Huawei Photovoltaic Inverter Production Key Locations and

Huawei''s photovoltaic inverter production combines geographic strategy with cutting-edge technology. As solar adoption grows, their focus on localized manufacturing and smart

Europe considers ban on Chinese solar inverters,

May 13, 2025 · Europe is grappling with growing concerns over the cybersecurity risks posed by Chinese-made photovoltaic inverters, prompting discussions

A Guide To Finding Top10 China solar inverter Manufacturers

Feb 18, 2025 · Discover the best china solar inverter manufacturers with our guide. Learn how to choose quality, reliable inverters for your solar projects today!

Huawei solar inverters | Solarity – distributor and

5 days ago · FusionSolar is the primary product from Huawei''s range of advanced photovoltaic technologies designed for residential and commercial projects. The solution consists of

Technical Report Template

Whilst inverters are typically expected to last for at least half the project lifetime of a PV plant (25 years), considering a bathtub failure rate and relatively low current failure rate for the initial

Huawei Solar Company Overview | Production Capacity, Is it

2 days ago · Established in 1987, Huawei Technologies Co., Ltd. has emerged as a global leader in information and communications technology (ICT) infrastructure and smart devices.

Huawei Photovoltaic Inverter Production Key Locations and

Summary: Explore how Huawei''s strategic photovoltaic inverter production facilities drive innovation in renewable energy. Learn about their manufacturing hubs, technological

Technical Report Template

Oct 27, 2017 · Whilst inverters are typically expected to last for at least half the project lifetime of a PV plant (25 years), considering a bathtub failure rate and relatively low current failure rate for

Top 10 Solar hybrid inverter Manufactures

Jan 9, 2025 · Explore the top 10 solar hybrid inverter manufacturers, including SMA, SRNE, Huawei, and Tesla, offering innovative and sustainable energy solutions for residential and

Huawei Photovoltaic Inverters in 2025: Leading the Global

Jan 31, 2025 · Does Huawei Still Dominate Solar Inverter Production? The 2025 Reality Check Short answer: Absolutely. Huawei remains a top-tier producer of photovoltaic inverters,

Huawei solar inverters | Solarity – distributor and

5 days ago · Huawei provides advanced photovoltaic technology that is manufactured for direct deployment in small-scale projects for residential,

Who are the top 5 inverter manufacturers in the

Nov 29, 2024 · Company Profile: Established in 1987, Huawei is not only one of the top ten photovoltaic inverter companies globally but also a world-leading

What does Huawei s photovoltaic inverter do

Huawei Sun2000-KTL-M0 Inverter Review The Sun2000-KTL-M0 is a series of three-phase grid-tied PV string inverters manufactured by Huawei Technologies Co. Ltd in China, with output

6 FAQs about [Are Huawei s photovoltaic inverters manufactured by OEM ]

What makes Huawei a leader in photovoltaic inverter?

Relying on powerful ICT technology, Huawei has deeply integrated intelligence and digitalization into photovoltaic inverters and launched the efficient, safe and intelligent FusionSolar solution. With global layout and innovation-driven, Huawei continues to lead the photovoltaic market.

Who sells Huawei photovoltaic inverters?

Solarity is an official distributor of Huawei photovoltaic inverters. If you are looking for a reliable supplier of solar inverters or other accessories for photovoltaic systems, don’t hesitate to contact us. We will be glad to list our references and help you find the optimal solution for your projects.

What makes Huawei inverters so popular?

Products: Huawei focuses on grid-tied and hybrid inverters, with energy storage solutions integrated for residential and commercial use. Their Smart PV inverters are particularly popular. Technology: Huawei’s inverters incorporate AI and cloud-based monitoring, allowing predictive maintenance and real-time monitoring through apps.

How to install and Commission Huawei solar inverters?

Installing and commissioning Huawei solar inverters and other technologies are facilitated by the SUN2000 app and their WebUI. Solarity is an official distributor of Huawei photovoltaic inverters. If you are looking for a reliable supplier of solar inverters or other accessories for photovoltaic systems, don’t hesitate to contact us.

What is Huawei photovoltaic technology?

Huawei provides advanced photovoltaic technology that is manufactured for direct deployment in small-scale projects for residential, commercial, and local photovoltaic systems. The system allows continuous optimisation of design, operation, and maintenance.

Does Huawei offer a warranty extension for photovoltaic inverters?

The warranty extension for photovoltaic inverters can be purchased during the warranty period. Huawei provides advanced photovoltaic technology that is manufactured for direct deployment in small-scale projects for residential, commercial, and local photovoltaic systems.

Learn More

- Huawei has photovoltaic grid-connected inverters

- Huawei is engaged in photovoltaic panel OEM

- Huawei Bhutan photovoltaic panel factory

- Huawei temperature-controlled photovoltaic energy storage battery

- Huawei Luxembourg regular photovoltaic panels

- The future prospects of photovoltaic inverters

- Classification of residential photovoltaic inverters

- Huawei makes solar photovoltaic panels

- Huawei Azerbaijan photovoltaic curtain wall brand

Industrial & Commercial Energy Storage Market Growth

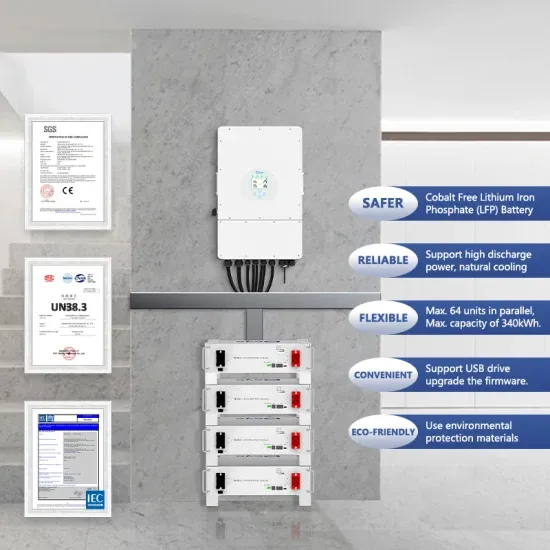

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.