Battery Energy Storage Systems Report

Jan 18, 2025 · This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their

Peruvian energy storage battery manufacturing company

Top 10 energy storage companies The rankings of each company have undergone significant changes compared to the top ten energy storage battery shipment volumes in 2022, reflecting

Development of Containerized Energy Storage System

Dec 24, 2014 · The lithium-ion battery has the characteristics of low internal resistance, as well as little voltage decrease or temperature increase in a high-current charge/discharge state. The

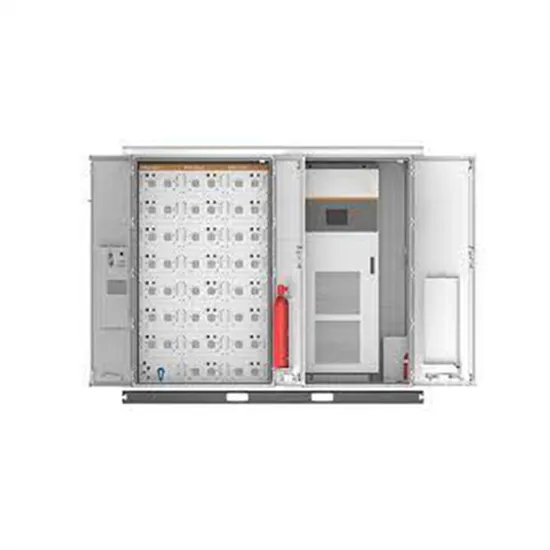

HIGH VOLTAGE CONTAINERIZED LITHIUM PHOSPHATE

Nov 22, 2021 · High voltage containerized lithium battery storage system is composed of high quality lithium iron phosphate core (series-parallel connection), advanced BMS management

1MW Battery Energy Storage System

5 days ago · MEGATRONS 1MW Battery Energy Storage System is the ideal fit for AC coupled grid and commercial applications. Utilizing Tier 1 280Ah LFP battery cells, each BESS is

Container battery energy storage Manufacturer & Supplier in

Container battery energy storage Compact containerized battery systems are a demonstration of new energy storage. These Avepower lithium battery energy storage units allow energy to be

Peruvian energy storage battery manufacturing company

Energy storage and EV infrastructure solutions firm NHOA has commissioned a 31MWh battery energy storage system (BESS) in Peru for multinational utility and IPP Engie. The BESS unit

Gotion launches 7 MWh BESS container, 650 Ah

Feb 27, 2025 · The Chinese manufacturer has joined the energy density race with the release of its latest utility-scale battery energy storage system and high

3 FAQs about [Peruvian iron-lithium battery energy storage container supplier]

What is a lithium battery energy storage container system?

lithium battery energy storage container system mainly used in large-scale commercial and industrial energy storage applications. We offer OEM/ODM solutions with our 15 years in lithium battery industry.

What is a containerized energy storage system?

The Containerized energy storage system refers to large lithium energy storage systems installed in sturdy, portable shipping containers, which usually range from 5ft, 10ft, 20ft, and 40ft, and mainly focus on 50Kwh to 10Mwh.

Why should you choose a lithium-ion battery storage container?

Flexibility and scalability: Compared with traditional energy storage power stations, lithium-ion battery storage containers can be transported by sea and land, no need to be installed in one fixed place and subject to geographical restrictions.

Learn More

- Huijue LiFePO4 Battery Energy Storage Container Supplier

- Hungarian energy storage battery EK supplier

- American Battery Energy Storage Container Cabinet Company

- Container battery energy storage fire protection system

- What is the capacity of the container photovoltaic energy storage battery warehouse

- How much does it cost to replace the starting battery of the energy storage container

- Industrial Park Battery Energy Storage Container Manufacturer

- Lithium-ion battery energy storage container installation in Antananarivo

- Telecom Battery Energy Storage Container Installation

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.