การติดตั้ง Inverter และการเลือกจุด

Nov 8, 2016 · 1.ควรติดตั้งใกล้กับแผง PV เนื่องจากหากวางใกล้กันก็จะทำให้ประหยัดสายไฟ DC ที่เดินจาก PV ไปยัง ตู้ Combiner Box ซึ่งส่วนใหญ่เราก็จะติดตั้งในห้อง Inverter Room (ก็มีบ้างบางแห่งที่ ติดตั้งตู้

Solar Inverters_Energy Storage Inverters

Solis is one of the world''s largest and most experienced manufacturers of solar inverters supplying products globally for multinational utility companies, commercial & industrial rooftop

Factory Sale 6SR Submersible Well Pump Single Iron

We can provide one-stop solution for solar water pump system (solar panel,solar water pump,inverter,cable and so on.) If you are interested in any of our products or would like to

Solis: The World''s 3rd Largest PV Inverter Manufacturer

May 13, 2024 · Manufacturing Capacity Established in 2005, Ginlong (Solis) (Stock Code: 300763.SZ) stands as the world''s third-largest PV inverter manufacturer. As a global provider

FMZ Vfd 0.75kw 380v 3 Phase Input and 3 Phase Output

DC TO AC MPPT Solar Pump Inverter Built-in PID & RS485 Commucication Support over-current, over-voltage, phase loss, short circuit, over temperature protection etc. Product Name

ว่าด้วยอินเวอร์เตอร์ Sungrow EP1

Aug 17, 2025 · ไปค้นหามาจากกราฟ เมื่อปี 2020 ส่วนแบ่งการตลาดของ ตลาดอินเวอร์เตอร์สำหรับระบบโซล่าเซลล์ เค้าเรียกกันว่า PV Inverter แถบภาคพื้น

75 kw solar inverter factory in bangkok

We attach value to innovation, especially with patents of China on 75 kw solar inverter factory in bangkok, its excellent technology has reached the international advanced level, and has a

โซล่าปั้ม solar pump inverter ขนาด 3p380v 7.5

อินเวอร์เตอร์ปั้มน้ำโซล่าเซลล์สำหรับ ปั้มน้ำการเกษตร เหมาสำหรับปั้มน้ำซัมเมอร์ส 3 เฟส 380/220V ช้อป โซล่าปั้ม solar pump inverter ขนาด 3p380v 7.5 kw

Global string inverter manufacturer

Presented under the Solis brand, the company''s solar inverter product line uses innovative string technology to deliver first-class reliability, validated under the most stringent international

Solis: World 3rd Largest PV Inverter Manufacturer

Established in 2005, Ginlong (Solis) (Stock Code: 300763.SZ) is the world 3rd largest PV inverter manufacturer. As global manufacturer of solar & energy storage solutions for residential,

Variable speed drive, Altivar Solar, 7.5kW, 380 to 500V, 3

The solar panels and the drive input shall be in compliance with NEC article 690. For the photovoltaic installation ground connection, safety instructions and orientation, refer to the

อินเวอร์เตอร์ pv,อินเวอร์เตอร์

อินเวอร์เตอร์ pv,อินเวอร์เตอร์พลังงานแสงอาทิตย์,อินเวอร์เตอร์กักเก็บพลังงาน - Solis

Learn More

- 3 6 kw solar inverter factory in Senegal

- Cheap 3 6 kw solar inverter factory Buyer

- 3 5 kw solar inverter factory in Oman

- 2 5 kw solar inverter factory in Auckland

- 7 5 kw solar inverter factory in Manila

- 2 5 kw solar inverter factory in Toronto

- 1 2 kw solar inverter factory in Karachi

- 3 5 kw solar inverter factory in Denmark

- 3 5 kw solar inverter factory in Turkmenistan

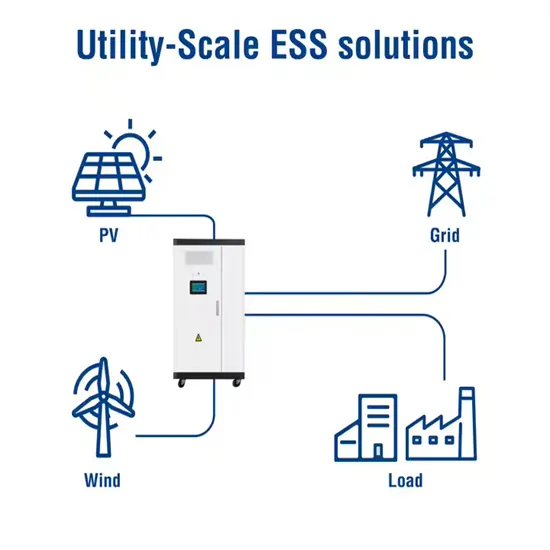

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.