Greece puts forward an ambitious energy storage support

Jun 8, 2023 · Key aspects of the Ministerial Decision are analysed below. The Scheme targets standalone energy storage technologies with a minimum injection capacity of 1MW connected

Regulatory progress for energy storage in Europe | Greece

Mar 4, 2019 · The updated National Action Plan 2019 on Energy Storage and Conversion 5 published by the industry group Energy Storage Netherlands identifies various issues that

Energy storage systems: a review

Sep 1, 2022 · Because of the large variety of available ESSs with various applications, numerous authors have reviewed ESSs from various angles in the literature. However, the types of ESSs

Electrical Energy Storage

Nov 14, 2022 · Regarding emerging market needs, in on-grid areas, EES is expected to solve problems – such as excessive power fl uctuation and undependable power supply – which are

Greece readies for next battery storage growth

Jul 17, 2024 · The government is now working a new plan, which will allow the colocation of batteries with existing solar plants as well as standalone, in front

Elsewedy Electric Gets Funding for Greece''s First

Jan 21, 2025 · Elsewedy Electric has achieved a major milestone by securing financial backing for Greece''s first large-scale battery energy storage system.

The time for electricity storage in Greece has arrived

Storage units are able to ''stockpile'' excess renewable energy production and help stabilize the problem – surplus energy can then be utilized whenever there is a power shortage. For the

EuroEnergy Advances Storage Portfolio in Greece Amid

Mar 6, 2025 · In February, the European Commission, through its Affordable Energy Action Plan, reaffirmed its commitment to electricity storage, focusing on accelerated permitting and grid

A comprehensive review of electricity storage applications in

Apr 1, 2024 · The purpose of this paper is to comprehensively review existing literature on electricity storage in island systems, documenting relevant storage applications worldwide and

Energy storage for electricity generation and related

Oct 1, 2018 · This paper presents an up to date comprehensive overview of energy storage technologies. It incorporates characteristics and functionalities of each storage technology, as

6 FAQs about [Energy storage system for large electricity users in Greece]

How long should energy storage be in a Greek power system?

Considering the energy arbitrage and flexibility needs of the Greek power system, a mix of short (~2 MWh/MW) and longer (>6 MWh/MW) duration storages has been identified as optimal. In the short run, storage is primarily needed for balancing services and to a smaller degree for limited energy arbitrage.

Should Greece invest in energy storage facilities?

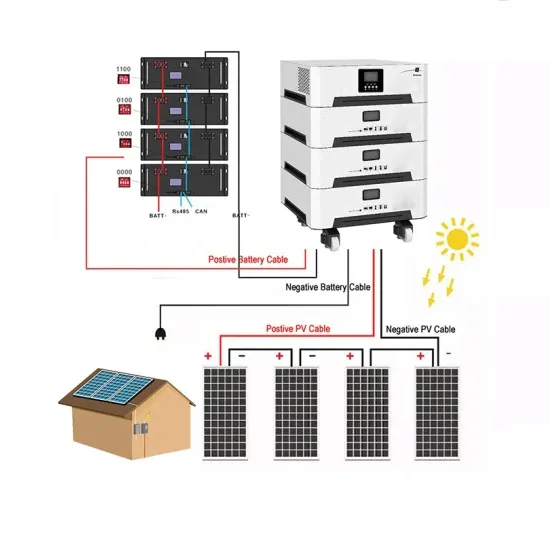

Currently there is a growing interest for investments in storage facilities in Greece. Licensed projects mostly consist of Li-ion battery energy storage systems (BESS), either stand-alone or integrated in PVs, as well as PHS facilities .

Why is Greece focusing on energy storage?

Greece has been actively focusing on energy storage since the emergence of the RES “boom” in 2020. The country recognised the pivotal role of energy storage in the energy transition and emphasised its importance in the first iteration of the country’s National Energy and Climate Plan in 2019.

How does storage work on Greece's islands?

The introduction and development of storage on Greece’s islands that are that are not connected to the mainland power system is quite different, as it is currently only possible via hybrid stations (i.e. virtual production stations consisting of renewable energy resources and storage units operating as single distribution entities).

Will Greece install 900 MW of storage by 2030?

According to the Greek National Energy and Climate Plan (NECP), the nation aims to install 4.3 GW of storage by 2030. Thus far, 900 MW has been allocated via the Greek Regulatory Authority for Energy, Waste, and Water (RAAEY) tenders. Therefore, the remaining share would be delivered under the new plan but without any subsidy support.

How is storage developing in Greece?

The development of storage in Greece has only just begun: this year has been the big "kick-start" and there is now a common understanding of the needs and requirements and the steps to be taken to ensure an adequate identification and prioritization of all necessary actions.

Learn More

- Energy storage system for large electricity users in Turkmenistan

- Electricity users build their own energy storage power stations

- West Africa Large Energy Storage Project Construction Unit

- Greece 400MW energy storage project

- What large energy storage batteries are there in Jamaica

- Honiara Large Energy Storage Battery Manufacturer

- Large power energy storage flywheel

- Large capacity battery energy storage

- How to generate electricity from a base station using photovoltaic energy storage cabinets

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.