Guatemala | Powertec Information Portal

Aug 19, 2025 · Guatemala''s telecommunications sector is still developing, with mobile penetration significantly higher than fixed-line telephony. Technological innovation is led by the private

Wind at solar complementary system application prospects

Sep 29, 2024 · Maraming bansa sa buong mundo ang mayaman sa hangin at solar energy. Samakatuwid, ang potensyal para sa paggamit ng wind at solar hybrid power generation

The solar power generation current of the

Nanjing Oulu Electric Corp has been deeply involved in the communication base station wind solar complementary project for many years, providing a complete set of integrated solutions

Quantitative evaluation method for the complementarity of wind–solar

Feb 15, 2019 · In this model, a tri-level framework was applied based on data mining, but the diurnal fluctuations analysis of wind and solar energy for typical days and the verification of

Overview of hydro-wind-solar power complementation

Jun 21, 2025 · China has abundant hydropower sources, mainly distributed in the main streams of great rivers.These regions are also rich in wind and solar energy sources; thus, the generation

Wind and solar base station energy storage

The prophase planning of hydroâEUR"windâEUR"solar complementary clean energy bases has been conducted in Sichuan, Qinghai, and some other provinces of China. 3

5kw Wind-Solar Complementary System for Communication Base Station

Feb 18, 2025 · 5kw Wind-Solar Complementary System for Communication Base Station, Find Details and Price about 5kw Hybrid Solar Wind System 5kw Hybrid Solar Wind System for

Telecom Base Station PV Power Generation System

Feb 1, 2024 · The communication base station installs solar panels outdoors, and adds MPPT solar controllers and other equipment in the computer room. The power generated by solar

Design of Oil Photovoltaic Complementary Power Supply

May 15, 2025 · 随着通信业的蓬勃发展,移动通信网络要在偏远地区实现广度覆盖,解决当地的通信需求,而此类区域一般无市电供应、市电不可靠或市电引入成本过高。 针对此类场景的建

移动通信基站油光互补供电方案设计

May 15, 2025 · In response to the construction needs of such scenarios, in order to solve the power supply problem of mobile communication base stations, the natural resource conditions

Design of Off-Grid Wind-Solar Complementary Power

Feb 29, 2024 · Currently, wind-solar complementary power generation technology has penetrated into People''s Daily life and become an indispensable part [3]. This paper takes a 1500 m high

OULU wind solar complementary power generation system

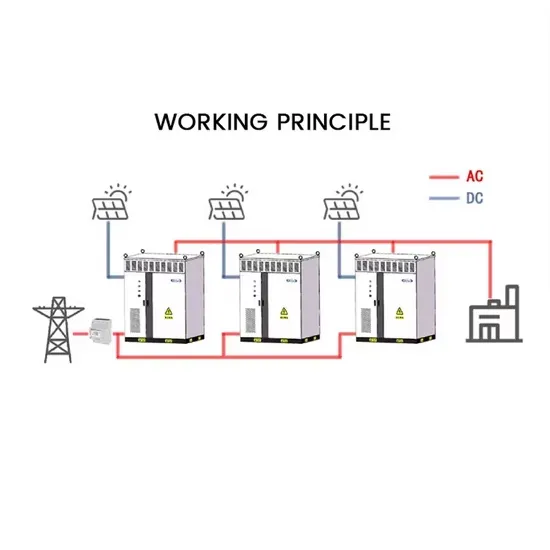

The wind solar complementary power supply system of communication base station is composed of wind turbine generator, solar cell module, mixed energy management integrated controller

Variation-based complementarity assessment between wind and solar

Feb 15, 2023 · To assess the complementarity between wind and solar resources, the observed daily wind speed (at 10 m) and sunshine duration data for 56 years (1961–2016) from 726

Evaluating wind and solar complementarity in China:

Dec 15, 2024 · Changes in wind and solar energy due to climate change may reduce their complementarity, thus affecting the stable power supply of the power system. This paper

Optimal Scheduling of 5G Base Station Energy Storage Considering Wind

Download Citation | On Mar 25, 2022, Yangfan Peng and others published Optimal Scheduling of 5G Base Station Energy Storage Considering Wind and Solar Complementation | Find, read

6 FAQs about [Guatemala s communication base station wind and solar complementary ownership]

What is Guatemala's energy source?

This page is part of Global Energy Monitor 's Latin America Energy Portal. In 2018, Guatemala derived 57.43% of its total energy supply from biofuels and waste, followed by oil (29.54%), coal (7.68%), hydro (3.22%), and other renewables such as wind and solar (2.12%).

How much electricity does Guatemala have?

As of 2020, Guatemala had 4110 MW of installed electrical capacity, based primarily on hydro power (38.38%), fossil fuels (30.36%), and biomass (25.20%). Other renewable sources represented a much smaller percentage of capacity, including wind (2.61%), solar (2.25%) and geothermal energy (1.20%).

How is electricity regulated in Guatemala?

Guatemala's electricity industry is regulated by the General Electricity Act (Ley General de Electricidad) and the CNEE (Comisión Nacional de Energía Eléctrica). The DGH (General Direction of Hydrocarbons) regulates the hydrocarbon sub-sector.

Does Guatemala have a national oil company?

Guatemala does not have a national oil company. Perenco and Pacific Rubiales are important private oil companies operating in the country. As of 2020, Guatemala had 4110 MW of installed electrical capacity, based primarily on hydro power (38.38%), fossil fuels (30.36%), and biomass (25.20%).

Are solar powered cellular base stations a viable solution?

Cellular base stations powered by renewable energy sources such as solar power have emerged as one of the promising solutions to these issues. This article presents an overview of the stateof- the-art in the design and deployment of solar powered cellular base stations.

Does Guatemala produce natural gas?

The country produces 1,162bbl/day of refined petroleum products. Guatemala does not produce any natural gas. Guatemala consumed 89,000 bbl/day as of 2016 of refined petroleum products. Oil and gas is imported primarily from the United States and Mexico.

Learn More

- Hargeisa s latest communication base station wind and solar complementary construction

- Tuvalu communication base station wind and solar complementary tower

- South Ossetia communication base station wind and solar complementary lightning protection grounding manufacturer supply

- Sophia Communication Base Station Wind and Solar Complementary Power Generation Maintenance

- Kiribati communication base station wind and solar complementary query

- Communication base station wind and solar complementary energy consumption integrated system

- Belize Communication Base Station Wind and Solar Complementary Bidding

- Swiss 5G communication base station wind and solar complementary project

- Marseille communication base station wind and solar complementary power generation quotation

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.