Communication Base Station Lead-Acid Battery: Powering

Why Are Lead-Acid Batteries Still Dominating Telecom Infrastructure? In an era where lithium-ion dominates headlines, communication base station lead-acid batteries still power 68% of global

【MANLY Battery】Lithium batteries for communication base stations

Mar 6, 2021 · In general, as the demand for 5G communication base stations continues to increase, there will be considerable market space for lithium battery energy storage in the

China s communication base station solar energy

Lithium battery is the winning weapon of communication base station energy storage system and electric container energy storage system. when the discharge resistance loss is small, low

Communication Base Station Energy Storage Battery Market

Apr 3, 2025 · The Communication Base Station Energy Storage Battery market is experiencing robust growth, driven by the increasing deployment of 5G and other advanced wireless

Price of batteries commonly used in communication base stations

The global Battery for Communication Base Stations market size is projected to witness significant growth, with an estimated value of USD 10.5 billion in 2023 and a projected

Lead-acid Battery for Telecom Base Station Market

The telecom base station sector relies on lead-acid batteries due to their cost-effectiveness, reliability, and adaptability to harsh environments. Expanding 4G and 5G infrastructure in

Environmental feasibility of secondary use of electric vehicle

May 1, 2020 · Repurposing spent batteries in communication base stations (CBSs) is a promising option to dispose massive spent lithium-ion batteries (LIBs) from electric vehicles (EVs), yet

Intelligent Telecom Energy Storage White Paper

Jul 7, 2023 · Replacement of lead-acid batteries Basic control & Management Multiple technologies Integration New dual-network Architecture Energy internet technology and new

Energy Cost Reduction for Telecommunication Towers

Jul 31, 2024 · Green technology in wireless communication is referred to using alternative or renewable energy sources as the power supply on telecom base station sites. Among green

Communication Base Station Lead-Acid Battery: Powering

In an era where lithium-ion dominates headlines, communication base station lead-acid batteries still power 68% of global telecom towers. But how long can this 150-year-old technology

Communication Base Station Power Backup Units | HuiJue

The Silent Guardians of Connectivity When typhoons knock out power grids or extreme temperatures strain energy systems, communication base station power backup units become

BATTERIES AND EV CHARGING STATIONS MANUFACTURERS IN BHUTAN

The Battery for Communication Base Stations market can be segmented by battery type, including lithium-ion, lead acid, nickel cadmium, and others. Among these, lithium-ion batteries

Communication Base Station Battery Market Size, Growth,

Global Communication Base Station Battery Market Size By Battery Type (Lead Acid Batteries, Lithium-Ion Batteries), By End-User Application (Telecommunication Providers, Private

Lead-Acid Batteries in Telecommunications: Powering...

Telecommunications infrastructure, including cell towers, base stations, and communication hubs, requires a constant and reliable power supply. Lead-acid batteries serve as a dependable

Communication base station lithium batteries | HuiJue Group

In an era where lithium-ion dominates headlines, communication base station lead-acid batteries still power 68% of global telecom towers. But how long can this 150-year-old technology

有道翻译_文本、文档、、在线即时翻译

有道翻译提供即时免费的中文、英语、日语、韩语、法语、德语、俄语、西班牙语、葡萄牙语、越南语、印尼语、意大利语、荷兰语、泰语全文翻译、翻译、文档翻译、PDF翻译、DOC

What is the purpose of batteries at telecom base

Feb 10, 2025 · Among the many types of batteries, why can lead-acid batteries become the first choice for telecom base stations? This is mainly due to its

COMMUNICATION LITHIUM BATTERY ENERGY STORAGE

We offer the lead acid forklift battery, automative battery, and provide energy analytics solution. Electric Energy Storage; Communication; Transportation Power; Data Security; Lithium

BHUTAN ENERGY STORAGE BATTERY PROJECT

What is the market for lead acid battery for energy storage? In terms of application, the market for Lead Acid Battery for Energy Storage is segmented into micro-grid, household, industrial, and

Global Lead-acid Battery for Telecom Base Station Market

The global Lead-acid Battery for Telecom Base Station market is projected to grow from US$ million in 2024 to US$ million by 2031, at a CAGR of % (2025-2031), driven by critical product

Base station lead-acid energy storage

Energy storage lead-acid batteries for power supply and communication base stations meet the technical needs of modern telecom operators who tend to integrate, miniaturize, and lighten

6 FAQs about [Bhutan communication base station lead-acid battery power generation]

Can a stepped battery be used in a communication base station backup power system?

In view of the characteristics of the base station backup power system, this paper proposes a design scheme for the low-cost transformation of the decommissioned stepped power battery before use in the communication base station backup power system. Figures - available via license: Creative Commons Attribution 3.0 Unported

How much power does a base station use?

Suppose the load power consumption of a base station is 2000 W by using the lithium-ion battery and the corresponding load current is approximately 41.67A (for simplification, here the 2000W power consumption includes the power consumption of the temperature control equipment divided by 48V per battery module).

What would be the contribution of a battery-based energy conservation model?

The contribution would be the initial development of an energy conservation model based on grid availability between 8 hours to 16 hours under the poor grid and bad grid scenarios based on energy-efficient systems such as hybrid energy storage between the lead-acid battery and the lithium-ion battery.

How many lithium-ion battery projects are there?

Currently, there are more than 300 MW to 400 MW utility large scale of lithium-ion battery projects already completed worldwide for frequency control, maximum demand plus microgrid integration support for the high power intermittent renewable energy resources .

How much power does a lead-acid battery use?

For the lead-acid battery similarly, based on power load consumption of 2000w and correspondingly, 41.67A for the load current. The battery capacity is 200AH, and the charging current ratio is 0.5C, and therefore the maximum battery charging current is 83A.

Is a valve-regulated lead acid battery reserve life estimation scheme adaptive?

This paper presents a valve-regulated lead acid (VRLA) battery reserve life estimation scheme. The scheme is adaptive in both type and frequency of involvement. The scheme is based on capacity trending with the support of a number of state-of-health (SOH) indicators.

Learn More

- Manama communication base station lead-acid battery photovoltaic power generation system bidding

- Ankara communication base station lead-acid battery photovoltaic power generation solution

- How far is the distance of communication base station battery power generation

- Battery energy storage system power generation in the communication base station room

- Armenia communication base station flow battery photovoltaic power generation parameter configuration

- Power of lead-acid battery module for communication base station

- Tehran Communication Base Station Photovoltaic Power Generation System Solution

- Hybrid power supply of battery energy storage system for Saint Lucia communication base station

- Tunisia communication base station photovoltaic power generation system power work

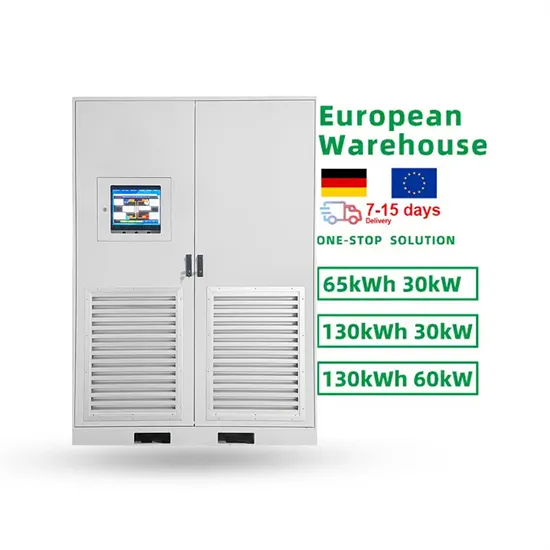

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.