South America''s Energy Transition: Tech, Impacts & Solutions

Dec 18, 2024 · Common technologies include electrolyzers, ammonia-to-hydrogen conversion, and green hydrogen storage. Impacts of energy transition technologies on South America''s

Latin America''s largest solar power plant with

Apr 18, 2025 · Chile leads the way in expanding Battery Energy Storage Systems (BESS) Chile is reaffirming its role as innovation hub in the energy transition of

South America Energy Storage Systems Market | Size, Share,

Aug 17, 2025 · The energy storage systems market is driven by the increasing integration of renewable energy, growing demand for grid stability, and supportive government policies

Advance highlights of the 2024 EES South America Conference

Aug 4, 2024 · The 2024 edition of the EES South America Conference takes place at the Expo Center Norte in São Paulo, Brazil on August 27–29 and will feature crucial discussions on the

South America''s energy storage market is surging, BYD, Sunny Power

Aug 1, 2024 · For example, Kolu America signed a procurement agreement on July 26 with GEA TRANSMISORA SpA of Chile for battery energy storage system equipment with a total

south america Archives

Dec 8, 2022 · Guyana, a country on South America''s north coast, has issued an invitation for bids for energy storage projects with a combined capacity of 34MWh. Developer On.Energy is

Accelerating Decarbonisation in South America with

May 25, 2022 · Wärtsilä enters South American energy storage market with supply of 8 MW / 32 MWh energy storage system the leading Chilean power generation company Colbun to

Latin America''s Energy Storage Boom: Market & Outlook 2025

Jul 15, 2025 · AnalystAMI Latin America is entering a transformative decade in its energy landscape, driven by the urgent need to expand power output, decarbonize, lower energy

Global Mobile Energy Storage Market Size, Trends, Share,

Mobile Energy Storage Market Size, Trends, Share, Growth, and Opportunity Forecast, 2023 - 2030 Global Industry Analysis By Application (Grid Storage, Electric Vehicles, Portable

The state of battery storage (BESS) in Latin America: A

May 14, 2024 · Large energy companies have expressed that there are no Power Purchasing Agreements (PPAs) available specifically for stand-alone storage projects, making it harder to

Exporting sunshine: Planning South America''s electricity

Nov 1, 2022 · Our study reveals that South America''s energy transition will rely, in decreasing order, on solar photovoltaic, wind, gas as bridging technology, and also on some concentrated

Atlas Renewable Energy launches a 200 MW energy storage

Apr 29, 2025 · Atlas Renewable Energy and COPEC inaugurate one of Latin America''s largest energy storage systems, strengthening Chile''s power grid stability.

ees South America – LATAM''s Key Event for Batteries & Energy Storage

Aug 27, 2024 · ees South America, LATAM''s key event for batteries & energy storage systems, takes place at the Expo Center Norte in São Paulo, Brazil, on August 27–29, 2024 and

South America''s Energy Storage Revolution: Tackling Grid

Why South America''s Renewable Boom Demands Immediate Energy Storage Solutions You know, South America''s installed solar capacity grew by 217% between 2020 and 2024, but

Mobile Energy Storage in South America: Powering the

But in South America, we''re talking about trailer-sized batteries literally driving energy revolutions. With countries like Chile hitting 21% renewable energy penetration (BloombergNEF 2023) and

South America Energy Storage Technology Research

12 comprehensive market analysis studies and industry reports on the Energy Storage Technology sector, offering an industry overview with historical data since 2019 and forecasts

Paris purchases mobile energy storage power supply

Are energy storage systems profitable? Recent energy storage literature lacks profitabilityand economic assessments of storage systems. Most of the literature covers dispatching

South America''s Energy Storage Boom: Why the Pack Storage

Jan 6, 2023 · Why South America Can''t Stop Talking About Battery Storage while the rest of the world argues about lithium-ion vs. solid-state batteries, South America''s energy markets are

5 FAQs about [South America purchases mobile energy storage power]

What are the opportunities for battery energy storage systems in Latin America?

The opportunities for battery energy storage systems are growing rapidly in Latin America. Below are some key details for those who want to understand and succeed in the BESS market. In 2010, the IEA projected that the world would reach its 2019 solar penetration only in 2035. Analysts underestimated solar adoption by 16 years.

Will Chile pay a capacity payment for energy storage projects in 2024?

Chile passed an energy storage and electromobility bill in late 2022, making stand-alone storage projects profitable for operators. However, the market is still awaiting new rules regarding a capacity payment for storage projects—expected in 2024.

Does Colombia have a power purchase agreement for hybrid solar & Bess projects?

As of now, Colombia’s reliability charge (Cargo por Confiabilidad) has encouraged hybrid solar + BESS projects to progress. Large energy companies have expressed that there are no Power Purchasing Agreements (PPAs) available specifically for stand-alone storage projects, making it harder to finance those projects.

How much battery capacity will Latin America have by 2023?

While the U.S. was expected to have nearly 60 GWh of installed battery capacity by the end of 2023, AMI estimates that Latin America had less than 1 GWH of operational BESS projects—a 60x difference. This large gap will be bridged at different speeds based on each country’s specific regulations.

Is energy storage legal in Brazil?

Brazil’s regulatory framework does not prohibit energy storage solutions, but there are currently no specific regulations on storage. At the end of 2023, most BESS applications in Brazil were behind the meter. There is a proposed law on energy storage to encourage front-of-the-meter BESS, but Congress has not prioritized its approval.

Learn More

- How much does a mobile energy storage cabin cost in South America

- South Ossetia Energy Storage Mobile Power Supply

- South America Energy Storage Equipment

- The mobile power bank with the highest energy storage

- Mobile energy storage power supply equipment

- South America Portable Energy Storage Solution Provider

- Manufacture and sell outdoor energy storage mobile power supplies

- Outdoor mobile power 1000w energy storage power supply

- Energy storage mobile power supply 600w energy storage power supply

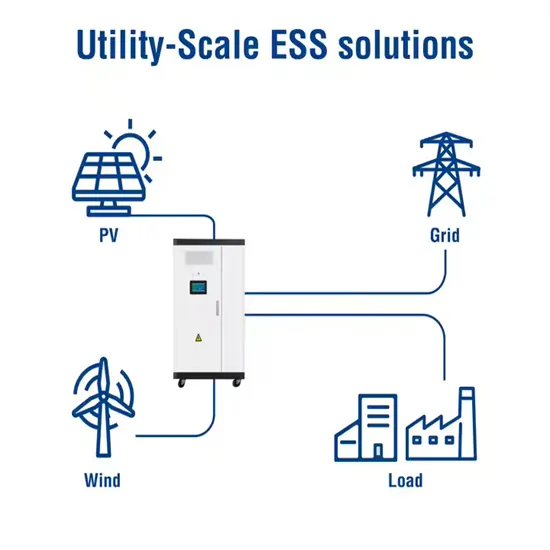

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.