An Overview of the Colombian Power System

Jun 22, 2023 · Abstract—The Colombian power system is facing a transition from hydro-thermal generation to a diversified mix of hydro, solar, and wind energy. This paper presents an

Technical and financial analysis for the implementation

Apr 30, 2024 · Regarding photovoltaic solar energy generation in Colombia, statistics from the Mineral-Energy Planning Unit (UPME) as of December 31, 2022, indicate that out of the

Sustainable electricity supply for small off-grid communities

Jan 1, 2023 · As the price of renewable energy continues to fall, the use of such technologies for off-grid electrification is accelerating (IRENA, 2021, 2019, 2017a; Ortiz-Jara et al., 2020). Solar

Colombia''s large-scale PV capacity additions hit

Mar 14, 2024 · Colombia''s cumulative installed utility-scale PV capacity hit 486 MW at the end of December 2023, on 207 MW of new installations for the full

Photovoltaic energy in Colombia: Current status, inventory, policies

Sep 1, 2018 · Until March 2017, the Ministry of Mines and Energy issued Decree 348 on small-scale self-generation surpluses, known as small-scale: "Self-generation whose maximum

State of the Colombian Solar Market

Sep 28, 2018 · The Colombian energy sector is increasingly turning to solar and renewables in order to diversify its electricity mix, which has been mainly dependent on hydropower.

Solar PV generation in Colombia

Oct 2, 2023 · Heavily relying on hydro-power, Colombia''s electricity system will become more vulnerable with extreme weather patterns such as El Ni ~no. This paper offers a multi-method

Technical and Financial Analysis for the Implementation of Small

Abstract The study focuses on integrating non-conventional renewable energy sources into Colombia''s power system. The regulatory framework allows small prosumers to trade energy

¿FOSSIL-FREE ENERGY GENERATION IN COLOMBIA

Aug 20, 2024 · SIGNAL 5 - If wind energy development in Colombia becomes unfeasible, solar and small hydropower will replace the lacking installed capacity. SIGNAL 6 - In the worst-case

Executive summary – Colombia 2023 – Analysis

Aug 17, 2025 · In the context of the National Energy Plan 2020-2050, launched in 2016, Colombia started a journey to diversify its energy resources and ensure

Characterization of photovoltaic solar energy systems in

Objective: To establish a baseline about the solar photovoltaic energy systems installed in the department of Caldas, Colombia. Methodology: The solar photovoltaic installations were

Characterization of photovoltaic solar energy systems in a Colombian

Data was collected from 28 installations with different characteristics. 50% of the solar photovoltaic systems are in the Central-South region of Caldas. 71% of the systems are mainly

Solar PV generation in Colombia

Oct 2, 2023 · Solar PV generation in Colombia - A qualitative and quantitative approach to analyze the potential of solar energy market Andrea Ruíz Lopez a, Alexandra Krumm a, Lukas

Power generation mix in Colombia including wind power:

Dec 1, 2024 · The Colombian power market is hydro-dominated since 67 % of the power produced comes from hydro-power sources. In addition, it has thermal power from natural gas

Colombia''s Renewable Energy Potential | Invest in Colombia

Colombia has ''world class'' potential for renewable energy sources The Colombian Association of Renewable Energies (SER Colombia), which brings together 54 companies related to the

Photovoltaic solar energy in Colombia

Jul 28, 2022 · This research work aimed to analyze the prospects for photovoltaic solar energy in Colombia. In the results, as a first measure, a conceptualization of solar energy, the

Colombian Solar Industry Analysis | The Energy Pioneer

2. Introduction Colombia is endowed with high solar irradiance (4.5–6.5 kWh/m²/day), placing it among Latin America''s most promising markets for photovoltaic (PV) deployment. Yet as of

Colombia plugs in 18 solar, small hydro plants to

Oct 27, 2023 · Colombia connected 18 renewable energy generation plants to the national interconnected system (SIN) during the second and third quarter of

Overview of Photovoltaic Solar Plants and their

Feb 28, 2024 · For this, there are several solar and wind energy projects in Colombia under the figure Power Purchase Agreement (PPA), which refers to a financial agreement in which a

Colombian Solar Industry Analysis | The Energy Pioneer

Atlas Renewable Energy, backed by Global Infrastructure Partners (GIP), launched its first Colombian solar venture—the Shangri‑La PV project—with a capacity of 201 MWp, expected

Caracterización de sistemas de energía solar fotovoltaica en

Data was collected from 28 installations with different characteristics. 50% of the solar photovoltaic systems are in the Central-South region of Caldas. 71% of the systems are mainly

Renewable Energy 2024

Oct 28, 2024 · This ruling is particularly relevant for renewable energy producers in Colombia, many of whom are small or medium-sized enterprises that face significant barriers to grid

Solar and wind power in Colombia: 2022 policy overview

Jan 19, 2024 · Colombia has world-class wind and solar energy potential and recent regulatory updates have enacted a robust framework of incentives. However, as of 2022, solar and wind

Photovoltaic energy in Colombia: Current status, inventory,

Sep 1, 2018 · This law aims to promote the development and use of unconventional sources of energy, integrating them into the national energy system, allowing a promising future for these

Feasibility analysis for the integration of solar photovoltaic

Nov 8, 2022 · The implementation of renewable energy projects contributes to developing distributed systems and small-scale power generators, arousing investors'' interest in creating

6 FAQs about [Small solar power generation system in Colombia]

Can photovoltaic solar energy be used in Colombia?

This research work aimed to analyze the prospects for photovoltaic solar energy in Colombia. In the results, as a first measure, a conceptualization of solar energy, the development of photovoltaic panels, and the conditions required for installing this type of electricity generation module were carried out.

Can solar energy boost energy supply in Colombia?

In this sense, Serrano (2017b) carried out in Colombia an analysis of the use of solar energy for the future of the country as part of the general concern for the increase in the emission of polluting gases into the atmosphere and that it can boost energy supply through renewable sources.

What percentage of Colombia's electricity is solar?

The analyzes were based on the report generated in 2015 by the Mining and Energy Planning Unit (UPME) of Colombia, where it was projected that by 2028 about 13.75% of the 3275 MW that is installed should correspond to energy sources solar.

Is solar energy a problem in Colombia?

Taking into account that Colombia is mostly a desert area, what was presented above confirms the deficit of photovoltaic development in the ZNIs, that underutilize the solar resource and the great territorial extension. 4. Future picture of the solar energy

Will solar and wind power increase in Colombia in 2022?

Colombia has world-class wind and solar energy potential and recent regulatory updates have enacted a robust framework of incentives. However, as of 2022, solar and wind have an operating installed capacity of just about 1.5% of the capacity mix. The next five years could see a sharp increase in solar and wind capacity.

Can solar power be used for residential self-sufficiency in Colombia?

Pre-feasibility of wind and solar systems for residential self-sufficiency in four urban locations of Colombia: implication of new incentives included in Law 1715 Renew. Energy, 130 ( 2019), pp. 1082 - 1091, 10.1016/j.renene.2018.06.087

Learn More

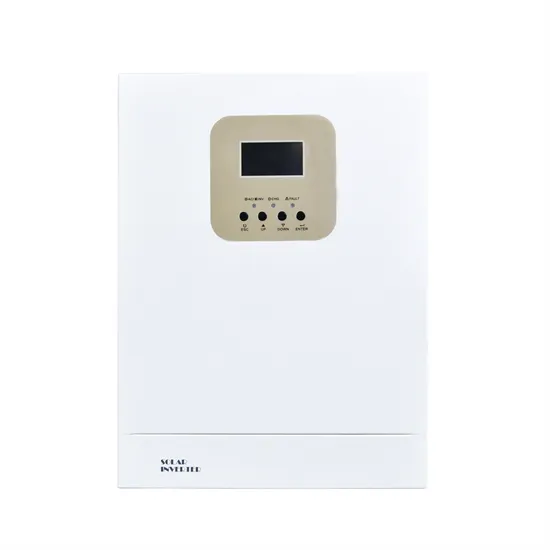

- 240V Small Solar Power Generation System

- Small power solar power generation system

- Small solar power generation system in Bolivia

- 16MW solar power generation

- Beijing Solar Power Generation System Home EK

- Moldova Grid-connected Solar Power Generation System Agent

- Customized home solar power generation system

- Belgian solar photovoltaic power generation energy storage cabinet

- Solar power generation solves the power consumption of 5g base stations

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.