Comprehensive review of energy storage systems

Jul 1, 2024 · The applications of energy storage systems have been reviewed in the last section of this paper including general applications, energy utility applications, renewable energy

Japanese Energy Storage Power Station Subsidies: A

Why Japan''s Battery Storage Boom Matters (and Why You Should Care) a country where 90% of households could power their homes during blackouts using "energy piggy banks" (a.k.a.

Mastering the Future of Energy: How Japanese Innovation

Aug 21, 2024 · Introduction The future of energy, characterized by clean and renewable sources, hinges largely on the development and perfection of energy storage systems. Over the years,

Energy storage power station japan co ltd

In 2015,we started Japan''s first demonstration project covering energy storage connected to the power grid in the Koshikishima,Satsumasendai City,Kagoshima. This project is still operating

Top 22 largest Japanese Energy Companies 2025

Jul 1, 2025 · Top 22 largest Japanese Companies in the Energy sector by Market Cap This is the list of the largest public listed companies in the Energy sector from Japan by market

Japan''s Pumped Storage Power Station Projects: Powering

Jan 10, 2023 · In Japan, they kind of do—thanks to pumped storage power stations. These engineering marvels are critical for balancing the country''s energy grid, especially as it shifts

Japan energy storage power station project

May 20, 2024 · The GS Yuasa-Kita Toyotomi Substation – Battery Energy Storage System is a 240,000kW lithium-ion battery energy storage project located in Toyotomi-cho, Teshio-gun,

Hirohara Battery Energy Storage System

3 days ago · The Hirohara Battery Energy Storage System (BESS) is located in Oaza Hirohara, Miyazaki City, Miyazaki Prefecture. The 30MW/120MWh battery is Eku''s first in Japan, and the

Japan''s Itochu, Osaka Gas partner for battery

Jun 8, 2023 · The corporation announced yesterday the launch of its new business Senri Chikuden (Senri Power Storage). The three partners will establish a grid-scale battery energy

Kansai Electric to Build One of Japan''s Largest Battery Storage

Kansai Electric Power announced plans to construct one of Japan''s largest battery storage facilities on the former site of the Tanagawa Power Station in Misaki Town, Osaka Prefecture,

China''s Largest Grid-Forming Energy Storage Station

Apr 9, 2024 · The station was built in two phases; the first phase, a 100 MW/200 MWh energy storage station, was constructed with a grid-following design and was fully operational in June

''Japanese market is ready for scale-up'': Gurin on

Dec 21, 2023 · Gurin Energy''s Franck Bernard speaking on a panel at the Energy Storage Summit Asia, hosted in Singapore earlier this year by our publisher

Top 28 Energy Storage Companies in Japan (2025) | ensun

PowerX is revolutionizing energy storage by establishing a gigafactory in Japan dedicated to producing various energy storage solutions, including EV hyperchargers and home batteries.

6 FAQs about [Japanese company s own power station energy storage]

What is Japan's first energy storage project?

In 2015, we started Japan's first demonstration project covering energy storage connected to the power grid in the Koshikishima, Satsumasendai City, Kagoshima. This project is still operating in a stable manner today. One feature of our grid energy storage system is that it utilizes reused batteries from EVs.

How many battery storage projects will Stonepeak and CHC develop in Japan?

Stonepeak and CHC’s energy storage platform will develop five new battery storage projects in Japan. These projects have a combined capacity of 348 megawatts (MW). The deals were finalized under Japan’s Long-term Decarbonization Auction. These projects were selected as part of Japan’s latest long-term auction focused on low-carbon energy.

Will Japan start a large-scale energy storage facility in 2024?

Here, we will delve into our path taken to launch a completely new business and start operation of the first large-scale energy storage facility in Japan in 2024, as well as the challenges and future prospects on the front line. Joined the Company in 2013.

How do storage systems work in Japan?

Storage systems like BESS help keep power systems stable, especially when more electricity comes from solar and wind sources. Other projects in Japan include a municipal BESS project in Iida City, Nagano Prefecture. This small-scale system, with an installed capacity of 2 MW/4 MWh, is operated by a city-owned energy company.

Which power stations in Japan are publicly or privately owned?

This page is a list of power stations in Japan that are publicly or privately owned. The Ikata Nuclear Power Plant. The Kashiwazaki-Kariwa Nuclear Power Plant as seen from space. The Tomari Nuclear Power Plant. ^ a b c d e f g h i j k l m n "Coal-Fired Plants in Japan".

Why is battery storage important in Japan?

Once operational, the battery storage systems will help balance supply and demand on the national power grid. Battery storage is viewed as an important part of Japan’s decarbonization plans. Storage systems like BESS help keep power systems stable, especially when more electricity comes from solar and wind sources.

Learn More

- Which company owns the London energy storage power station

- Sri Lanka Energy Storage Power Station Installation Engineering Company

- Central Asia Company s own power station energy storage

- Which company owns the solar energy storage power station

- North Korea Power Supply Company Energy Storage Power Station

- Almaty Compressed Air Energy Storage Power Station in Kazakhstan

- Juba outdoor energy storage power supply company

- Advantages and disadvantages of compressed wind energy storage power station

- Power station energy storage battery

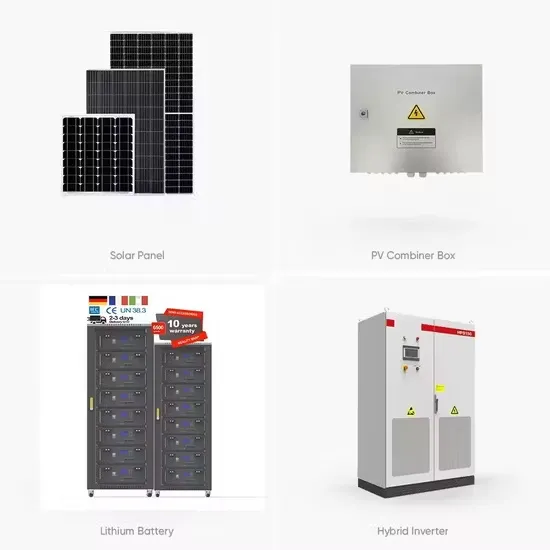

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.