Feasibility study and impacts mitigation with the integration

Jul 1, 2023 · The integration of a solar PV can also contribute to an effective raise in the exploitation of national energy resources, likely to result in consistent, cost effective, and

Regulatory Review of the Electricity Market in Rwanda

May 23, 2023 · This report provides an analysis of Rwanda''s electricity sector policies, laws, and regulations in relation to crowding-in private sector participation in developing national

REPUBLIC OF RWANDA MINISTRY OF INFRASTRUCTURE

Jun 25, 2021 · Victoria Motors Rwanda Ltd Limited has set up a company to exclusively focus on promotion of Plug-in-Hybrid electric vehicles (PHEV) Outlanders and electric buses in

Rwanda Utilities Regulatory Authority: Electricity

To reduce the cost of electricity access, there is a national electrification plan in place with allocation of areas to be electrified with off grid systems or with grid extension.

REG NEW ELECTRICITY CONNECTION POLICY

Jul 4, 2018 · The policy will ensure effective and efficient connections to the grid and will be implemented through the two subsidiaries of Rwanda Energy Group; EUCL and EDCL. The

Rwanda Among Countries With Cheapest Electricity Tariffs

Mar 27, 2023 · Rwanda has been listed as one of the 30 countries globally with the cheapest household electricity prices, according to a report released earlier this month by Statista ,

Post-connection electricity demand and pricing in newly

Mar 1, 2025 · This study examines consumption patterns and price elasticity among newly connected households in Rwanda, utilizing consumption and billing data from the national

REPUBLIC OF RWANDA

Jul 4, 2018 · The electricity access roll-out program aims at increasing connections, boost economic activities all over the country, direct and indirect creation of jobs and raise off-firm

E L E C T R I C I T Y S T A T I S T I C S R E P O R T A S O F

Jun 9, 2023 · 1.2. Electricity generation mix The electricity produced in Rwanda is generated using different source of energy namely hydro, methane gas, peat, solar, heavy and light fuel

Electric mobility promoted in Rwanda, environmental

Rwanda is depending on imports where 100% of fuel used in Rwanda is imported and transport cost is high due to fuel imported. Today Rwanda is promoting E-Mobility where electrical

Rwanda Utilities Regulatory Authority: Electricity

1. ELECTRICITY SUB-SECTOR 1.1. Overview The Ministry of Infrastructure (MININFRA) has the primary responsibility of setting the overall policy and strategy of the energy sector, and

Energy | National Institute of Statistics of Rwanda

The total exportation of electricity decreased from 9.6 million kilowatts in 2022 down to 9.1 million kilowatts in 2023 . Rwanda''s electricity consumption has continuously grown, reaching

Consumer electricity prices | Rwanda

In liberalized markets, Globalpetrolprices takes power prices from the current offers of the largest electricity providers, the cost of distribution and transmission from the regulators, and

6 FAQs about [Electricity prices for communication base stations in Rwanda]

How much electricity is available in Rwanda?

Between 2012 and 2020, overall access to electricity in Rwanda more than tripled growingfrom 16% (15% on grid and 1% off-grid) to 56% (41% on-grid and 15% off-grid).

What is the current electrification rate in Rwanda?

T SHEET, the current electrification rate in Rwanda is 72% in urban areas such as Kigali and 12% in rural areas. [USAID, 2020] The government has declared that it will reach 100% domestic electrification by 2024, so the electr

How much does a kWh cost in South Africa?

For telecom towers, the current price stands at Rwf185 per kWh, while prices for water treatment plants and water pumping stations is Rwf126 per kWh. For hotels, the price of a kWh is Rwf126 while health facilities are charged a flat rate of Rwf192 per kWh. In the August 2018 prices, broadcasters were charged a flat rate of Rwf184 per kWh.

Will Rwanda release new electricity tariffs?

RURA to Release New Tariffs Rwanda Utilities Regulatory Authority (RURA) will this afternoon announce new electricity tariffs – with expectations getting high over a possible downward move. The current electricity tariffs used were announced in August 2018 – which favored industrialists as the country increased its efforts to attract investments.

What is the best private radio station in Rwanda?

Founded in 2004, Radio10 - 87.6 FM is the first & probably the best rwandan private radio station. From KGL to NYC, R10 is the See more Radio of all Rwandans & friends of Rwanda. With millions of listeners, Radio10 is one of the most listened Radio in Rwanda. At Radio10 they tend to think big and out of the box.

Will Rwanda hit 100 percent electricity by 2024?

For instance, in an interview with KT Press in September last year, Rwanda Energy Group (REG) – the country’s power supplier’s CEO, Ron Weiss, said that energy production increased from 37 percent in 2017 to 51 percent countrywide as of last year, while government plans to hit 100 percent access to electricity by 2024.

Learn More

- On which floor do communication base stations usually use electricity

- Electricity application for communication base stations

- What is the nature of electricity consumption in communication base stations

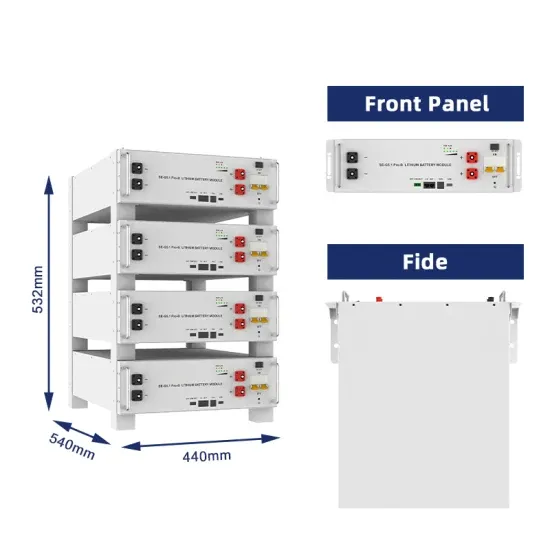

- Battery design for small communication base stations

- Lead-acid battery tower base protection for communication base stations

- How many 5g communication base stations are there in London

- How to view 5g communication base stations

- The importance of energy storage and power generation in communication base stations

- Laying the foundation for the battery energy storage system for communication base stations

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.