Tendering for government construction projects

Tendering for government construction projects If you want to undertake construction projects for the UAE Government, log in to the website of Ministry of Energy and Infrastructure to purchase

Research on Carbon Emission of 5G Base Station Construction

Sep 2, 2022 · With the new infrastructure construction proposed in China, 5G base stations as the basis for it will make the environmental impact during the construction process. Quantifying the

Base Station Energy Storage Construction: Powering 5G

Why 5G Base Stations Are Facing an Energy Crisis Did you know a single 5G base station consumes up to 3.7x more power than its 4G counterpart? As of Q1 2025, China alone

Dublin MetroLink Project Market Update

Oct 13, 2023 · MetroLink Client Partner ("Client Partner") for MetroLink. This partnership is made up of Turner & Townsend and WSP supported by sation within the Client Partner team.

Optimal configuration of 5G base station energy storage

Jun 21, 2025 · The high-energy consumption and high construction density of 5G base stations have greatly increased the demand for backup energy storage batteries.To maximize overall

Ireland Tenders | Latest Ireland Tender

Aug 20, 2025 · Find relevant Irish tenders on official and local websites, journals, newspapers or on aggregator portals like Global tenders. Check Eligibility to

9187 5G Private Network for Irish Rail Tender, Ireland

Feb 21, 2025 · IARNRÓD EIREANN-IRISH RAIL has floated a tender for 9187 5G Private Network for Irish Rail. The project location is Ireland and the tender is closing on 21 Feb 2025.

5G Base Station Construction Market in India

5G Base Station Construction in India Trends and Forecast The future of the 5G base station construction market in India looks promising with opportunities in the smart home, medical &

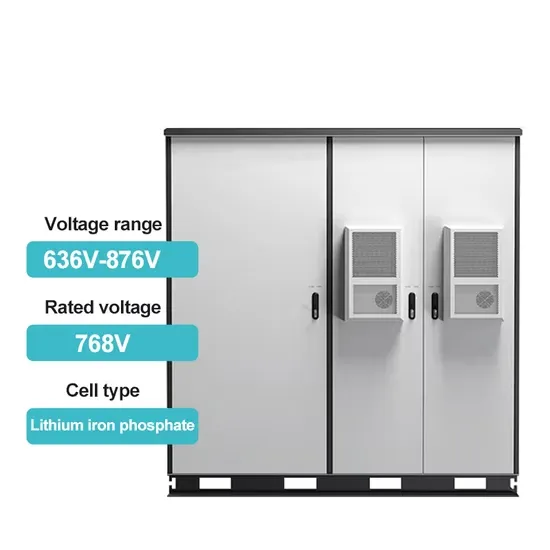

Technical Requirements and Market Prospects of 5G Base Station

Jan 17, 2025 · With the rapid development of 5G communication technology, global telecom operators are actively advancing 5G network construction. As a core component supporting

Dublin''s innovative 5G neutral host network

Apr 28, 2022 · Dublin City''s "first of its kind" 5G neutral host network offers wholesale access to multiple operators while reducing infrastructure costs. The project uses ''street level''

Optimal configuration of 5G base station energy storage

Feb 1, 2022 · The high-energy consumption and high construction density of 5G base stations have greatly increased the demand for backup energy storage batteries. To maximize overall

An Extended R-Number MARICA Fuzzy Method with Aczel

Nov 29, 2022 · Finally, this study applies the proposed RN-MARICA method to the risk analysis of 5G base station project construction, proving the feasibility and applicability of the proposed

CHINT won the bid for China Mobile 5G base station project

Jun 20, 2020 · As a partner of China Mobile for many years, CHINT T&D has positively established project cooperation to facilitate its 5G base station construction. In the just

6 FAQs about [Tender for Dublin Hybrid Energy 5G Base Station Construction Project]

How does global tenders work in Ireland?

GlobalTenders aggregates tenders from Ireland's official, authorities and agencies websites, newspapers, journals and magazines. With artificial intelligence and machine learning the data is authenticated, segregated and reorganized to make thousands of Ireland Tenders easily searchable on a single platform. How to bid on Ireland tenders?

Where can I find information about tendering opportunities in Ireland?

They provide a wealth of information on their website, including tendering opportunities, procurement guidelines, and supplier registration. eTenders: eTenders is the Irish government's online tendering platform. Suppliers can register with eTenders to be notified of new tender opportunities and to submit tenders electronically.

Who can bid on Ireland tenders?

All companies and individuals who are capable of fulfilling the requirements can potentially bid on Ireland tenders. There might be additional restrictions based on domicile, experience and qualifications depending on the project's nature and complexity. What are the top products and services procured by Ireland tenders?

How to get Ireland government tenders & RFPs?

Subscribe to get Ireland government tenders, Bids, RFPs and eProcurement notices from the biggest online database of Ireland. IrelandTenders is the most authentic and comprehensive database of Ireland Tenders, RFPs, Bids and eProcurement Notices.

What is Ireland tenders?

IrelandTenders is the most authentic and comprehensive database of Ireland Tenders, RFPs, Bids and eProcurement Notices. The information on eTenders, EOI, GPN and other public and private tenders from various industry sectors in Ireland is sourced from newspapers, government public procurement portals and individual purchasers websites.

How do I apply for a tender in Ireland?

Find relevant Irish tenders on official and local websites, journals, newspapers or on aggregator portals like Global tenders. Check Eligibility to bid for the Irish tender. Prepare the bid documents. Submit on time and furnish all required information.

Learn More

- Timor-Leste 5G communication base station hybrid energy construction project bidding

- St John s 5G communication base station energy management construction project

- 5G base station of Slovakia Hybrid Energy Branch

- Castries hybrid energy 5g base station photovoltaic power generation system planning

- South Tarawa Communication 5G Base Station Construction Project

- Seychelles 5G communication base station uninterrupted power supply construction project

- Construction of battery energy storage system for 5G communication base station in Nassau

- Jakarta 5g communication base station inverter construction project

- Jakarta hybrid energy 5g signal base station

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.