Onyx Solar Company

1 day ago · As a top photovoltaic glass manufacturer, Onyx Solar''s glazing integrates seamlessly into building façades, curtain walls, atriums, canopies, and walkable floors. Our solutions boost

Top 10 Photovoltaic Glass (PV Glass) Supplier in

Apr 8, 2025 · As the global demand for clean energy continues to rise, China has solidified its position as a leader in photovoltaic (PV) glass manufacturing. The

Onyx Solar: Transforming New York''s Skyline with

This tower, which redefines New York''s skyline, features photovoltaic glass on its facade, enabling its occupants to enjoy breathtaking views while generating renewable energy. This innovation

Onyx Solar ponencia en PV World Forum: Info

Oct 21, 2024 · global leader in building integrated photovoltaic glass SPAIN (Avila) Factory: C/ Palma de Mallorca 8 • 05194 Phone: +34 920 25 98 83 Main office: C/ Rio Cea 1-46 • 05004

Walking on Sunshine: Photovoltaic Glass Floor Revolutionizes NYC

Nov 22, 2024 · Developed and patented by Onyx Solar, a global leader in BIPV technology, and in conjunction with Solar Deck, this photovoltaic glass floor system seamlessly combines

Vitro Investing in Production of Patterned Solar

Jan 22, 2025 · Vitro is in ongoing discussions with U.S.-based solar photovoltaic module manufacturers about sourcing patterned solar glass and is confident

Photovoltaic Solar Glass Companies And Suppliers In USA

Onyx Solar is the world''s leading manufacturer of transparent photovoltaic (PV) glass for buildings. Onyx Solar uses PV Glass as a material for building purposes as well as an

(PDF) Glass Application in Solar Energy Technology

May 3, 2025 · This chapter examines the fundamental role of glass materials in photovoltaic (PV) technologies, emphasizing their structural, optical, and spectral conversion properties that

Onyx Solar: the global leader in photovoltaic glass for

Onyx Solar leads in producing innovative transparent photovoltaic (PV) glass for buildings globally. Their PV Glass serves dual purposes: as a building material and as a means to

NSG starts US solar glass production line

Jan 22, 2025 · The investment will support the expansion strategy of First Solar, an American photovoltaic (PV) solar technology and manufacturing company. First Solar and NSG share a

6 FAQs about [USA New York Solar Photovoltaic Glass]

How long has NSG been producing TCO-coated glass for thin-film PV?

NSG has been producing TCO-coated glass for thin-film PV for more than 25 years. “Every year the solar market is bigger and bigger; more capital, more resources,” said Stephen Weidner, who heads NSG’s North American architectural glass and solar products groups. “We see this on a global basis.” Glass for solar is becoming more significant.

Why are solar glass suppliers investing in new production capacity?

As PV module capacity increases, glass suppliers are investing in new solar glass production capacity. New facilities are popping up in North America, with unique features to ensure competitiveness, such as using recycled material.

Does Vitro Architectural Glass supply First Solar?

Vitro Architectural Glass is supplying First Solar with additional US capacity. In October 2023, it announced an expansion of its contract with First Solar and a plan to invest in a plant in Pennsylvania, as well as in adapting existing PV glass facilities.

Is thin glass suitable for a PV system?

Thin glass is not ideal for PV systems due to its optimized design for shipping and logistics, rather than durability and performance in the field. According to Teresa Barnes, who manages the PV reliability and system performance group at NREL, thin glass may not be the best choice for long-term durability.

What is the demand for solar glass?

Andries Wantenaar, from market intelligence company Rethink Technology Research, said that "demand for solar glass is looking robust." “We’re excited about the potential for domestic solar manufacturing growth to provide jobs and R&D development in the US,” Solarcycle Chief Operating Officer (COO) Rob Vinje told pv magazine.

Will solar pattern glass reach 100 GW by 2030?

Anshul Vishal, head of corporate development at CPS, estimates that demand for solar pattern glass in North America will reach nearly 100 GW by 2030. This growth is driven by the reshoring of the solar panel manufacturing supply chain in the US.

Learn More

- Local photovoltaic panel manufacturer in New York USA

- Photovoltaic integrated panel manufacturer in New York USA

- Photovoltaic glass solar power generation

- Buenos Aires New Energy Ultra-thin Photovoltaic Glass

- London New Energy Building Photovoltaic Glass Component Wholesale

- New house solar photovoltaic panels for home use

- New solar photovoltaic panels 3000 watts

- Solar photovoltaic transparent glass

- Angola Photovoltaic Solar Glass Manufacturer

Industrial & Commercial Energy Storage Market Growth

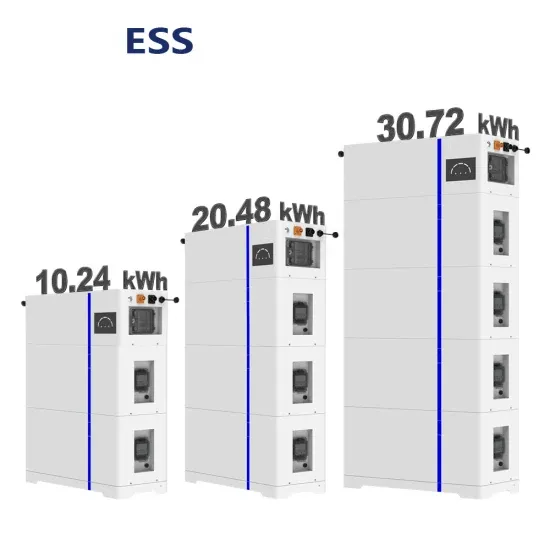

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.