U.S. Tariffs on Chinese Lithium Batteries: Full Breakdown

Apr 15, 2025 · U.S. tariffs on Chinese lithium batteries have become a critical factor shaping the global battery market in 2025. These tariffs directly impact lithium-ion batteries'' cost, supply

How much is the price of Shanxi lithium energy storage power supply

May 7, 2024 · The price of Shanxi lithium energy storage power supply is influenced by several pivotal factors. 1. Market demand and supply dynamics, 2. Technological advancements in

How much is the price of Hubei lithium energy storage power supply

Feb 11, 2024 · 1. The price of Hubei lithium energy storage power supply varies significantly based on several factors, including technology type, capacity, brand, installation requirements,

How much does Beijing lithium energy storage power supply cost?

Apr 28, 2024 · The cost of lithium energy storage power supplies in Beijing varies significantly based on several factors including technology, capacity, installation specifics, and market

How much is the price of Jiangxi lithium energy storage power supply

Jul 20, 2024 · The price of Jiangxi lithium energy storage power supply varies depending on several factors, including technology, capacity, and market demand. 1. Pricing typically ranges

What Are The Implications Of $66/kWh Battery Packs In China?

Dec 26, 2024 · Bids averaged $66.3/kWh, with 60 bids under $68.4/kWh. The tender, covering supply, system design, installation guidance, 20-year maintenance, and safety features,

The price of the energy storage industry chain continues to fall

Jun 3, 2024 · According to the data of SMM on May 28, the price range of prismatic lithium iron phosphate batteries (energy storage type, 280Ah) is 0.31-0.4 yuan/Wh, and the average daily

What is the state of the lithium market and how

Oct 14, 2024 · Essential for producing lithium-ion batteries, which power electric vehicles (EVs) and energy storage systems (ESS), lithium has earned the

Fact Sheet: Lithium Supply in the Energy Transition

Dec 20, 2023 · An increased supply of lithium will be needed to meet future expected demand growth for lithium-ion batteries for transportation and energy

How much does Shanxi lithium energy storage power supply cost

Jun 26, 2024 · 1. The cost of Shanxi lithium energy storage power supply varies significantly based on multiple factors, including the scale of the project, the specific technology used, and

What is the appropriate price for lithium energy storage power supply

Jun 19, 2024 · The appropriate price for lithium energy storage power supply is influenced by several key factors, namely 1. market dynamics, 2. technological advancements, 3. economic

How much is the price of energy storage power supply in Shanghai

Jun 23, 2024 · The price of energy storage power supply in Shanghai varies greatly based on several factors, including technology type, capacity, and market dynamics. 1. Pricing ranges

How much is the price of Liaoning lithium energy storage power supply

Sep 10, 2024 · The price of Liaoning lithium energy storage power supply varies significantly due to several influential factors. 1. Current cost ranges between $200 and $500 per kilowatt-hour;

Current Price of Energy Storage Power in China: 2025 Market

Jul 28, 2024 · As of March 2025, the average price for industrial-scale lithium iron phosphate (LiFePO4) battery systems has hit ¥0.456 per watt-hour (Wh) in competitive bids [4]—that''s

Prices of Lithium Batteries: A Comprehensive Analysis

Apr 11, 2025 · How Have Lithium Battery Prices Trended Historically? From 2010–2023, average prices fell from $1,200/kWh to $139/kWh. However, 2022 saw a 7% price spike due to lithium

Costs of 1 MW Battery Storage Systems 1 MW /

Mar 25, 2023 · Discover the factors affecting the Costs of 1 MW Battery storage systems, crucial for planning sustainable energy projects, and learn about the

How much is the price of lithium energy storage power supply

Aug 8, 2024 · The price of lithium energy storage power supplies in Yunnan varies significantly based on several factors. 1. Market dynamics, 2. Technological advancements, 3. Scale of

Long on expectations, short on supply: Regional lithium

Jun 27, 2025 · This study integrates supply-demand analysis with trade network simulations, using eight lithium demand scenarios and two supply scenarios to examine regional lithium

Lithium Prices – Historical Graph [Realtime

2 days ago · Why are lithium prices fluctuating? 1. Supply and Demand The surge in demand and prices for lithium primarily arises from the increasing adoption

The price of batteries has declined by 97% in the

Jun 4, 2021 · There are several ways to store excess energy. Most of us think of batteries. Here we''re going to look at lithium-ion batteries: the most common

6 FAQs about [How much is the price of lithium energy storage power supply in Ljubljana]

Who provides the lithium commodity price?

We provide the lithium commodity price for the following: Fastmarkets’ mission is to meet the market’s data requirements honestly and independently, acting with integrity and care to ensure that the trust and confidence placed in the reliability of our pricing methodologies is maintained.

What is a lithium futures contract?

The new lithium futures [contract] will provide our customers with another tool for managing the price risk associated with the manufacturing of electric vehicles. Get long-term clarity and market intelligence in the critical lithium market Understand the battery material demands of today and plan for tomorrow Trade on market-reflective prices

Why should you trade with Iosco-compliant lithium price data?

Trade with lithium price data that is unbiased, IOSCO-compliant and widely used across the energy commodity markets. Our lithium prices are market-reflective, assessing both the buy- and sell-side of transactions.

Can a healthy lithium futures market be built?

Evidence of efforts to build liquidity and infrastructure for a healthy lithium futures market is already seen in major financial hubs like New York, London and China. While trading represents a smaller fraction of Albemarle’s business, it provides flexibility in supply chain management and insights into future price trends.

Why should lithium traders invest in the lithium market?

Norris also believes that there will be increased opportunities for lithium traders to enter and expand their presence as the lithium industry grows. This is essential for enhancing market liquidity and enabling price risk hedging.

What is the future of lithium?

The future lithium landscape in a decade is envisioned to feature three key regions: China, North America and Europe, each with self-sustaining supply chains. Global trade will continue, with resources from Australia, Chile and Africa contributing to this interconnected market.

Learn More

- Riga lithium energy storage power supply sales price

- London lithium energy storage power supply price

- Bissau lithium energy storage power supply manufacturer

- Mobile energy storage power supply price

- Cyprus Sunshine Energy Storage Power Supply Price

- Southern Europe lithium energy storage power supply manufacturer

- Zambia lithium energy storage power supply field quotation

- Armenia lithium energy storage power supply manufacturer direct sales

- Portonovo Energy Storage Power Supply Sales Price

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

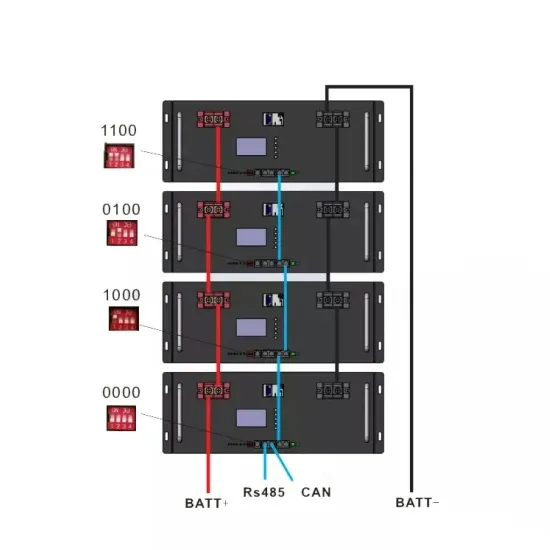

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.