Increased Wind Power Generation in Sri Lanka: A

Mar 1, 2013 · Sri Lanka has a significantly large wind resource, as proven in many studies. The Central Province has the best wind capability compared with

(PDF) Energy Storage Solutions for Sri Lanka

Feb 23, 2025 · To address these issues, the report evaluates the potential of three key energy storage technologies: Pumped Energy Storage Systems (PESS), Thermo-mechanical Energy

Solar Energy | Sri Lanka Sustainable Energy

1 day ago · The Solar Resource Atlas of Sri Lanka is an important addition to the existing knowledge on solar resources of Sri Lanka. The first solar atlas of Sri

Storage of wind power energy: main facts and feasibility −

Sep 2, 2022 · With the improvements in battery technology, connecting wind turbines with energy storage devices is now much more practical and efficient. Battery technology is anticipated to

Renewable Generation Report

Apr 10, 2024 · Introduction: This report offers comprehensive insights into the quarterly performance of renewable energy generation in Sri Lanka. The data and analysis presented

CEB IS FULLY COMMITTED TO PROMOTE SOLAR POWER

Nov 28, 2022 · There-fore, a huge opportunity exists in Sri Lanka for the development of Solar Power Projects and CEB is fully com-mitted to facilitate those projects under open market

Future of wind energy in Sri Lanka

Jul 13, 2023 · At present, higher wind potential areas in Sri Lanka are analyzed to construct effective wind power plants. After the selection of a proper site, conducting a thorough wind

Sri Lanka Wind Farm Analysis and Site Selection

Sep 4, 2013 · The current avoided cost for electricity generation in Sri Lanka is approximately $0.06/kWh. These costs are expensive compared to other countries in the region due to the

RENEWABLE GENERATION REPORT

Sep 25, 2024 · op PV typically below 1 MW. Residences may be limited to small systems usually up to 20 kilowatts (kW), while larger public, commercial, and industrial buildings may have

ENERGY STORAGE

Jan 30, 2024 · higher costs from third-party energy providers. Based on an extensive evaluation of various energy storage technologies, four (4) key solutions have been identified as the most

Wind Power Generation in Sri Lanka

Mar 1, 2007 · In this article, cost of wind power generation in various parts of Sri Lanka is discussed and compared to the existing power purchasing tariff system in the country.

Renewable energy plans 2030 energy targets

Dec 29, 2024 · To meet its 2030 renewable energy target and address growing energy demand under economic constraints, Sri Lanka must adopt a multifaceted approach. By prioritising

(PDF) Energy Storage Solutions for Sri Lanka

Feb 23, 2025 · This report delves into the transformative phase of Sri Lanka''s energy sector, highlighting the growing adoption of renewable energy sources like solar and wind power.

6 FAQs about [How much does a wind power storage system cost in Sri Lanka]

What is the wind energy resource of Sri Lanka?

An all island Wind Energy Resource Atlas of Sri Lanka was developed by National Renewable Energy Laboratory (NREL) of USA in 2003, indicates nearly 5,000 km 2 of windy areas with good-to-excellent wind resource potential in Sri Lanka. About 4,100 km 2 of the total windy area is on land and about 700 km 2 is in lagoons.

Can Sri Lanka build a wind power plant?

Factors such as wind speed, wind direction, topography, and proximity to the power grid need to be assessed to determine the site's suitability for wind power generation. At present, higher wind potential areas in Sri Lanka are analyzed to construct effective wind power plants.

Does Sri Lanka have offshore wind power?

The offshore wind power development programme by the World Bank Group, recently published the ‘Offshore Wind Roadmap for Sri Lanka’. It has been identified that Sri Lanka has good conditions for offshore wind and its potential is estimated to be 56,000MW (referred to as 56GW-Giga Watts).

Why is Sri Lanka a good place to get wind power?

1. Abundant wind resources: Sri Lanka has significant wind potential, particularly along its coastal regions and in certain hilly areas. Wind speeds are generally favourable for wind power generation, especially during monsoon seasons. 2.

What is the offshore wind roadmap for Sri Lanka?

The Offshore Wind Roadmap for Sri Lanka, funded by the World Bank Energy Sector Management Assistance Program (ESMAP) and PROBLUE, provides a full overview of potential low and high growth scenarios for offshore wind development in the country, as well as a series of recommendations for the government to take in order to realize these scenarios.

What percentage of Sri Lanka's land is windy?

About 4,100 km 2 of the total windy area is on land and about 700 km 2 is in lagoons. The windy land represents about 6% of the total land area (65,600 km 2) of Sri Lanka. Using a conservative assumption of 5 MW per km 2, this windy land could support almost 20,000 MW of potential installed capacity.

Learn More

- How much does wind power storage equipment cost

- How much does 10kv solar power generation and energy storage cost

- How much does it cost to maintain a wind power station in Phnom Penh

- How many wind and solar energy storage power stations are there in Sweden

- How much does a Gabon communication wind power base station cost

- How much does a storage power station usually cost

- How much does a large energy storage power supply cost in Tajikistan

- Tiraspol wind power storage system cost

- How much does photovoltaic panels cost in Sri Lanka

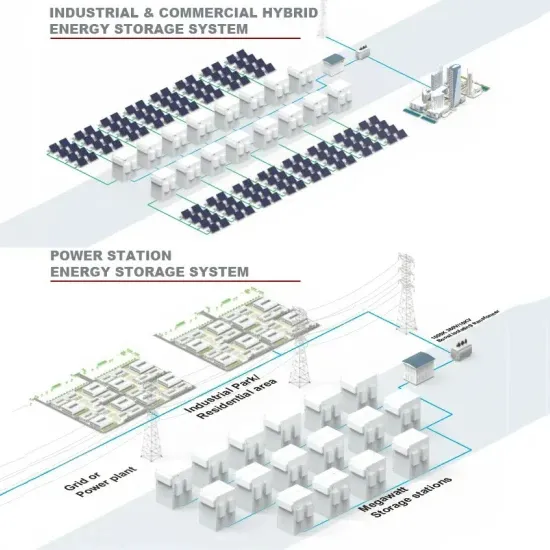

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.