State of Energy Security in East and Southeast Asia

Dec 25, 2024 · Abstract In this chapter, we review the state of energy security in East and Southeast Asia using three indicators: (1) energy supply security, (2) energy diversification,

Fossil Fuel New Energy Generation Market

Aug 1, 2025 · Fossil Fuel New Energy Generation Market Size and Share Forecast Outlook 2025 to 2035 The Fossil Fuel New Energy Generation Market is estimated to be valued at USD

Top 10 Energy Storage Developers in Asia | PF Nexus

Jul 14, 2025 · Discover the current state of energy storage developers in Asia, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Asia is building the backbone of its renewable future with energy storage

Jul 18, 2025 · From Southeast Asia to India and Australia, landmark policies, first-of-their-kind projects and bold investment decisions show that energy storage is no longer a niche

Indonesia''s First Pumped Storage Hydropower Plant to Support Energy

Sep 11, 2021 · The World Bank''s Board of Executive Directors today approved a US$380 million loan to develop Indonesia''s first pumped storage hydropower plant, aiming to improve power

Portable Energy Storage for Events Market Research Report

As per our latest research, the global Portable Energy Storage for Events market size stood at USD 1.42 billion in 2024, reflecting a robust surge in demand for reliable, sustainable, and

South Asia Energy Storage Study | International Activities

Jan 31, 2025 · South Asia Energy Storage Study The South Asia Energy Storage Study offers a comprehensive analysis of the potential role of energy storage technologies in the South Asia

Storage in the energy transition in Asia-Pacific | PFI

Apr 10, 2024 · China is leading in this area, with its gross energy storage capacity addition reaching 22GW in 2023. This makes up 36% of the world''s total additions, according to

Is South-east Asia storing up trouble with carbon

Jul 1, 2024 · By 2030 or even earlier, CO2, the main greenhouse gas captured from refineries, power stations and cement plants in East Asia could be transported by specialised tanker

Energy storage for renewable energy Integration in ASEAN and East Asian

Oct 12, 2021 · Energy storage for renewable energy Integration in ASEAN and East Asian Countries: prospects of hydrogen as an energy carrier vs other alternatives. Senayan, Jakarta,

Energy storage Changing and charging the future in Asia

Aug 10, 2018 · As the demand for electricity goes up and with increasing renewable sources in the energy mix, what is clear now is that utilities must now be alive to the impending integration of

SOUTHEAST ASIA''S ENERGY TRANSITION

May 1, 2025 · Preface The International Energy Agency is delighted to make our analysis available for this discussion paper for Temasek. Singapore is an important and highly valued

Energy Storage for Renewable Energy Integration in

Power regulations do not allow onsite production of hydrogen at renewable power stations, either, even if they were to use curtailed electricity. An implementation plan study could collect

Asia is building the backbone of its renewable future with energy storage

Jul 18, 2025 · By 2026, the Asia-Pacific region is forecast to contribute 68% of the projected $10.84 billion market. Over the past decade, Asia has fortified its grids with batteries that

ESIE 2025 underscores Beijing''s rising role in global energy

Apr 24, 2025 · Beijing hosted the 13th International Energy Storage Conference and Expo amid a record-breaking turnout, showcasing breakthroughs from 800 exhibitors and drawing global

Energy storage and power battery development

Jun 24, 2023 · This article introduces the energy storage and battery development status in Southeast Asia, also why it''s developed and Chinese manufacturers

6 FAQs about [What are the energy storage power stations in East Asia ]

How to secure energy supply in ASEAN?

For ASEAN, regional energy networks such as the Trans-ASEAN Gas Pipeline (TAGP) with virtual pipelines of LNG and the ASEAN Power Grid (APG), are recommended to maintain energy supply security in the region. Nuclear power generation is another option for securing the energy supply in the region.

What challenges will ASEAN and East Asia face in the energy transition?

The ASEAN and East Asia grouping faces tremendous challenges when it comes to the future energy landscape and in trying to determine how the energy transition will embrace new architectures including sound policy and technologies to ensure energy access with affordability, energy security, and energy sustainability.

What was the main source of energy in the ASEAN region?

ASEAN region’s dominant source of energy in 1990 was oil which made 42 % of the total primary energy consumption share, of which consumption increased yearly by 3.4 % from 99 Mtoe in 1990 to 244 Mtoe in 2017. The second dominant source of commercial energy was natural gas.

What is the role of energy cooperation with East Asian countries?

Energy cooperation with East Asian countries will play a key role in this regard. Energy eficiency and demand-side management are important. New power plants, new factories, new buildings, new appliances, and new cars should be more eficient.

Which China provinces have the largest pumped storage capacity?

In the central China region, the provinces of Zhejiang, Hubei, and Hunan possess the largest prospective capacities in the pipeline, with 95 GW across 79 projects. Moreover, 13 provinces that do not presently have any operating pumped storage facilities boast over 127 GW of prospective capacity.

How are energy models developed in ASEAN countries?

The energy models of ASEAN countries were developed using the Long-range Energy Alternative Planning System (LEAP) software, which is used to project energy balance tables based on final energy consumption and energy input and/or output in the transformation sector.

Learn More

- What are the Bangui energy storage power stations

- What are the medium and large energy storage power stations

- What are the Swedish energy storage power stations

- What are the energy storage power stations in Bucharest

- What are the energy storage power stations in Ukraine

- What are the Basseterre energy storage photovoltaic power stations

- What are the container energy storage power stations in Micronesia

- What kind of liquid flow is the West Asia energy storage power station

- What are the independent energy storage power stations in Arequipa Peru

Industrial & Commercial Energy Storage Market Growth

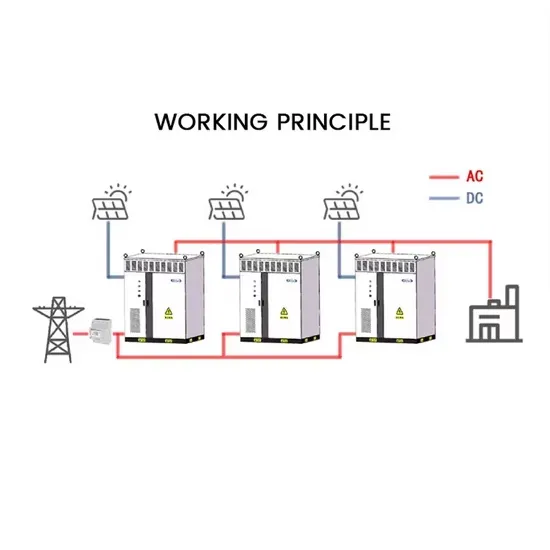

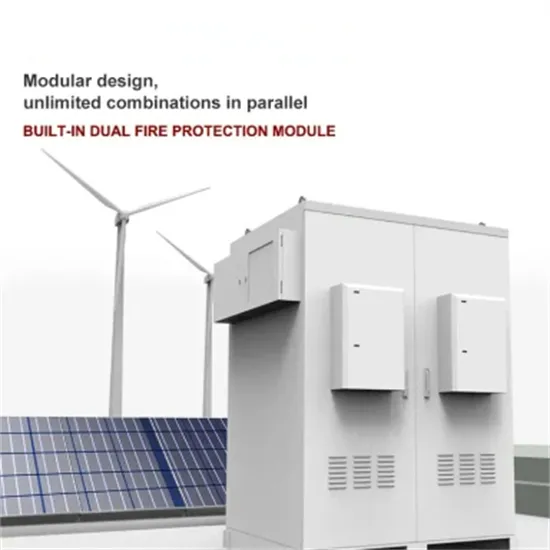

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

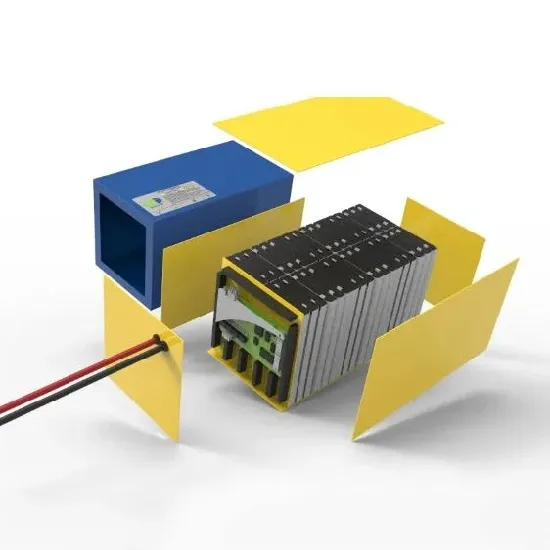

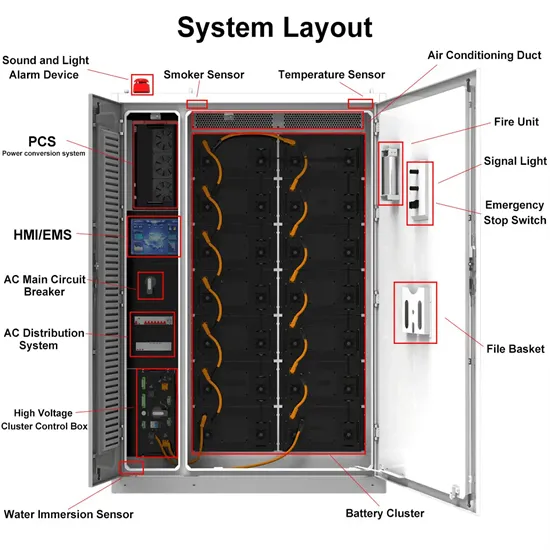

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.