PV Inverter Market Size, Share & Forecast 2025 to 2035

Apr 3, 2025 · PV Inverter Market Forecast and Outlook from 2025 to 2035 The PV inverter generators industry is valued at USD 1.7 billion in 2025. As per FMI''s analysis, the PV inverter

Global PV Module Market Analysis and 2025

Dec 11, 2024 · PV modules are the central component of the solar industry. This analysis reviews market conditions that affect solar panel pricing and availability.

PVBL2025: Global PV Brand Rankings Set to Unveil Industry

May 26, 2025 · This milestone comes as global PV capacity is projected to exceed 350GW in 2025, driven by worldwide decarbonisation efforts and renewable energy roadmaps. The

Global PV inverter shipments rise 10% to 589 GWac in 2024,

Jul 11, 2025 · ETEnergyWorld Published On Jul 11, 2025 at 11:49 AM IST power New Delhi: Global photovoltaic (PV) inverter shipments grew by 10 per cent to 589 gigawatts alternating

Top 5 global inverter trends to watch in 2025 –

Jan 29, 2025 · After a challenging 2024, marked by high inventory levels and declining residential demand, the inverter market is set to recover in 2025.

Photovoltaic Inverters Strategic Business Report 2025:

May 21, 2025 · Key growth drivers include advances in inverter technology, residential and commercial solar adoption, and integration with smart grid and energy management systems.

Pv inverter market in the world in 2025 – TYCORUN

May 9, 2025 · This article analyzes the current global demand for photovoltaic inverters based on the global photovoltaic shipment volume in the second quarter of 2025 and policy adjustments

Sungrow, Huawei Lead PVBL 2025 Global Solar Inverter

Jun 14, 2025 · At the 10th Century Photovoltaic Conference held in Shanghai on June 10, the Photovoltaic Brand Lab (PVBL) released its much-anticipated 2025 Global Top 100 Solar

Top 5 global inverter trends to watch in 2025 –

Feb 3, 2025 · After a challenging 2024, marked by high inventory levels and declining residential demand, the inverter market is set to recover in 2025.

Sungrow, Huawei Lead PVBL 2025 Global Solar Inverter

Jun 14, 2025 · PVBL has revealed the 2025 list of top 20 global solar inverter brands, with Sungrow and Huawei leading the pack, showcasing strong performance despite industry

Top 10 Solar Inverter Manufacturers in 2025:

Mar 21, 2025 · With the global solar inverter market poised for significant growth by 2025, driven by rising demand for clean energy solutions, identifying the

Top 10 Solar Inverter Manufacturers in the World

Jul 17, 2025 · The global solar energy industry is booming, and at the heart of every solar system lies the solar inverter — a device that transforms solar power into usable electricity. With

Global Market Outlook for Solar Power 2025-2029

May 6, 2025 · The Global Market Outlook for Solar Power 2025–2029 is SolarPower Europe''s flagship annual publication, delivering the most authoritative analysis of solar market trends

Global solar inverter manufacturer rankings – pv magazine USA

Aug 11, 2025 · Sinovoltaics, a quality assurance services firm based in Hong Kong, has released its latest global PV Inverter Manufacturer Ranking Report, based on Altman-Z scores for 35

6 FAQs about [Global Photovoltaic Inverter in 2025]

What will the solar inverter industry look like in 2025?

Part 9. Conclusion The solar inverter industry in 2025 is set to be a vibrant and competitive landscape, led by a mix of established giants and innovative players. From Huawei’s smart technology to Enphase’s microinverter expertise, the top 10 solar inverter manufacturers offer a range of solutions to meet diverse energy needs.

Who are the top 10 solar inverter manufacturers in 2025?

Top 10 Solar Inverter Manufacturers in 2025 1. Huawei 2. Sungrow 3. SMA Solar Technology 4. SolarEdge Technologies 5. Fronius 6. Enphase Energy 7. Growatt 8. GoodWe 9. Sineng Electric 10. TMEIC (Toshiba Mitsubishi-Electric Industrial Systems Corporation) Part 4. Global Supply Chain Centers for Solar Inverters Part 6.

How big is the global PV inverter market?

The global PV inverter market was valued at USD 34.6 billion in 2024 and is estimated to grow at a CAGR of 9.5% from 2025 to 2034. The paradigm shift toward the integration of renewable energy resources will fuel the adoption of efficient systems.

What will the solar market look like in 2025?

With global solar installations forecast to grow at a CAGR (2024-27) of only 3.4% for the next 3 years, according to S&P Global Commodity Insights, manufacturers can expect tough market conditions to continue in 2025, with gradual price declines and pressure on ‘normal’ profit margins expected.

When will a solar inverter be available in Europe?

For instance, at Intersolar 2024, SolarEdge Technologies unveiled a new three-phase solar inverter and a dedicated home battery aimed at the European residential sector. Set for launch in the latter half of 2025, the inverter will offer power capacity of up to 20kW and is engineered to support complete home backup.

What was the market size of PV inverter in 2024?

The market size for PV inverter was valued at USD 34.6 billion in 2024 and is projected to reach USD 90 billion by 2034, growing at a CAGR of 9.5% during the forecast period. What was the market share of the three-phase segment in 2024?

Learn More

- Xia Communication Base Station Inverter Grid-connected Photovoltaic Power Generation System

- 6 igbt photovoltaic inverter prices

- How many volts does Huawei string photovoltaic inverter have

- Photovoltaic panel inverter price

- Huawei 20k photovoltaic inverter

- Cambodia Converter Photovoltaic Inverter

- Budapest photovoltaic dedicated inverter manufacturer

- Will the photovoltaic inverter automatically stop if it overheats

- Photovoltaic power station inverter in the Democratic Republic of Congo

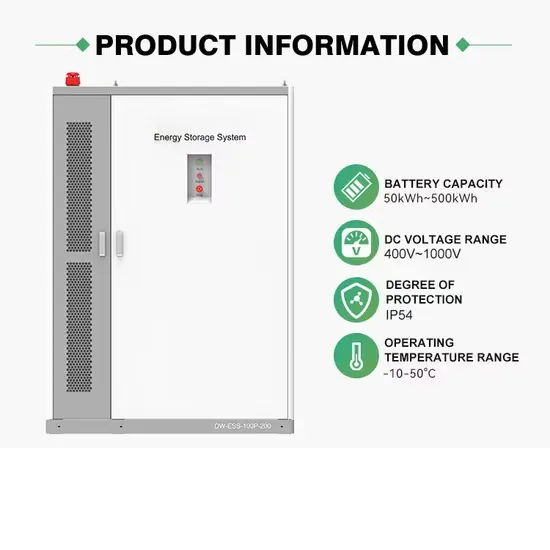

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

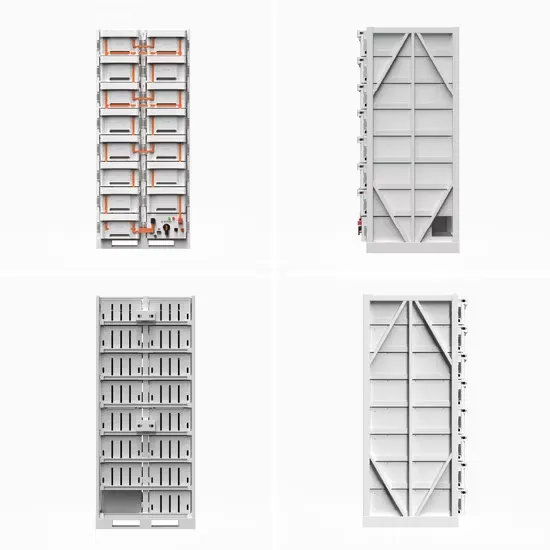

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.