Meinergy partners with Huawei for 1 GW/500 MWh of solar power and storage

GHANA – Meinergy, a Ghana-based solar project developer has signed a partnership deal with Huawei Digital Power Technologies to build a 1GW solar plant and 500MWh of storage at an

What are the mine energy storage power stations in Jiangsu?

May 16, 2024 · Mine energy storage power stations in Jiangsu represent innovative infrastructure that harnesses the potential of abandoned or under-utilized mining sites for renewable energy

Harbour ghana energy storage power station

The inauguration of the Akosombo hydroelectric power station in 1966 by the then independent Ghana Government marked a significant turning point in Ghana''s electricity sector. This large

Pumped storage power stations in China: The past, the

May 1, 2017 · The pumped storage power station (PSPS) is a special power source that has flexible operation modes and multiple functions. With the rapid economic development in

Ghana Solar Power Storage Solutions | GSL ENERGY, a One-Stop Energy

Aug 6, 2025 · Solar Power and Solar Energy Storage: The Inevitable Path for Ghana''s Energy Transition In Ghana, power shortages, frequent blackouts, and a large off-grid population are

Top five thermal power plants in operation in Ghana

Sep 9, 2024 · Of the total global thermal capacity, 0.08% is in Ghana. Listed below are the five largest active thermal power plants by capacity in Ghana, according to GlobalData''s power

Ghana Compressed Air Energy Storage Project

From pv magazine print edition 3/24. In a disused mine-site cavern in the Australian outback, a 200 MW/1,600 MWh compressed air energy storage project is being developed by Canadian

中国电力规划设计协会

Mar 16, 2023 · 中国电力规划设计协会The world''s first immersion liquid-cooled energy storage power station, China Southern Power Grid Meizhou Baohu Energy Storage Power Station,

China''s Coal Mines Reborn: The Rise of Energy Storage Power Stations

Apr 3, 2024 · Imagine an abandoned coal mine—dark, dusty, and seemingly useless. Now picture it transformed into a cutting-edge energy storage power station, buzzing with tech that powers

Ghana energy storage power station project

Mar 1, 2025 · station project Huawei Digital Power Technologies, a unit of Chinese multinational tech giant Huawei, has signed a deal with Ghana-based solar project developer Meinergy

Genser Energy Ghana Limited|Powering the Mining

May 19, 2023 · EVEN WITH STABLE GRID CONNECTION, MINING COMPANIES IN GHANA STILL FACE ISSUES WITH POWER SUPPLY Price Even with contracts with the national IPP,

Assessing the performance of hydro-solar hybrid (HSH

Jun 1, 2024 · Despite their numerous benefits, they pose significant challenges to power grid operation. Ghana is dedicated to reaching a 10 % renewable energy mix target by 2030 to

Learn More

- Windhoek Mine Energy Storage Power Station

- Ghana Energy Storage Power Plant Factory

- Porto Novo Energy Storage Power Station

- Huawei Energy Storage Power Station Supercapacitor

- Can the energy storage power station be placed indoors

- Vienna Energy Storage Container Power Station Platform

- Operational model of energy storage power station

- Micronesia Photovoltaic Power Station Energy Storage System

- Can individuals work on energy storage power station projects

Industrial & Commercial Energy Storage Market Growth

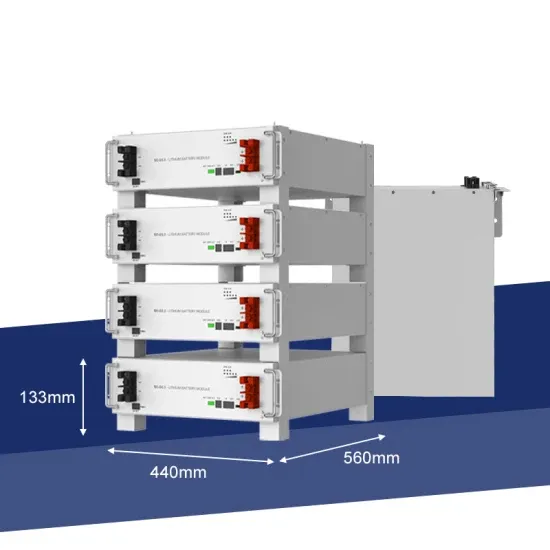

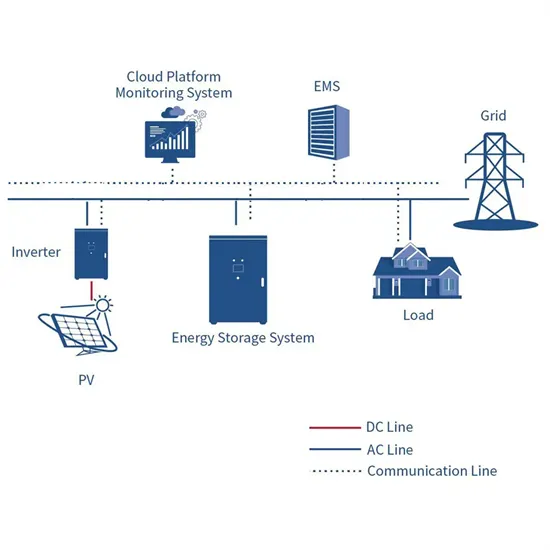

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.