150 kw solar system price Timor-Leste

Specifically for Timor Leste,country factsheet has been elaborated,including the information on solar resource and PV power potential country statistics,seasonal electricity generation

Buy solar panels direct from manufacturer Timor-Leste

Is Timor-Leste a good country for solar energy? Timor-Leste has a high-quality solar resource. The global horizontal irradiance in Dili is higher than on the east coast of Australia,where the

East Timor Energy Storage System Integration Company

These roof-integrated photovoltaic systems provide a dual benefit: structural coverage and clean power generation. Tailored for building-integrated microgrids, they align with modern design

Solar Photovoltaic Power Generation Project Description

PV systems are most commonly in the grid-connected configuration because it is easier to design and typically less expensive compared to off-grid PV systems, which rely on batteries. Grid

Solar Photovoltaic Panel Production in East Timor

East Timor''s solar photovoltaic production initiative represents more than energy reform - it''s a gateway to technical sovereignty. With strategic partnerships and phased implementation, this

Solar power systems for home use Timor-Leste

A Case Study: Performance Comparison of Solar Power GridLAB-D, System Advisor Model, Solar Power Generation, Timor Leste, WRF 1. Introduction According to the strategic plan for the

Timor-Leste sun power gen systems

Nov 6, 2024 · Through the training, the young specialists in Timor-Leste gain an understanding of harnessing and converting solar radiation into usable energy using solar photovoltaic (PV)

Solar Power Plant Project Introduction

Solar PV farms harness the energy from the sun to generate electricity on a large scale. These plants utilize photovoltaic (PV) technology or concentrated solar power (CSP) systems to

Timor-Leste solar power housing

How long did it take to install solar panels in Timor-Leste? Caption: It took almost a year- from feasibility to completion - to see the solar panel installed at the UN Timor-Leste compound. A

Signing of Power Purchase Agreement (PPA) for Solar and

Jul 25, 2025 · As a result, substantial reductions in both power generation costs and CO₂ emissions are expected. The Project involves the construction and 25-year operation of a new

Climate Change Story

Jul 9, 2024 · Timor-Leste holds a strategic advantage over its neighbours in transitioning to solar rooftops, with potential electricity cost reductions and a recovery period of 2.5 years, lower

Solar photovoltaic power generation installation in East Timor

East Timor (Timor-Leste) Solar Project | Sustainable East Timor solar project, Timor Leste. In cooperation with our local partner, GSOL Energy technicians have installed a 300kWp on-grid

Energy storage planning for East Timor s power system

These roof-integrated photovoltaic systems provide a dual benefit: structural coverage and clean power generation. Tailored for building-integrated microgrids, they align with modern design

Construction of solar power generation system in Timor-Leste

A Case Study: Performance Comparison of Solar Power this paper is to compare the output power of solar PV panels between the System Advisor Model (SAM) and the GridLAB-D tool

6 FAQs about [East Timor Solar Photovoltaic Power Generation System]

What is the Timor-Leste solar power project?

The Project involves the construction and 25-year operation of a new power plant in Manatuto, Timor-Leste, comprising a 72 MW solar power plant co-located with a 36 MW/36 MWh battery energy storage system. This will be the country’s first full-scale renewable energy IPP project.

Why is solar energy implemented in Timor Leste?

Plotting of analyses of solar radiation in Timor Leste. power generation is dependent on the cli mate. The output values from an NWP system. such as solar and wind energy to supply ele ctricity in all territory . Particula r- in some areas. For all these reasons, the implementation of solar energy in Timo r

How a solar module is used in Dili & Timor Leste?

tion in Dili, Timor Leste were used to s imulate solar power. There were 5 mo d- power flow, module residential and module climate. Module climate uses two in CSV file type. Objec t meter as part of module generator applies a nominal voltage of 220 V. For generator case, phase CN w ith panel type of Multi Crystal

Why did DLA Piper advise Eletricidade de Timor-Leste on a PPA?

DLA Piper advised Eletricidade de Timor-Leste on a PPA to develop Timor-Leste’s first solar PV power plant and battery energy storage system.

Who bids for solar IPP project in Timor-Leste?

For Timor-Leste, bidders are typically from legacy countries such as Indonesia, Portugal and People’s Republic of China. For the Solar IPP project, Government of Timor-Leste represented by the Ministry of Finance has provided backstop guarantee for EDTL obligations under the Implementation Agreement.

Why should Timor-Leste invest in solar & storage infrastructure?

José added: “The investment in Timor-Leste’s solar and storage infrastructure is transformative. It will help reduce dependence on fossil fuels while improving grid stability and energy access across the country”. José de Ponte was supported by special counsel Marnie Calli, senior associate Lisa Huynh and solicitor Jeraldine Mow.

Learn More

- East Timor photovoltaic off-grid power generation system manufacturer

- Belgian solar photovoltaic power generation energy storage cabinet

- Kathmandu Solar Photovoltaic Power Generation System

- Rooftop solar glass photovoltaic power generation

- East Africa wind and solar energy storage power generation

- Communication base stationChina solar photovoltaic power generation

- Photovoltaic power generation from solar panels in Zagreb

- 380V photovoltaic solar wind two-in-one power generation system complete set

- Solar photovoltaic power generation system in Pecs Hungary

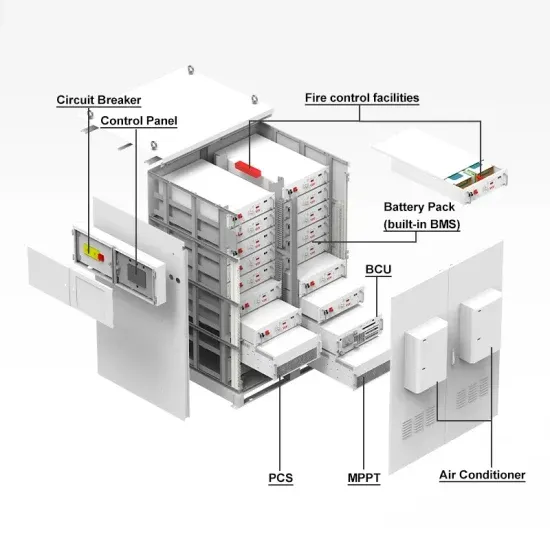

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.