Expert Incorporated Deep Reinforcement Learning Approach

Dec 18, 2023 · Peak-valley arbitrage is one of the important ways for energy storage systems to make profits. Traditional optimization methods have shortcomings such as long solution time,

Energy storage peak-valley arbitrage case study

Peak-valley arbitrage revenue: The third type of user has a moderate energy storage capacity (10,000 kWh), which is large enough to play a significant role in load reduction and peak-valley

The value of electricity storage arbitrage on day-ahead

Jul 1, 2023 · Highlights • Significant variations in arbitrage value are observed among European countries. • Over 2000 to 2020, the trend in arbitrage value has ben decreasing. • Round-trip

Capacity Configuration of Energy Storage for Photovoltaic

Jan 24, 2021 · The system benefits are primarily from the peak-valley arbitrage of energy storage and PV grid-connected profit. The cost of configuring capacity ( C_ {battery.cap} ) is the

Arbitrage analysis for different energy storage technologies

Nov 1, 2021 · Revenue of arbitrage is compared to cost of energy for various storage technologies. Breakeven cost of storage is firstly calculated with different loan periods. The

Energy Storage Systems: Profitable Through

Jun 6, 2024 · Peak-valley arbitrage is one of the most common profit models for energy storage systems. In the electricity market, electricity prices fluctuate

Two-Stage Optimal Allocation Model of User-Side Energy Storage

Aug 8, 2019 · In recent years, in the context of the energy revolution, energy storage has gradually become an indispensable part of the energy Internet because of its flexible charging

Combined Source-Storage-Transmission Planning

Jun 20, 2022 · To comprehensively consider the direct income of peak-valley arbitrage and indirect income of energy storage configuration, a coordinated planning model of source

Unlocking the Potential of Peak-Valley Arbitrage Income in

May 18, 2025 · Peak-valley arbitrage, a cornerstone strategy for energy storage systems, has gained significant traction across ASEAN''s rapidly evolving power grids. By storing electricity

Peak-shaving cost of power system in the key scenarios of

Jun 30, 2024 · On the other hand, references [35,36] do not consider the impact of energy storage utilizing peak and off-peak electricity price arbitrage on the peak-shaving cost of the power

Battery systems on the U.S. power grid are

Jul 27, 2022 · Batteries also help maintain grid reliability. For example, batteries used to regulate frequency—still the most common battery application in the

Research on the integrated application of battery energy storage

Mar 1, 2023 · Abstract To explore the application potential of energy storage and promote its integrated application promotion in the power grid, this paper studies the comprehensive

Economic benefit evaluation model of distributed energy storage

Jan 5, 2023 · Firstly, based on the four-quadrant operation characteristics of the energy storage converter, the control methods and revenue models of distributed energy storage system to

Research on the integrated application of battery energy storage

Mar 1, 2023 · To explore the application potential of energy storage and promote its integrated application promotion in the power grid, this paper studies the comprehensive application and

A Joint Optimization Strategy for Demand Management and Peak-Valley

Jun 25, 2025 · Demand reduction contributes to mitigate shortterm peak loads that would otherwise escalate distribution capacity requirements, thereby delaying grid expansion,

C&I energy storage to boom as peak-to-valley spread

Aug 31, 2023 · In China, C&I energy storage was not discussed as much as energy storage on the generation side due to its limited profitability, given cheaper electricity and a small peak-to

Peak-valley arbitrage at energy storage stations

Three business models for industrial and commercial energy storage According to the above background setting, the enterprise''''s 1MW/2MWh industrial and commercial energy storage

Energy storage peak and valley profit

It is generally believed that when the peak-valley price 01: peak and valley arbitrage The most basic earnings: users can charge the energy storage battery at a cheaper valley tariff when the

Exploring Peak Valley Arbitrage in the Electricity

Apr 28, 2024 · Peak valley arbitrage presents a compelling opportunity within the electricity market, leveraging price differentials between peak and off-peak

How much can the peak-valley price difference of energy storage

Jan 27, 2024 · The peak-valley price difference refers to the disparity in energy prices between high-demand periods (peak) and low-demand times (valley). This difference provides a

The expansion of peak-to-valley electricity price

5 days ago · 1. Peak and valley arbitrage Using peak-to-valley spread arbitrage is currently the most important profit method for user-side energy storage. It

Peak and Valley Arbitrage_One Profit For C & I Energy Storage

As an emerging business model, energy storage grid peak-valley spread arbitrage has injected vitality into the electricity market. In this paper, we will discuss what grid peak-valley spread

energy storage achieves peak-valley arbitrage

Improved Deep Q-Network for User-Side Battery Energy Storage Therefore, energy storage-based peak shaving and valley filling, and peak-valley arbitrage are used to charge the grid at

Optimized Economic Operation Strategy for Distributed Energy Storage

Dec 24, 2020 · In the day-ahead optimization stage, under the constraint of demand charge threshold and with the goal of maximizing returns, the distributed energy storage is controlled

Energy Storage Arbitrage Under Price Uncertainty:

Jan 16, 2025 · Energy storage participants in electricity markets leverage price volatility to arbitrage price differences based on forecasts of future prices, making a profit while aiding grid

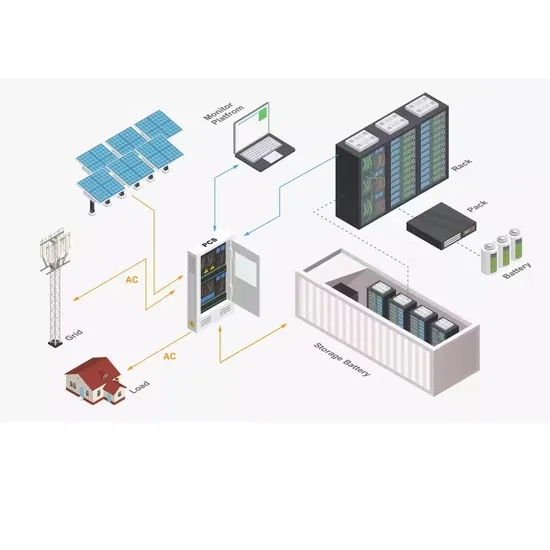

Schematic diagram of peak-valley arbitrage of energy storage.

An energy storage system transfers power and energy in both time and space dimensions and is considered as critical technique support to realize high permeability of renewable energy in

Energy storage peak-valley arbitrage case

To mitigate the impacts, the integration of PV and energy storage technologies may be a viable solution for reducing peak loads [13] and facilitating peak-valley arbitrage [14]. Concurrently, it

Analysis and Comparison for The Profit Model of Energy Storage

Nov 7, 2020 · The role of Electrical Energy Storage (EES) is becoming increasingly important in the proportion of distributed generators continue to increase in the power system. With the

6 FAQs about [Percentage of peak-valley arbitrage income from energy storage on the ASEAN grid]

How do price differences influence arbitrage by energy storage?

Price differences due to demand variations enable arbitrage by energy storage. Maximum daily revenue through arbitrage varies with roundtrip efficiency. Revenue of arbitrage is compared to cost of energy for various storage technologies. Breakeven cost of storage is firstly calculated with different loan periods.

What is the maximum daily revenue through arbitrage?

Maximum daily revenue through arbitrage varies with roundtrip efficiency. Revenue of arbitrage is compared to cost of energy for various storage technologies. Breakeven cost of storage is firstly calculated with different loan periods. The time-varying mismatch between electricity supply and demand is a growing challenge for the electricity market.

How energy storage systems can be used to generate arbitrage?

Due to the increased daily electricity price variations caused by the peak and off-peak demands, energy storage systems can be utilized to generate arbitrage by charging the plants during low price periods and discharging them during high price periods.

Can arbitrage characteristics and breakeven costs guide energy storage system development?

The results indicate that the arbitrage characteristics and breakeven costs can be used to guide the choice of energy storage system development (capacity, effectiveness, and cost) and to determine the constraints and potential economic benefits for stakeholders who are considering investing in energy storage systems.

How can energy storage technologies be analyzed for maximum profitability?

Based on the above arbitrage revenue and capacity costs, the potential selections of energy storage technologies can be analyzed in more detail for maximum profitability once breakeven costs are achieved via attainment of technology readiness and/or system cost reductions.

Can arbitrage compensate for energy losses introduced by energy storage?

The arbitrage performance of PHS and CAES has also been evaluated in five different European electricity markets and the results indicate that arbitrage can compensate for the energy losses introduced by energy storage (Zafirakis et al., 2016).

Learn More

- Andorra Energy Storage Peak-Valley Arbitrage Solution

- Industrial and commercial energy storage peak-valley arbitrage solution

- Electrochemical energy storage connected to the Libreville power grid

- Grid Energy Storage System ESS

- Energy storage battery box China Southern Power Grid

- Energy storage system high voltage grid connection

- Maldives Power Grid Energy Storage Enterprise

- User-side energy storage grid dispatching

- ASEAN New Energy Battery Storage Box

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.