Hungary Energy Storage Market (2025-2031) | Trends & Size

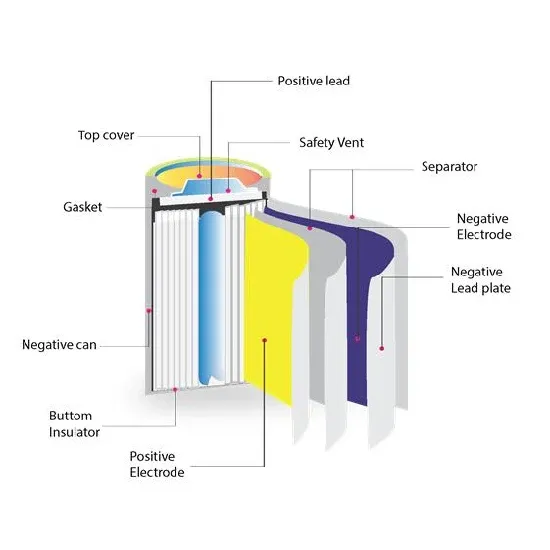

Key trends include the adoption of advanced battery storage technologies, such as lithium-ion batteries, for both utility-scale and residential applications. Energy storage projects are also

Anticipating Global Surge: Household Energy Storage Gains

Feb 4, 2024 · Should the electricity price remain at normal levels, the ongoing decline in investment costs for energy storage and solar systems is expected to continuously stimulate

European Market Outlook for Battery Storage 2025-2029

May 7, 2025 · The European Market Outlook for Battery Storage 2025–2029 analyses the state of battery energy storage systems (BESS) across Europe, based on data up to 2024 and

Supercapacitor Module Manufacturer in Pecs Hungary Innovation in Energy

Looking for reliable supercapacitor solutions in Europe? Pecs, Hungary, has emerged as a hub for advanced energy storage manufacturing. This article explores the growing role of

Carbon Dioxide Emissions, Capture, Storage and Utilization:

Mar 1, 2022 · Carbon capture and storage (CCS) is an essential component of mitigating climate change, which arguably presents an existential challenge to our plane

Energy Storage Project in Pecs Hungary Powering a

Why Pecs? A Strategic Hub for Energy Innovation Located in southern Hungary, Pecs combines solar-rich geography with growing industrial demand. The city''s 2,100 annual sunshine hours

NEW ENERGY MIX FOR 2030 OWARDS A MORE

May 17, 2023 · The best energy is energy that is not consumed: energy and climate targets can only be met if energy demand is significantly reduced for society as a whole. Thus, energy

HUNGARY Energy Snapshot

Oct 17, 2022 · 6. Energy Country Specific Recommendation (CSR) 20222 Reduce overall reliance on fossil fuels by accelerating the deployment of renewables, in particular by streamlining the

Energy storage in Europe

Mar 11, 2025 · Pumped hydro is the most widely used technology for energy storage in Europe and worldwide, but batteries and hydrogen have come into the spotlight over the last decade

National Battery Industry Strategy 2030

Jan 31, 2024 · The recent significant decline in battery prices and the improvement in energy density have created new opportunities for battery-powered vehicles in all areas of transport.

Energy Storage Solutions from Pécs Hungary Powering

Summary: Discover how Hungary''s strategic hub in Pécs is revolutionizing energy storage exports. This article explores industry applications, market trends, and why European-made

Energy Storage Projects in Pécs Power Grid Innovations and

With rising demand for renewable integration and grid stability, energy storage projects here are reshaping how the region manages electricity. But what makes Pécs stand out? Innovation,

Executive summary – Hungary 2022 – Analysis

6 days ago · Hungary has seen rising energy demand reaching 753 PJ in 2020. Efficiency efforts have not been able to decouple energy demand from economic growth, notably in transport

6 FAQs about [What is the trend of energy storage demand in Pecs Hungary ]

How much does Hungarian government spend on energy storage projects?

The Hungarian government has allocated HUF 62 billion (EUR 158 million) for energy storage projects with an overall 440 MW in operating power. Hungarian authorities launched the tender for grid-scale batteries on January 15 and received offers until February 5. The winning bidders were selected a few days ago.

Where will Hungary's largest energy storage system be built?

With funds obtained through a previous program, transmission system operator MAVIR is already building the country's largest energy storage system – a 20 MW project in Szolnok, central Hungary, the ministry said. It added that several projects with even bigger capacity will be installed under the tender concluded a few days ago.

Will Hungary increase energy storage capacity by 2026?

The government has plans to increase energy storage capacity to at least 1 000 MW by 2026 and to add 100 MW capacity of demand-side response by 2030. However, Hungary’s existing legislative framework for regulating energy storage is inadequate to facilitate significant market-based commercial storage investments.

Will Hungarian energy storage projects get subsidy support?

The Hungarian Ministry of Energy has announced that around 50 grid-scale energy storage projects with a cumulative capacity of 440 MW have received subsidy support through a tender launched in February this year.

What is Hungary's energy storage goal?

The ministry said that Hungary has set its 2030 energy storage goal at 1 GW in the updated National Energy and Climate Plan. Home » News » Electricity » Hungary awards EUR 158 million for 440 MW of energy storage

How has energy consumption changed in Hungary since 2021?

Total energy consumption has decreased rapidly since 2021 (-7%/year). The share of oil in total consumption has increased by 7 points since 2010. Hungary is counting on nuclear (2.4 GW expansion of the Paks plant) to ensure its long-term electricity supply. MVM plans to extend the Paks nuclear power plant by 20 years, up to the 2050s.

Learn More

- Hungary Pécs simplified energy storage project

- Hungary Pecs Energy Storage Charging Station

- What is the energy storage demand in Izmir Türkiye

- What are the components of the integrated energy storage price

- What is the infrastructure of photovoltaic energy storage equipment

- What is the material of the energy storage cabinet liquid cooling

- What are the types of electric energy storage systems

- What are the Basseterre energy storage photovoltaic power stations

- What are the energy storage containers in Madagascar

Industrial & Commercial Energy Storage Market Growth

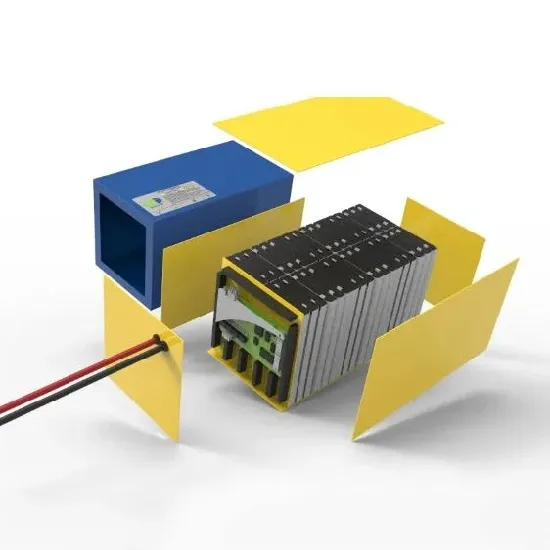

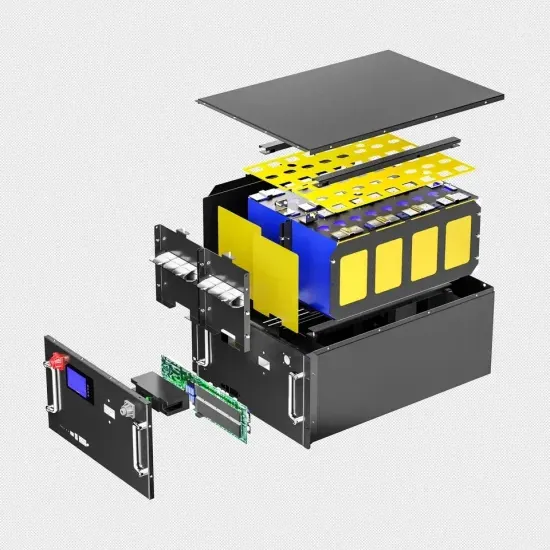

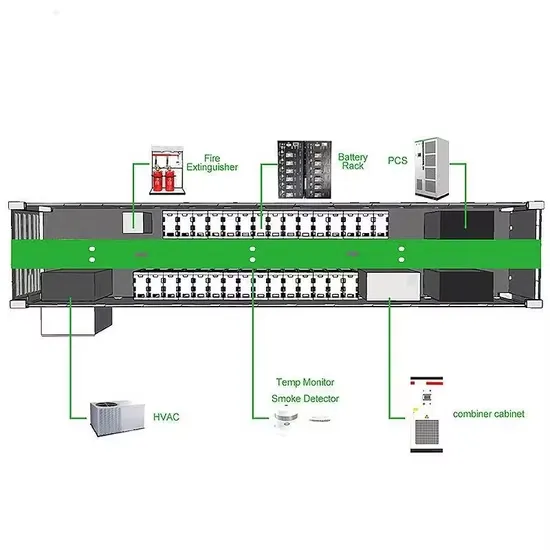

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

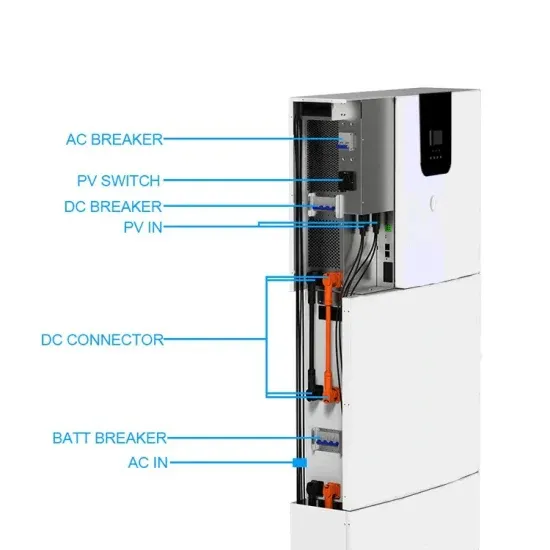

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.