Base Station market Analysis

Aug 17, 2025 · Base stations consist of various components, including antennas, transceivers, power amplifiers, and signal-processing equipment. These components work together to

Huawei and CommScope are the Market Leaders in ABI

Aug 12, 2025 · The updated Cellular Base Station Antenna Market competitive ranking report from ABI Research, a global tech market advisory firm, provides insights into the competitive

有道翻译_文本、文档、、在线即时翻译

有道翻译提供即时免费的中文、英语、日语、韩语、法语、德语、俄语、西班牙语、葡萄牙语、越南语、印尼语、意大利语、荷兰语、泰语全文翻译、翻译、文档翻译、PDF翻译、DOC

Communication Base Station Equipment Rigid PCB Market

The global Communication Base Station Equipment Rigid PCB market was valued at US$ 1804.8 million in 2022 and is projected to reach US$ 2571.3 million by 2029, at a CAGR of 5.2%

Simulation and Classification of Mobile Communication Base Station

Dec 16, 2020 · In recent years, with the rapid deployment of fifth-generation base stations, mobile communication signals are becoming more and more complex. How to identify and classify

Market Share of Top Three Suppliers of Base Stations

Jul 29, 2021 · Chinese and European suppliers of base station equipment are expected to once again account for a global market share of more than 70% in 2021, and the top three suppliers

Communication base station storage battery company

Communication base station energy storage lithium battery refers to a type of rechargeable lithium-ion battery that is specifically designed for use in communication base stations. These

How Solar Energy Systems are Revolutionizing Communication Base Stations

Nov 17, 2024 · Energy consumption is a big issue in the operation of communication base stations, especially in remote areas that are difficult to connect with the traditional power grid,

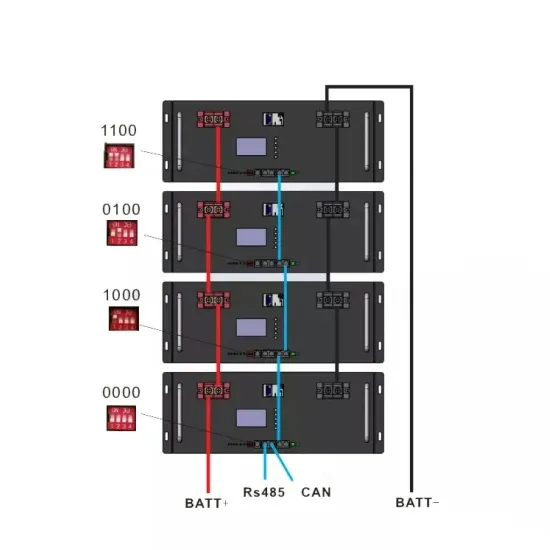

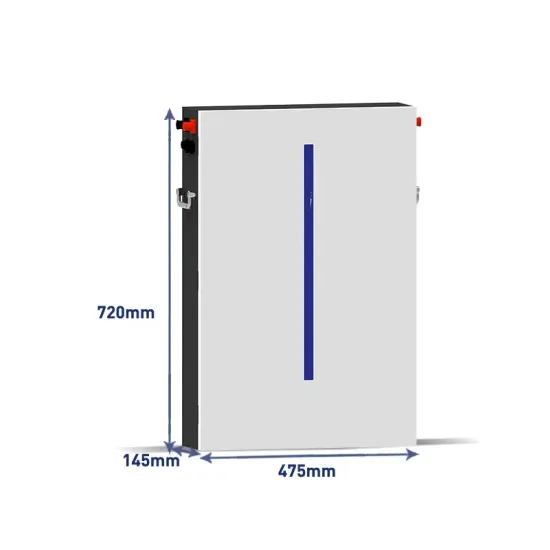

Energy storage system of communication base station

Energy storage system of communication base station Base station energy cabinet: floor-standing, used in communication base stations, smart cities, smart transportation, power

Communication Base Station Energy Metering | HuiJue

The Silent Power Drain in 5G Era Did you know a single 5G base station consumes 3-4 times more energy than its 4G counterpart? As global mobile data traffic surges 40% annually,

Communication Base Station Innovation Trends | HuiJue

Rethinking Infrastructure for the 5G-Advanced Era As global mobile data traffic surges 35% annually, communication base stations face unprecedented demands. Can traditional tower

5G Base Station Equipment Market 2025

The global 5G Base Station Equipment Market size was valued at US$ 18.45 billion in 2024 and is projected to reach US$ 41.28 billion by 2032, at a CAGR of 12.3% during the forecast period

Global Communication Base Station Equipment PCB Market

Chapter 2, to profile the top manufacturers of Communication Base Station Equipment PCB, with price, sales, revenue and global market share of Communication Base Station Equipment

Ranking of the top 10 manufacturers in the global 5G base station

Jul 4, 2024 · Samsung ranks 5th in terms of global base station sales, with a market share of only 3%, which is the bottom line. But in the race for 5G commercialization, Samsung is

Communication Base Station Equipment Flex PCB Market,

Global top five Communication Base Station Equipment Flex PCB companies in 2022 (%) Market has surveyed the Communication Base Station Equipment Flex PCB manufacturers, suppliers,

Communication Base Station Equipment Flex PCB Market

The global Communication Base Station Equipment Flex PCB market was valued at US$ 811.8 million in 2022 and is projected to reach US$ 1209.9 million by 2029, at a CAGR of 5.9%

Communication Base Station Equipment PCB Market Share

Chapter 6: Sales of Communication Base Station Equipment PCB in regional level and country level. It provides a quantitative analysis of the market size and development potential of each

Report | Communication Base Station Equipment PCB

Global top five Communication Base Station Equipment PCB companies in 2022 (%) Market has surveyed the Communication Base Station Equipment PCB manufacturers, suppliers,

Top 1! Chint Power Inverter Bankability Ranking Breakthrough!

Chint Power Supply ranked TOP 1 in BNEF inverter bankability ranking, which demonstrates the strength of Chint Power Supply in technological innovation, product quality, financing ability

6 FAQs about [Communication base station inverter equipment sales ranking]

What are the top 3 base station equipment providers in the world?

The top three base station equipment providers are China-based Huawei with the share accounting for 30%, Sweden-based Ericsson with 23% shared and the third one is Finland-based Nokia with 20% market shares. The noticeable point is amid US sanctions, Huawei still leads the global market share and continues its leadership.

What is the market share of base station equipment suppliers?

A world-leading market intelligence provider – TrendForce released the global market share analysis report of suppliers of base station equipment. The report discloses that more than 70% of the market is covered by Chinese and European suppliers.

Who owns the base station equipment market?

The report discloses that more than 70% of the market is covered by Chinese and European suppliers. The top three base station equipment providers are China-based Huawei with the share accounting for 30%, Sweden-based Ericsson with 23% shared and the third one is Finland-based Nokia with 20% market shares.

Which segment dominates the 5G base station market in 2024?

The industrial segment maintains its dominance in the global 5G base station market, commanding approximately 27% market share in 2024. This significant market position is driven by the accelerating adoption of Industry 4.0 initiatives and the growing integration of IoT devices in manufacturing facilities.

What is the fastest growing segment in 5G base station market?

The 5G macro cell segment is emerging as the fastest-growing segment in the 5G base station market, projected to grow at approximately 40% during the forecast period 2024-2029.

How big is the 5G base station market?

The 5G Base Station Market is expected to reach USD 37.44 billion in 2025 and grow at a CAGR of 28.67% to reach USD 132.06 billion by 2030. Huawei Technologies Co., Ltd., ZTE Corporation, Nokia Corporation, CommScope Holding Company, Inc. and QUALCOMM Incorporated are the major companies operating in this market.

Learn More

- Pyongyang communication base station inverter grid-connected equipment processing

- Old communication base station inverter grid-connected equipment

- Paraguay communication base station inverter equipment

- Nordic communication base station inverter photovoltaic power generation equipment

- USA communication base station inverter grid-connected equipment processing

- Energy storage ESS rate of communication base station inverter grid connection

- Can the communication base station inverter be connected to the grid using an energy storage cabinet

- Communication base station energy storage power generation equipment

- The company that provides battery energy storage system equipment for Paramaribo communication base station

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.