Which manufacturer of single-glass photovoltaic curtain wall in Managua

Top 10 Photovoltaic Glass (PV Glass) Manufacturers in the Specialization: HIITIO is a leading manufacturer of Photovoltaics (PV) Glass, specializing in extending clean energy generation to

Glass and Glass Product Manufacturing Companies in Managua, Managua

Find detailed information on Glass and Glass Product Manufacturing companies in Managua, Managua, Nicaragua, including financial statements, sales and marketing contacts, top

Top Companies Latin America Solar Photovoltaic Glass Market

It has been operating in Latin America since the early 2000s and has established itself as a leading manufacturer of solar glass for the photovoltaic industry. Borosil Renewables Limited

Top Manufacturing Companies in Managua | Glassdoor

Browse the top Manufacturing companies in Managua. Salaries, reviews, and more - all posted by employees working at the top Manufacturing companies in Managua. Apply to jobs near you.

Top 10 Photovoltaic Glass Brand & Manufacturers

Jul 22, 2025 · Founded in June 1998, Fulait Glass Group is one of the world''s largest photovoltaic glass manufacturers, integrating glass research and development, manufacturing, processing

Managua fully automatic inverter manufacturer

The solar inverter manufacturing industry focuses on producing devices that convert the variable direct current (DC) output of a photovoltaic solar panel into alternating 240V current (AC) for

Which manufacturer of single-glass photovoltaic curtain wall in Managua

What is a photovoltaic curtain wall? Building Integrated Photovoltaics At Onyx Solar we provide tailor-made photovoltaic glass in terms of size, shape, transparency, and color for any curtain

Top Manufacturing Companies in Managua, Nicaragua | Glassdoor

Browse the top Manufacturing companies in Managua, Nicaragua. Salaries, reviews, and more - all posted by employees working at the top Manufacturing companies in Managua, Nicaragua.

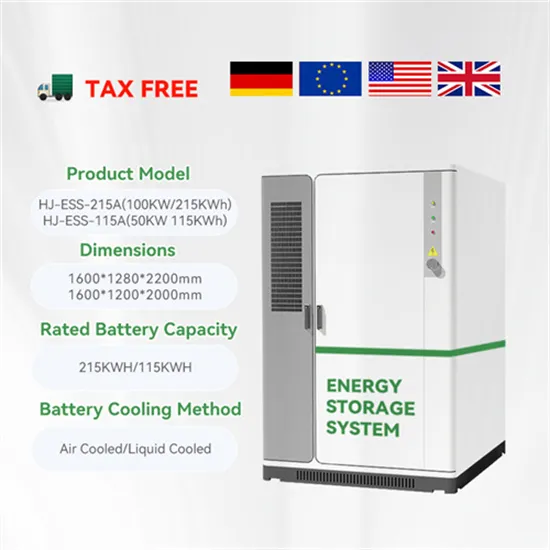

Managua household energy storage power supply manufacturer

Energy Storage Battery Manufacturer, Outdoor Power Supply, ZheJiang Minedoo New Energy Co., Ltd. Focuses on the research and development, manufacturing and sales of energy

Managua High Efficiency Photovoltaic Cell Project

High-Efficiency Crystalline Photovoltaics NREL is working to increase cell efficiency and reduce manufacturing costs for the highest-efficiency photovoltaic (PV) devices involving single-crystal

Custom-Made Solar Panels in Managua Tailored Solutions

As solar energy adoption surges across Central America, Managua''s photovoltaic manufacturers are stepping up to deliver personalized solutions. This article explores how custom solar

Learn More

- Angola Photovoltaic Solar Glass Manufacturer

- Asian single glass photovoltaic curtain wall manufacturer

- Iraq 300W photovoltaic glass manufacturer

- Netherlands glass photovoltaic panel manufacturer

- Nordic glass photovoltaic manufacturer

- Tanzania double glass photovoltaic module manufacturer

- Malaysia Penang Photovoltaic Transparent Glass Manufacturer

- The largest photovoltaic glass manufacturer in Cape Verde

- West Asia photovoltaic glass manufacturer

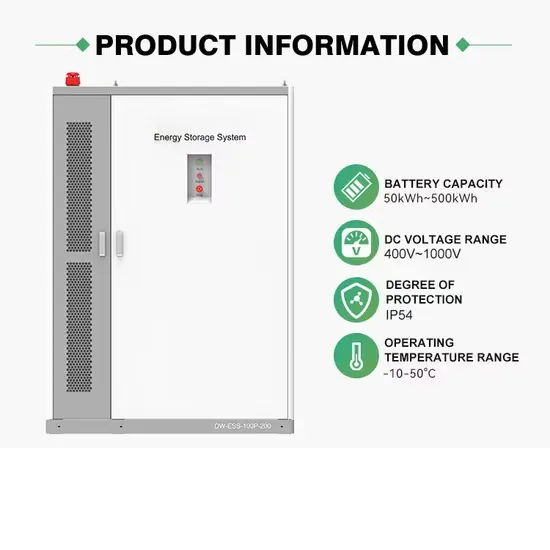

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.