Solar power systems for home use Timor-Leste

A Case Study: Performance Comparison of Solar Power GridLAB-D, System Advisor Model, Solar Power Generation, Timor Leste, WRF 1. Introduction According to the strategic plan for the

Solar panel brands in Timor-Leste

Solar-powered UN House lights the way for a greener and It took almost a year – from feasibility to completion – to see the solar panel installed at the UN Timor-Leste compound. Photo: RCO

Solar Company in Timor Leste | Solar EPC Companies in Timor Leste

Solar Power Solutions Pvt Ltd is the leading solar company in Timor Leste. As one of the best-known solar EPC companies in the country, we specialize in providing comprehensive solar

Latest and best solar panels Timor-Leste

Australia''s Market Development Facility (MDF) and ITP Renewables conducted an assessment of the potential market for roof-top solar energy systems in Timor-Leste. Can a solar power grid

Timor Leste Solar Power in Petrol Pump Market (2025-2031

Historical Data and Forecast of Timor Leste Solar Power in Petrol Pump Market Revenues & Volume By Onsite Generation for the Period 2021-2031 Historical Data and Forecast of Timor

Timor-Leste the best solar panel in

As Timor-Leste moves toward prioritizing more climate-friendly development, clean energy is providing empowerment and opportunity for its people. With solar lights in their homes, women

Lessons learned from development of the SDG 7

4 days ago · Power generation in the SDG scenario Timor-Leste plans to implement 72 MW solar and 50 MW wind by 2024 and 2026 respectively. This will increase RE share in power

Top solar epc companies in europe Timor-Leste

This report lists the top Europe Solar Photovoltaic (PV) companies based on the 2023 & 2024 market share reports. Mordor Intelligence expert advisors conducted extensive research and

Ranking of manufacturers of energy storage charging piles in Timor-Leste

Top 10 solar energy storage battery manufacturers in China in The core products cover 1-255KW photovoltaic inverters, 3-20KW energy storage inverters, high and low voltage

Timor-Leste solar power for workshop

Solar-powered UN House lights the way for a greener and more The Operations Management Team started weighing the feasibility and working on a cost-efficient alternative energy solution

Gokoval: Reliable Solar Energy Solutions in Timor Leste

May 16, 2025 · Site Assessments: Evaluate sunlight availability and system compatibility. Customized Solutions: Design efficient systems with top-tier solar panels and components.

GI SOLAR PANEL STAND MANUFACTURERS IN TIMOR LESTE

Who makes flexible solar panels? Wind and Sun is a top manufacturer of flexible solar panels with a reputation for hands-on expertise. More importantly, they are known to introduce advanced

6 FAQs about [Timor-Leste Solar Onsite Energy Brand Ranking]

Does Timor-Leste need a roof-top solar energy system?

In addition, most of Timor-Leste's electricity is generated through costly and polluting diesel generators. Australia's Market Development Facility (MDF) and ITP Renewables conducted an assessment of the potential market for roof-top solar energy systems in Timor-Leste.

Is Timor-Leste a good country for solar energy?

Timor-Leste has a high-quality solar resource. The global horizontal irradiance in Dili is higher than on the east coast of Australia, where the solar market is mature and installation costs are higher. The cost of electricity in Timor-Leste for commercial and industrial consumers is high compared to ASEAN countries.

What is energy security in Timor-Leste?

1 Energy security is “uninterrupted availability of energy sources at an affordable price”; International Energy Agency. The average payback period for a rooftop PV solar energy system in Timor-Leste is 2.5 years. This is much lower than the global average of 6 to 10 years, due to solar resource and electricity costs:

How long does a solar system last in Timor-Leste?

High electricity costs and readily available solar radiation mean that the average payback period for a rooftop photovoltaic (PV) solar energy system in Timor-Leste is only 1.5 to 3 years instead of the global average of 6-10 years. Transitioning to solar can also help the country meet environmental commitments.

Why is solar energy maintenance important in Timor-Leste?

Maintenance tends to be limited to repairing malfunctioning system components, instead of preventative care or servicing, which can reduce the effectiveness of solar energy systems and increase costs. Technicians in Timor-Leste have experience in small-scale, off-grid solar energy systems.

Why is Timor-Leste not able to finance solar panels?

MDF research found that lenders in Timor-Leste are unwilling to lend to small and medium sized enterprises due to levels of default, perceived risks, and the dificulty of securing collateral. Evaluate the upfront costs of installing solar panels versus long-term savings. Consider financing options to determine overall economic viability.

Learn More

- Solar Onsite Energy Photovoltaic Outdoor Brand

- The latest ranking of wind solar and energy storage

- Outdoor Solar Onsite Energy Installation

- Outdoor Solar Onsite Energy Storage Wireless

- Onsite Energy Solar Charging Panel Two-in-One Cable

- Solar Panels Onsite Energy Outdoor Panels

- Bangi solar energy storage battery brand

- Solar Network Onsite Energy

- Which brand of home solar energy storage equipment is good

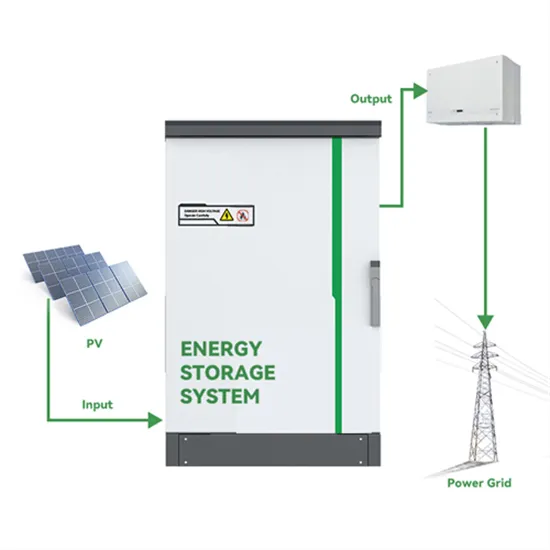

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

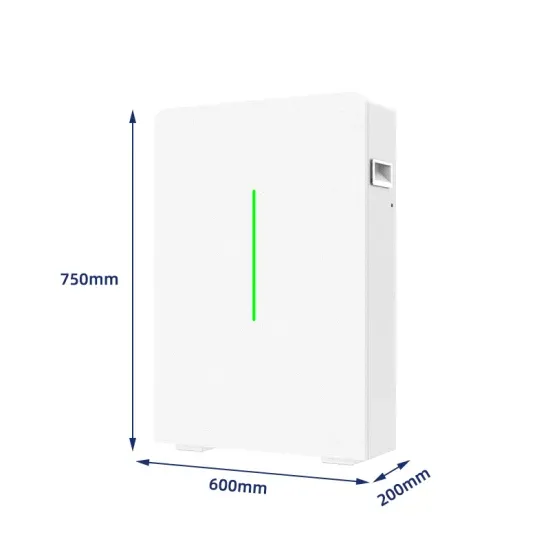

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.