Albemarle & SWA Benefit From $3bn US Battery Production

Sep 23, 2024 · The funding will support various aspects of battery production, including solid-state batteries, recycling, silicon-anode production, and lithium iron phosphate (LFP) batteries. Solid

National Blueprint for Lithium Batteries 2021-2030

Jul 1, 2024 · Lithium-based batteries power our daily lives from consumer electronics to national defense. They enable electrification of the transportation sector and provide stationary grid

Battery supply chain database maps out the state of

5 days ago · As part of ongoing efforts to map the battery landscape, NAATBatt International and NREL established the Lithium-Ion Battery Supply Chain Database to identify every company in

Albemarle, Caterpillar partner to bring zero

Sep 27, 2023 · The partnership aims to support Albemarle''s efforts to establish Kings Mountain, North Carolina, as the first-ever zero-emissions lithium mine

Lithium mines in the United States: where mining stands

May 15, 2024 · As part of ongoing efforts to map the battery landscape, NAATBatt International and NREL established the Lithium-Ion Battery Supply Chain Database to identify every

Tesla begins making lithium chemicals in the US

Jan 21, 2025 · Currently, the US only has a few, relatively small lithium chemical plants, operated by Albemarle and Arcadium Lithium. Tesla claims its facility will be the largest in North America.

7 Biggest Lithium-mining Companies in 2025

Apr 25, 2025 · Additionally, there are companies working on technology to recycle battery metals, which will eventually allow lithium from lithium-ion batteries to re-enter the supply chain.

NREL Battery Supply Chain Database Maps Out the State of North America

May 17, 2024 · The Lithium-Ion Battery Supply Chain Database highlights companies at various points in the supply chain, ranging from mining and raw materials production to end-of-life

North American Lithium-ion Battery Supply Chain

Apr 19, 2023 · Summary Lithium-ion batteries (LIBs) are used in a wide range of applications, including cell phones, electric vehicles (EVs), and grid storage, and are essential for economic

NREL Battery Supply Chain Database Maps Out the State of North America

May 15, 2024 · As of March 2024, the database now offers a directory of nearly 700 companies and 850 facilities in North America across lithium-ion battery supply chain segments, including

Lithium Mining in North America

Sep 21, 2022 · North America needs lithium mines to compete with China''s dominance of the electric vehicle battery chain. There are some clear candidates, but no clear winner as

Lithium Global Strategic Industry Research Business Report

Feb 11, 2025 · Lithium Global Strategic Industry Research Business Report 2024-2030: North America to Take Lead in Non-Chinese Supply, Carbonate & Battery Segments Powering

Fact Sheet: Lithium Supply in the Energy Transition

Dec 20, 2023 · An increased supply of lithium will be needed to meet future expected demand growth for lithium-ion batteries for transportation and energy

6 FAQs about [North America Energy Storage Lithium Battery Mining]

Should North America start a lithium mine?

North America needs lithium mines to compete with China’s dominance of the electric vehicle battery chain. There are some clear candidates, but no clear winner as bankruptcies and environmentalists get in the way of new mine openings.

Is there a lithium mine in America?

Lithium is used in many electronics, from laptops and cell phones to electric car batteries and home energy storage. Yet, the United States is home to just one operating lithium mine. Some approved permits for new mines exist, but it will be years before they are operational — if they ever open at all.

What is the North American lithium complex?

Utilizing advanced processing and hydroelectric power, the facility supports sustainable battery manufacturing for electric vehicles and energy storage solutions. The North American Lithium Complex, operated by Sayona Mining Inc., stands as one of North America’s significant lithium production facilities, located in La Corne, Quebec.

Will Albemarle build a zero-emissions lithium mine in North Carolina?

The partnership aims to support Albemarle’s efforts to establish Kings Mountain, North Carolina, as the first-ever zero-emissions lithium mine site in North America, according to a statement released Wednesday. These efforts include utilization of next-generation, battery-powered mining equipment.

What's going on with US lithium mining?

Despite the U.S. having up to 9.1 million tons of lithium reserves, plans for new mines have stalled. Everything from cheaper import options to local opposition has put U.S. lithium mine construction on hold. We’ll update you on the state of U.S. lithium mining and what we anticipate regarding lithium and climate change.

Who owns the North American lithium complex?

Sayona Mining Limited maintains a 75% ownership stake in the North American Lithium Complex, while Piedmont Lithium Inc. holds the remaining 25%. This partnership structure emerged from the 2021 acquisition, representing a strategic alliance between two established mining entities.

Learn More

- North American energy storage lithium battery brand

- North Korea lithium battery energy storage cabinet integrated system

- North Macedonia liquid-cooled energy storage cabinet system lithium battery pack

- North Asia Energy Storage System Lithium Battery Project

- Kingsdon Iron Lithium Battery Energy Storage Container Quote

- Lithium battery energy storage grid connection

- Vanuatu lithium battery station cabinet factory energy storage battery

- Wellington 40kw lithium battery energy storage system inverter

- Basseterre energy storage lithium battery manufacturer

Industrial & Commercial Energy Storage Market Growth

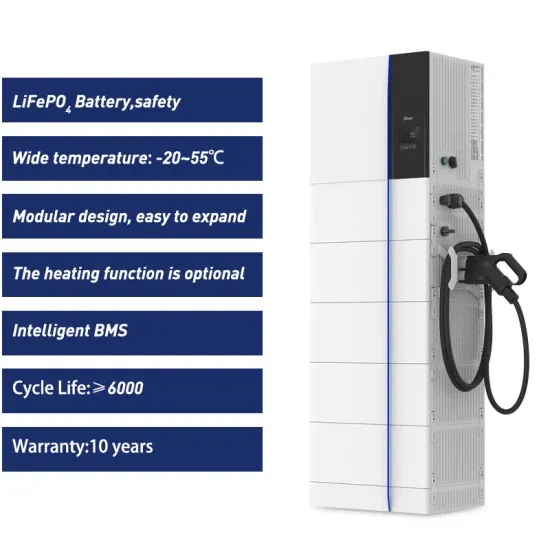

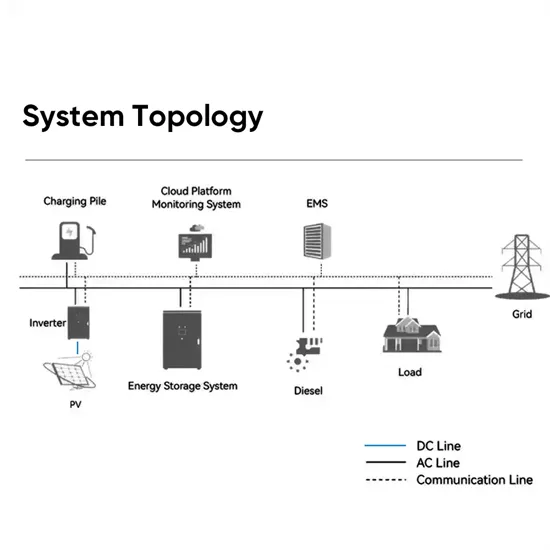

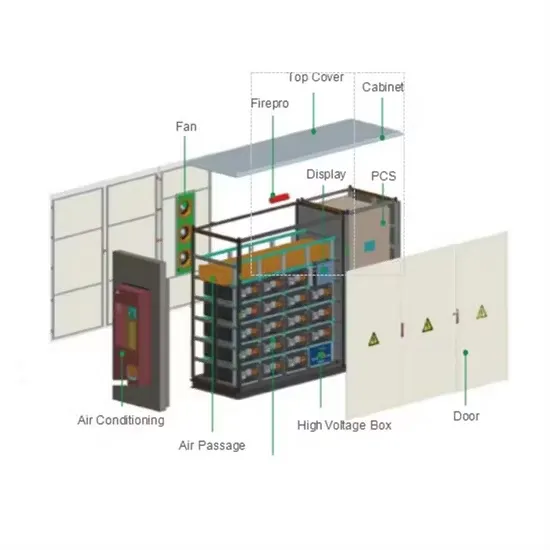

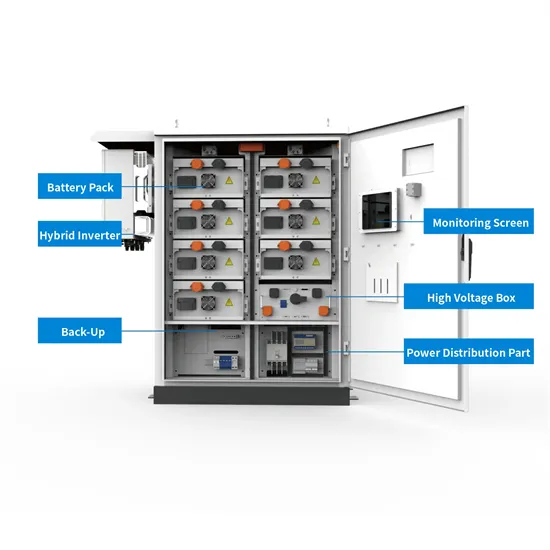

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.