. LLC (AHSG) & Al Hassan Power Industries LLC (AHPI) is the largest manufacturer of

AL Hassan Switchgear Manufacturing | 1 customers and 45

408 shipments of AL Hassan Switchgear Manufacturing with information about suppliers, customers, products purchased and sold, quantities, prices and supply chain networks.

Hot sale al hassan switchgear in china price

Providing ideal top quality Hot sale al hassan switchgear in china price items,we are professional manufacturer in China.Wining the majority of the crucial certifications of its sector,our Hot sale

4 FAQs about [Al hassan switchgear for sale in Germany]

Who makes switchgear equipment in Oman?

Al Hassan Switchgear Manufacturing Co. LLC (AHSG) & Al Hassan Power Industries LLC (AHPI) are the largest manufacturers of Switchgear Equipment in Oman with manufacturing facilities at Muscat. AHSG manufactures complete range of LV Switch Boards while AHPI manufactures MV Switch Boards and Control & Relay panels.

Who is al Hassan?

Through its LLC operations, i.e. Manufacturing & Trading SBU, Al Hassan has emerged as one of the leading business groups involved in the manufacturing of low and high voltage switchgear panels and trading of electromechanical items across Oman.

Why should you choose hi-tech & Al Hassan group?

Hi-Tech has a prominent presence with high acceptability in all sectors of energy viz. O&G, Petrochem, Power, Water & Waste Water and delivers differentiated solutions with emphasis on quality & reliability. Established in 1975, Al Hassan Group is a dynamic company focused on building products and solutions for the needs of the 21stcentury.

Who is AHSG?

AHSG is a manufacturer of complete range of Low Voltage switchgear fully type tested upto 6400 A rating, 120kA / 1sec fault level and Internal arc tested for 50 kA / 1sec. AHSG serves all segments of the market starting from critical oil and gas projects to building projects with optimal tailor made solutions.

Learn More

- Best al hassan switchgear for sale manufacturer

- Cheap al hassan switchgear for sale Buyer

- Al hassan switchgear for sale in Hungary

- Hot sale al hassan switchgear in China producer

- Al hassan switchgear for sale in Johannesburg

- Al jameel switchgear for sale in Niger

- Al jameel switchgear for sale in Cape-Town

- Al hassan switchgear in China in Sweden

- Al jameel switchgear for sale in Manila

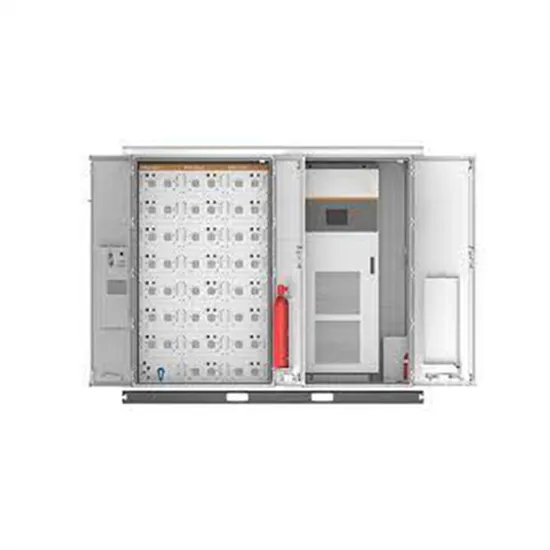

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

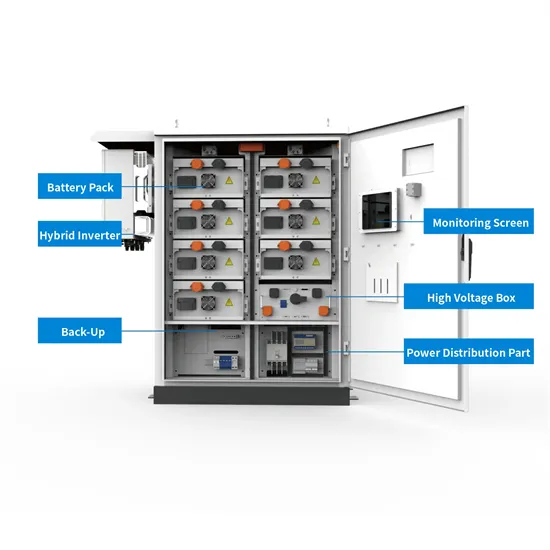

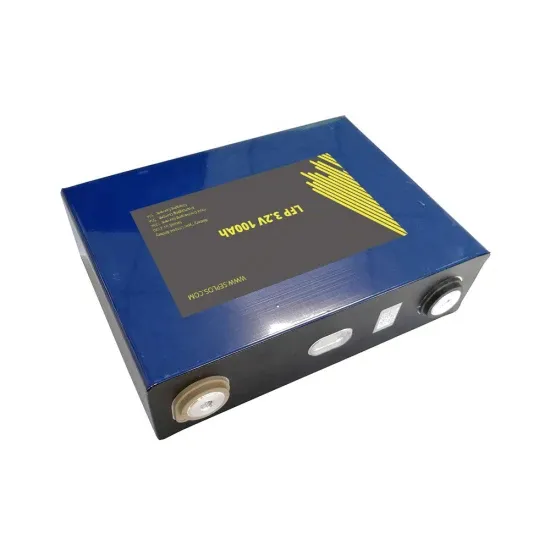

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.