Cost Projections for Utility-Scale Battery Storage: 2023

Jul 25, 2023 · In 2016, the National Renewable Energy Laboratory (NREL) published a set of cost projections for utility-scale lithium-ion batteries (Cole et al. 2016). Those 2016 projections

QATAR BATTERY ENERGY STORAGE MARKET 2024 2030

Lithium iron phosphate energy storage battery type market share Rising Trend of Electric Vehicles and Hybrid-Electric Vehicles Owing to Increasing Fuel Prices will Propel the Adoption of LFP

Prices of Lithium Batteries: A Comprehensive Analysis

Apr 11, 2025 · Lithium battery prices fluctuate due to raw material costs (e.g., lithium, cobalt), manufacturing innovations, geopolitical factors, and demand surges from EVs and renewable

Where will lithium-ion battery prices go in 2025?

Jan 13, 2025 · After tumbling to record low in 2024 on the back of lower metal costs and increased scale, lithium-ion battery prices are expected to enter a

Li-Ion Cell Price: What You Need to Know in 2025

Apr 17, 2025 · A lithium-ion (Li-ion) cell is a type of rechargeable battery cell known for its high energy density, lightweight design, and rechargeability.

Costs of 1 MW Battery Storage Systems 1 MW /

Mar 25, 2023 · Discover the factors affecting the Costs of 1 MW Battery storage systems, crucial for planning sustainable energy projects, and learn about the

Qatar Lithium Market (2025-2031) | Trends, Outlook & Forecast

The lithium market in Qatar is gaining significance as lithium-ion batteries become increasingly crucial in various industries, including electric vehicles and renewable energy storage. Qatar

Qatar Energy Storage Equipment Plug Price: What You Need

Why Qatar''s Energy Storage Market Is Heating Up (Literally!) Let''s face it – when you think of Qatar, "energy storage equipment plug prices" probably aren''t the first thing that comes to

Lithium-Ion Battery Pack – Power Tools Qatar

Description Lithium-Ion Battery Pack - Efficient and High-Performance Energy Storage A Lithium-Ion Battery Pack is a high-performance power tool accessory providing long-lasting, reliable

Qatar''s Grid-Scale Battery Market Surges Amid Renewable Energy

Jan 16, 2024 · In 2022, Lithium-Ion batteries dominated the market, claiming the largest revenue share. Advancements in technology and increased manufacturing capabilities led to a

Felicity Solar Battery LPBA48300 300AH 15kWH

Unlock the power of renewable energy with the LPBF48300 15KW Lithium Ion Phosphate Solar Battery. Designed to provide reliable backup power during outages and seamlessly integrate

Utility-Scale Battery Storage | Electricity | 2024 | ATB | NREL

It represents lithium-ion batteries (LIBs)—primarily those with nickel manganese cobalt (NMC) and lithium iron phosphate (LFP) chemistries—only at this time, with LFP becoming the

Qatar battery energy storage price list latest

Battery Energy Storage System in India Market The India Battery Energy Storage Systems Market is projected to register a CAGR of 11.20% during the forecast period (2024-2029) Reports.

Top 10 Energy Storage Trends in 2023

Jan 11, 2023 · At the beginning of each year, we pause to reflect on what has happened in our industry and gather our thoughts on what to expect in the coming 12 months. These 10 trends

Qatar Lithium Ion Battery Market (2024-2030) | Trends,

As Qatar diversifies its energy mix and explores renewable energy sources, the need for energy storage systems like lithium ion batteries becomes critical. These batteries find applications in

Qatar lithium battery energy storage equipment

The Qatar Battery Energy Storage System (BESS) market is witnessing significant growth as the nation increasingly focuses on sustainable energy solutions. Key players in this market include

Top Solar Battery Suppliers in Qatar

4 days ago · The most popular for energy storage, lithium-ion batteries have the longest lifespan. These batteries are also quite compact and light compared to other battery types.

Qatar Lithium Battery Import Regulations Guide for Safe

May 23, 2025 · Lithium-ion batteries power everything from smartphones, laptops, and electric vehicles to backup power systems like 12v, 24v, and 48v energy storage batteries.

Qatar Grid-Scale Battery Market Report 2023-2029 Featuring

Jan 13, 2024 · Utility companies in Qatar are poised to dominate the market as battery storage for renewable energy gains traction, optimizing peak-hour electricity distribution and pricing

Middle East Energy Storage Pricing Report 2025

5 days ago · Report Summary: This report analyses the cost of utility-scale lithium-ion battery energy storage systems (BESS) within the Middle East utility-scale energy storage segment,

qatar energy storage low temperature lithium battery price

High performance hybrid Mg-Li ion batteries with conversion cathodes for low cost energy storage 1. Introduction Lithium ion batteries (LIBs) have achieved a great success in commercial

Qatar lithium battery storage cabinet quotation

What are the safety storage cabinets for lithium-ion batteries? Safety storage cabinets for passive storage of lithium-ion batteries according to EN 14470-1 and EN 1363-1 with a fire resistance

Top 5 Battery Suppliers in Qatar (2025) | ensun

Key takeaway Voltaat offers a Lithium Ion Battery (950mAh), known for being thin, light, and powerful, with an output range of 4.2V to 3.7V. They provide a full range of LiPoly batteries to

qatar iron lithium battery energy storage container price

Fossil fuel nation The State of Qatar launches lithium-ion battery The State of Qatar has begun a pilot project to store grid-scale power using a 1MW/4MWh lithium-ion energy storage

6 FAQs about [Qatar lithium-ion energy storage battery prices]

What is the Global X lithium & battery tech ETF (lit)?

The Global X Lithium & Battery Tech ETF (LIT) offers exposure to the full lithium cycle by investing in companies involved in lithium mining, refining, and battery production. The OECD provides a comprehensive framework for determining the price of lithium. Here are the main factors that affect lithium price:

Why is lithium a commodity in China?

China produces an estimated 80% of the entire world’s lithium-ion batteries each year, and about 60% of all electric vehicle batteries. As a result, Chinese prices for battery-grade lithium (i.e. lithium carbonate with over 99.5% purity) have become one of the foremost proxies for the price performance of lithium as a commodity.

How does the OECD determine the price of lithium?

The OECD provides a comprehensive framework for determining the price of lithium. Here are the main factors that affect lithium price: Market Conditions and Demand: The surge in demand from electric vehicles, portable electronic devices, and energy storage options significantly influences lithium demand.

What grade of lithium ion battery do I Need?

The specific grade required can vary significantly depending on the end use. Lithium Carbonate 99.5%: Battery Grade, essential for lithium-ion batteries in EVs and portable electronics. The pricing for Lithium Carbonate 99.5% (CNY/mt) is considered the benchmark for lithium pricing worldwide.

What is lithium carbonate (CNY/Mt)?

The pricing for Lithium Carbonate 99.5% (CNY/mt) is considered the benchmark for lithium pricing worldwide. Lithium Carbonate 99.2%: Technical or Industrial Grade, used in glass, ceramics, and greases. Lithium 99.9%: Used in pharmaceuticals or aerospace applications where a high degree of purity is necessary.

What is lithium carbonate used for?

Lithium Carbonate 99.5%: Battery Grade, essential for lithium-ion batteries in EVs and portable electronics. The pricing for Lithium Carbonate 99.5% (CNY/mt) is considered the benchmark for lithium pricing worldwide. Lithium Carbonate 99.2%: Technical or Industrial Grade, used in glass, ceramics, and greases.

Learn More

- Lithium-ion energy storage battery prices in Tunisia

- Antananarivo lithium-ion battery energy storage container quotation

- Lithium-ion battery energy storage in Mozambique

- Lithium-ion battery energy storage cabinet

- Reykjavik lithium-ion energy storage battery life

- Lithium battery energy storage prices in South America

- Lithium-ion battery energy storage container installation in Antananarivo

- Equatorial Guinea energy storage battery prices

- Is the energy storage battery lead-acid or lithium-ion

Industrial & Commercial Energy Storage Market Growth

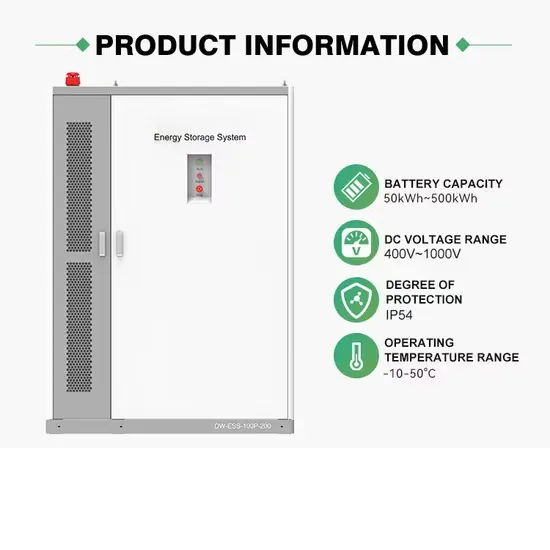

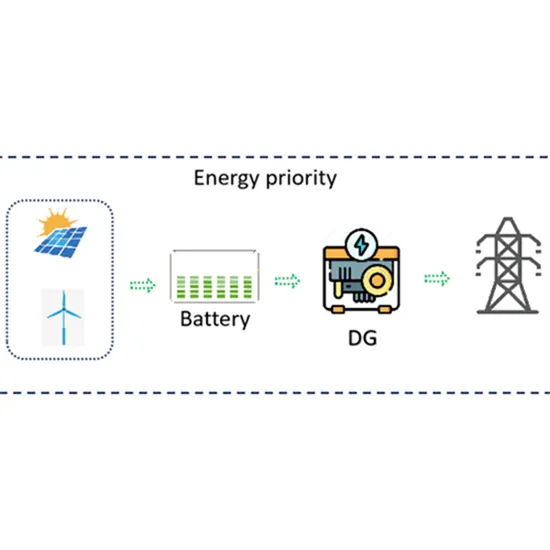

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

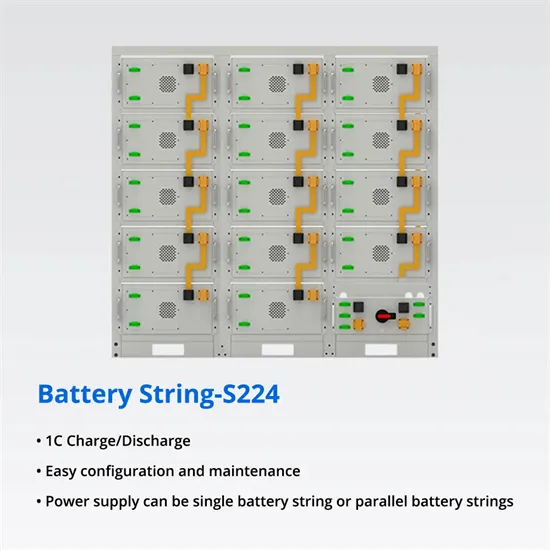

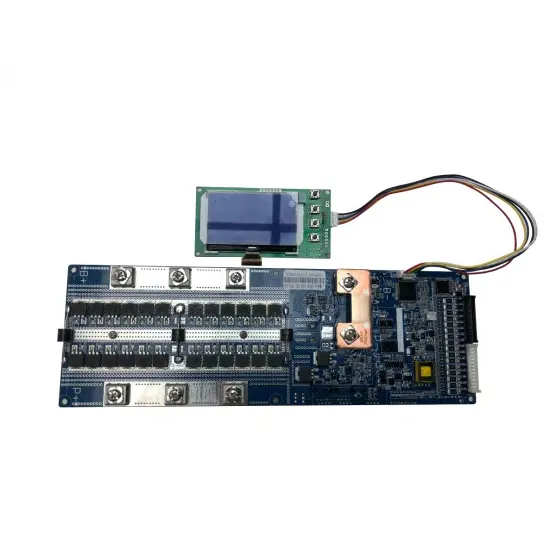

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.