Tender for lease of an office space-Juba.

Mar 5, 2024 · Any inquiry regarding this tender can only be made in writing to the email address southsudanprocurement@imaworldhealth with the subject title- Tender for lease of an

Closed tender — Rovision of Labour and Materials for

Jun 2, 2023 · Rovision of Labour and Materials for Grading, Graveling and Drainage Works at Juba Jebel Warehouse Way Station Action Africa Help International (AAH-I) is inviting bids

Supply of Drinking water bottled MSF EOI-07

Jul 22, 2025 · The Médecins Sans Frontières (MSF), South Sudan, seeks for qualified and reliable suppliers for provision of drinking water in Juba South

Caritas Juba-Call for Tender

Dec 11, 2024 · Tenders & Other Advertisments Caritas_Juba (Caritas Archdiocese of Juba ) December 11, 2024, 12:29pm 1 Caritas Juba a faith based humanitarian & social wing of the

Prequalification and Frame work contract

Feb 10, 2025 · TITI Foundation invites potential service providers to apply for prequalification and framework contract under various categories for works, supplies and service for 2025-2026.

South Sudan Govt Tender for Supply and delivery of

South Sudan government tender for Supply and delivery of household equipment to dap unmiss logbase in, juba, south sudan, TOT Ref No: 21089399, Tender Ref No: EOIUNMISS14834,

ForAfrika-Tender for Construction of Two water Kiosk in Juba

Mar 24, 2025 · Dear All, ForAfrika is inviting legally registered companies in South Sudan to submit their bids for the construction of 2 water Kiosks in Juba. Good luck! Procurement Units

Closed tender — Pre-qualification of Suppliers -2025 for Juba

Feb 17, 2025 · Objectives: The tender aims to pre-qualify vendors for supplying and delivering assorted items and services to ACROSS South Sudan during 2025. The goal is to establish a

juba Tender News | Latest juba Tender Notice

16 rows · Jul 11, 2025 · Get latest information related to international tenders for juba Government tender document, juba tender notifications and global tender opportunities from world wide

Supply, delivery and installation of Radio Equipment for Base

Jul 22, 2024 · Supply, delivery and installation of Radio Equipment for Base Radio and Mobile At NCA Office in Juba - Tenders & Other Advertisments - South Sudan NGO Forum -

Caritas Juba-Urgent Tender

Mar 13, 2025 · CARITAS JUBA-URGENT TENDER.pdf (8.4 MB) Caritas Juba is re-advertising this tender for urgent and immediate response as it was posted previously. Detail in the tender

PPRA :: Public Procurement Regulatory Authority

5 days ago · Tender & Advertisments Procurement & Notices Tender Notice () Pre-Qualifications PQ () Request for Proposal () Expression of Interests-EOI (0) Sales/Auction/Disposal ()

Learn More

- Baghdad Communication Base Station EMS Tender

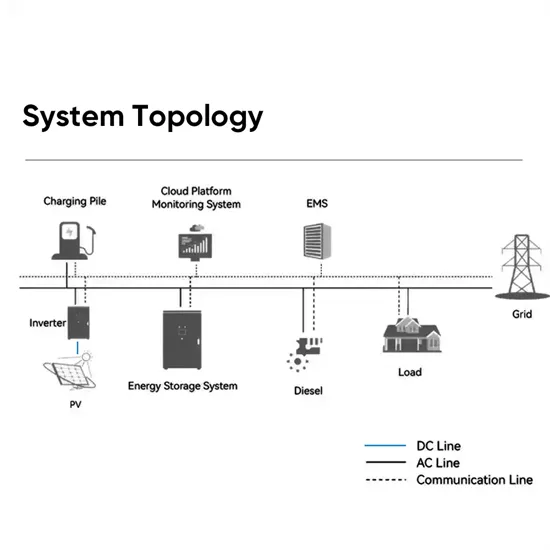

- How to connect the cylindrical energy storage cabinet of the communication base station battery energy storage system

- Communication base station wind and solar hybrid direct ventilation cabinet

- Hanoi Communication Green Base Station Cabinet Manufacturer

- Communication 5G base station energy storage cabinet price

- Customized price of super capacitor cabinet for Italian communication base station

- How much does a wind-solar hybrid energy storage cabinet for a communication base station cost

- Albania outdoor communication base station battery photovoltaic generator cabinet

- Berlin Base Station Communication Cabinet Factory

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.