Is Africa about to see the solar energy boom it needs?

11 hours ago · A record surge of solar panels flowing from China to countries in Africa over the past year is a sign the continent is seeing a rapid build-out of renewable energy. That could

Africa''s Solar Boom: A Shift Toward Energy Independence

Aug 7, 2025 · Africa is witnessing a significant solar boom as countries across the continent ramp up their investments in solar energy. A new report by the Africa Solar Industry Association

Compare Solar Panel Prices Makro, Builders

3 days ago · Solar panel prices South Africa vary considerably in terms of quality, supplier and size which makes things confusing if you aren''t sure how many or

Live Supply & Demand Widget, sponsored by RenewEconomy

Live Supply & Demand Widget, sponsored by RenewEconomy Thanks for your interest in what has been called the "NEMwatch Widget", or the "RenewEconomy Widget" or the "Fuel Mix

SA: Energy storage required to balance renewables – SALGA

Mar 26, 2025 · No country has been successful without enough energy, underscored Silas Zimu, energy advisor in the South Africa''s Presidency in his keynote opening address at the Solar &

Solar power market in full flight

May 20, 2025 · On the residential front, rising electricity prices and unreliable grid supply are pushing homeowners—especially in South Africa and Nigeria—towards rooftop solar.

ANNUAL SOLAR OUTLOOK 2024

Jan 26, 2024 · With decreasing solar and storage prices (see article later in this report) and growing concerns about energy security at national and individual level, it seems business and

SOLAR & STORAGE LIVE AFRICA

Mar 25, 2025 · At the opening of the Solar & Storage Live Africa 2025 conference, Silas Zimu, energy adviser in the Presidency, delivered a keynote address highlighting solar energy as a

Solar PV Panel Prices in 2024 | Cost of Installing

Nov 9, 2024 · These prices reflect the range for each brand, offering a variety of options for different energy needs and budgets. Typical Solar Battery and

Cost of Solar Panels South Africa: Breakdown of

Feb 26, 2025 · The cost of solar panels in South Africa varies by system size and efficiency. Compare solar panel prices to find the best option for your energy

6 FAQs about [Solar Africa Live Energy Prices]

How much does solar cost in Africa?

Stand-alone solar PV mini-grids have installed costs in Africa as low as USD 1.90 per watt for systems larger than 200 kilowatt. Solar home systems provide the annual electricity needs of off-grid households for as little as USD 56 per year, less than the average price for poor-quality energy services.

How much solar power does Africa have?

Currently, the deployment of solar PV and wind power in Africa is roughly evenly matched, with installed capacities of solar PV at around 8 GW as of 2020–21 12, and wind power at 6.5 GW 13. For solar power, this number is strongly dominated by South Africa and Egypt, which cover around 80% of installed capacity on the continent 12.

How much solar PV will Africa have by 2030?

IRENA estimates that with the right enabling policies, Africa could be home to more than 70 gigawatts of solar PV capacity by 2030. The report discusses challenges in policy making and proposes a coordinated effort to collect data on the installed costs of solar PV in Africa, across all market segments.

How much solar PV is installed in Africa?

IRENA data and statistics show that Africa’s total cumulative installed capacity of solar PV jumped from around 500 MW in 2013 to around 1 330 MW in 2014 and 2 100 MW at the end of 2015 (Figure 7). Total installed solar PV capacity therefore more than quadrupled in two years.

How much does a 5kwh Solar System cost in South Africa?

Still, it’s becoming an option in South Africa. A company called Metrowatt, based in Johannesburg, offers 5kWh solar installations. R2,800/m covers eleven solar panels, 5kWh inverter, and 5kWh of battery storage. Up the monthly payment to R3,800 and you snag the same inverter, sixteen solar panels, and 10kWh of storage.

Are solar home systems a good investment for Africa?

Solar home systems provide the annual electricity needs of off-grid households for as little as USD 56 per year, less than the average price for poor-quality energy services. IRENA estimates that with the right enabling policies, Africa could be home to more than 70 gigawatts of solar PV capacity by 2030.

Learn More

- Solar PV Energy Storage Prices

- Real-time solar energy storage cabinet prices

- Energy storage box prices in North Africa

- Stockholm energy efficient solar system prices

- South Korea s solar power generation and energy storage prices

- Communication base station solar energy 8kw specifications and prices

- West Africa energy-saving and environmentally friendly solar energy storage cabinet

- East Africa wind and solar energy storage power generation

- Approximate prices of solar on-site energy

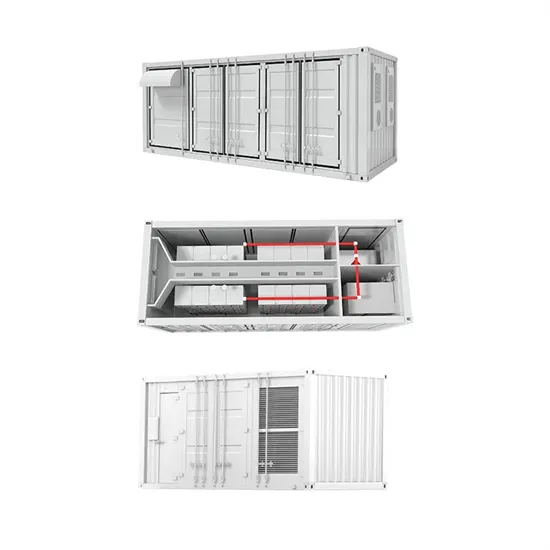

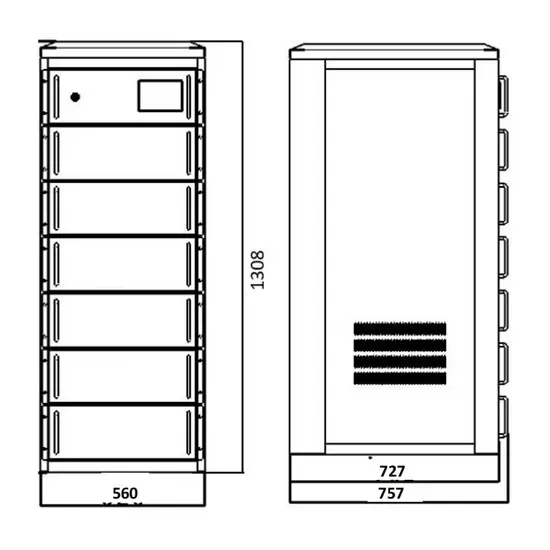

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.