Huawei''s 5G Base Station Shipments Exceed 1.2 Million

Jun 27, 2025 · During the convention of "2022 World Telecommunications and Information Society Day" held recently, Jiang Yafei, Senior Vice President of Huawei Technologies Co.,

Huawei Releases 5G Series Products to Expand

Jun 28, 2021 · At the 2021 Mobile World Congress (MWC 2021) in Barcelona, Huawei launched a series of 5G products and solutions oriented to "1+N" 5G

5G Network Architectures and Technologies

Aug 1, 2025 · gNodeB (gNB): a 5G base station. gNBs are base stations deployed based on 5G standards to provide wireless access to 5G networks. 5G modem: is built into a router to

Base Station Operation Increases the Efficiency of Network

These results indicate that base station operation can help operators efficiently build networks and effectively shorten the ROI period. Base Station Operation Has a Bright Future According to

What is the significance of Huawei''s Remote Radio Unit

Jan 12, 2024 · The RRU, as a component of the radio unit, is responsible for managing these advanced antenna technologies, enabling efficient communication between the base station

Huawei Maintains the Top Position in the Global Passive

Dec 17, 2024 · In their latest report, the global technology market intelligence firm ABI Research released its 2023 global base station antenna market research report titled "Passive Cellular

huawei base station

Dec 23, 2023 · Huawei Base Station Overview: A base station, also known as an eNodeB (for 4G LTE) or gNodeB (for 5G NR) in Huawei''s terminology, is a piece of equipment that facilitates

Innovative Solutions for Efficient huawei base station in

Optimize your network with cutting-edge huawei base station that enhances connectivity, boosts efficiency, and ensures reliable communication across vast distances.

HUAWEI UBBPd6: The Backbone of 5G Wireless Communication

Jan 8, 2025 · The HUAWEI UBBPd6 baseband board stands as a pinnacle of technological advancement in the realm of wireless communication. As a critical component of 5G wireless

HUAWEI DBS3900 Dual-Mode Base Station Hardware

Mar 26, 2022 · DBS3900 Dual-Mode Base Station is the fourth generation base station developed by Huawei. It features a multi-mode modular design and supports three working modes: GSM

RRU3936 900MHz 1800MHz 02310MNP Wireless base station communication

High-Quality Huawei Equipment: The RRU3936 900MHz 1800MHz 02310MNP Wireless base station communication equipment is a high-quality product from Huawei, a renowned brand in

6 FAQs about [What are Huawei s base station communication equipment ]

What is a Huawei base station?

Let's dive into a technical explanation. A base station, also known as an eNodeB (for 4G LTE) or gNodeB (for 5G NR) in Huawei's terminology, is a piece of equipment that facilitates wireless communication between user equipment (UE) like smartphones, tablets, and IoT devices, and the core network of the telecommunications provider.

What systems does Huawei offer?

Huawei provides comprehensive management and control systems, such as Huawei's U2000 or Huawei's Cloud BTS. These systems enable operators to monitor, configure, and manage base stations remotely, ensuring optimal network performance and reliability.

How many 5G base stations does Huawei have?

The contracts have been split into two projects, with the first covering 63,800 base stations using 2.6GHz to 4.9GHz spectrum, while the second covers 23,141 in the 700MHz band. Huawei is estimated to have secured 45,426 5G base stations worth an estimated 4.1 billion yuan (US$574 million).

Is Huawei a good telecommunications company?

Huawei is one of the global leaders in telecommunications infrastructure and has played a pivotal role in the development and deployment of 5G networks. As the world transitions from 4G LTE to 5G, Huawei’s equipment has become central to many mobile operators’ strategies.

Does Huawei offer a 5G network?

As the world transitions from 4G LTE to 5G, Huawei’s equipment has become central to many mobile operators’ strategies. The company offers a wide range of 5G solutions, including base stations, antennas, core network components, and software-defined networking tools.

What is dbs3900 dual-mode base station?

DBS3900 Dual-Mode Base Station is the fourth generation base station developed by Huawei. It features a multi-mode modular design and supports three working modes: GSM mode, GSM+UMTS dual mode, and UMTS mode through configuration of different software. In addition, the DBS3900 supports smooth evolution to the Long-Term Evolution (LTE).

Learn More

- Huawei Communication Base Station EMS Equipment Environmental Assessment

- How to sell Huawei base station communication equipment

- What is the battery capacity of base station communication equipment

- What are the communication equipment in the base station room

- What equipment does communication base station wind power consist of

- What does the communication network base station equipment include

- What equipment does a small communication base station have

- Uninterruptible power supply equipment for Nuku alofa communication base station

- What are the parameters of photovoltaic power generation of communication base station batteries

Industrial & Commercial Energy Storage Market Growth

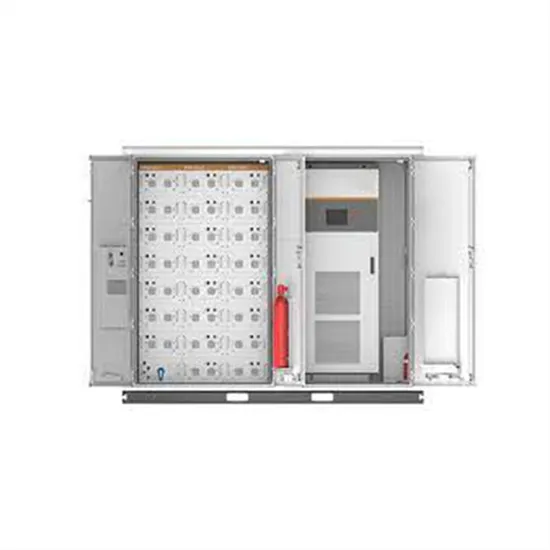

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.